My 5 Favorite Mid Cap Stocks - Tuesday, Jan 16

Today, I wanted to find 5 Mid Cap stocks that had great returns over the past year and still seem to have some juice left.

Today's watch-list includes: Scientific Games, IPG Photonics, KB Homes, First Solar and NVR Inc.

Scientific Games (SGMS)

Barchart technical indicators:

- 169.07+ Weighted Alpha

- 100% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 4 new highs and up 6.10% in the last month

- Relative Strength Index 65.39%

- Technical support level at 53.52

- Recently traded at 53.90 with a 50 day moving average of 50.96

IPG Photonics (IPGP)

Barchart technical indicators:

- 159.12+ Weighted Alpha

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 12 new highs and up 25.60% in the last month

- Relative Strength Index 79.10%

- Technical support level at 256.61

- Recently traded at 262.11 with a 50 day moving average of 225.13

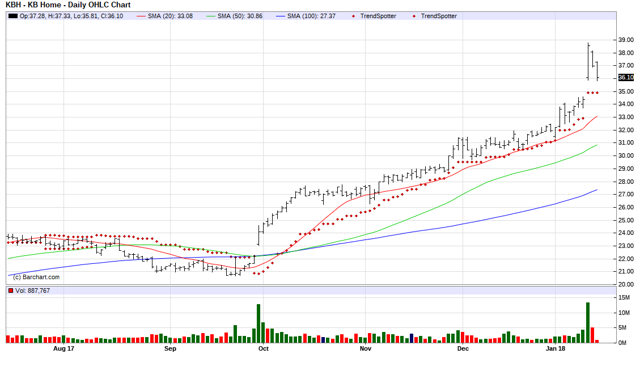

KB Homes (KBH)

Barchart technical indicators:

- 131.55+ Weighted Alpha

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 10 new highs and up 16.89% in the last month

- Relative Strength Index 67.92%

- Technical support level at 36.52

- Recently traded at 36.27 with a 50 day moving average of 30.85

First Solar (FSLR)

Barchart technical indicators:

- 127.67+ Weighted Alpha

- 96% Technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averags

- 4 new highs and up 5.37% in the last month

- Relative Strength Index 60.39%

- Technical support level at 71.92

- Recently traded at 72.45 with a 50 day moving average of 65.41

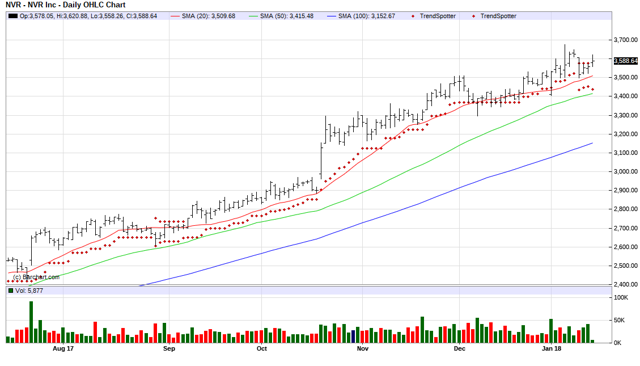

NVR Inc (NVR)

Barchart technical indicators:

- 108.40+ Weighted Alpha

- 72% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 6 new highs and up 5.77% in the last month

- Relative Strength Index 62.04%

- Technical support level at 3529.85

- Recently traded at 3559.95 with a 50 day moving average of 3415.60

Disclosure: None.

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!