Microsoft: The Numbers Look Good

Microsoft (MSFT) is going through a major transformation over the past several years, particularly after Satya Nadella replaced Steve Ballmer as CEO in 2014. Nadella already was running Microsoft’s cloud division before being appointed as CEO, and focusing on the cloud was arguably his most important and effective contribution.

This transformation is producing solid results, and the company is reporting attractive financial performance on the back of impressive numbers from Azure, Office 365, and LinkedIn, in addition to more modest contributions from smaller segments such as Xbox and gaming, Surface, and Dynamics.

According to data from the most recent earnings report, Microsoft has more than 135 million users in Office 365 commercial. Outlook mobile is being used on more than 100 million iOS and Android devices, and more than 200,000 organizations are using Microsoft Teams as the hub for teamwork. Windows 10 is now active on nearly 700 million devices.

LinkedIn ended the most recent quarter with 575 million members and year-over-year revenue growth of 37%. Both engagement levels and job postings on LinkedIn reached new records last quarter, and mobile sessions grew 55% versus the same quarter in the prior year.

Microsoft closed a record number of multimillion-dollar commercial cloud agreements on Azure during the fiscal year 2018, more than doubling the number of $10 million-plus Azure agreements. Commercial bookings increased 18% year over year, with commercial unearned revenue reaching $29 billion and growing by 23%.

The gaming business surpassed $10 billion in annual revenue for the first time ever, and Microsoft is investing aggressively in content, community and cloud services across every endpoint of the gaming business to expand usage and deepen engagement.

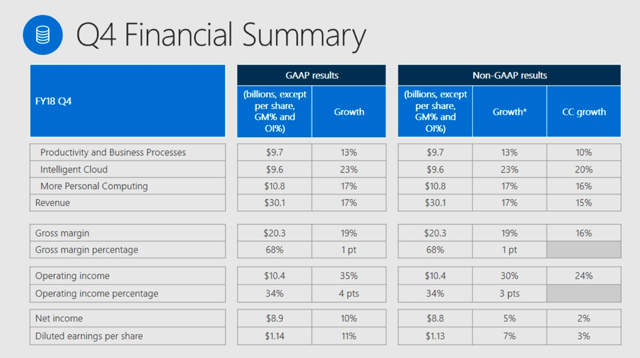

Financial performance at the whole company level is clearly healthy. Microsoft produced $30.1 billion in sales last quarter, a vigorous increase of 17% year over year. Importantly, the company's multiple business segments are performing strongly across the board, which is a major positive in terms of evaluating Microsoft's ability to sustain performance going forward.

Source: Microsoft

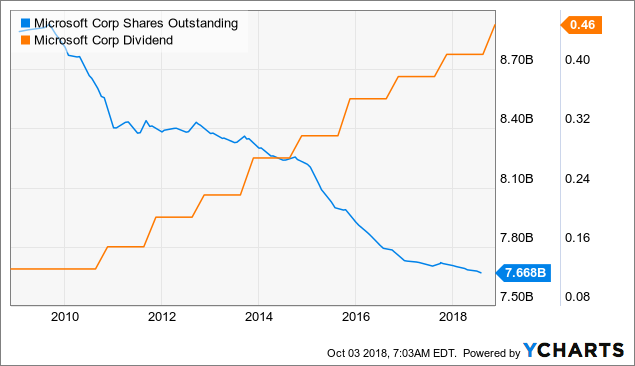

The business model generates abundant cash flows, and this has allowed Microsoft to reward investors with growing dividends and sustained share buybacks over the past several years.

MSFT Shares Outstanding data by YCharts

Reasonable Valuation

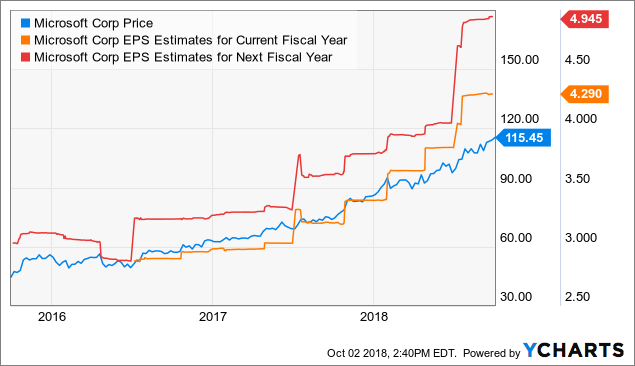

Microsoft's stock is not cheap at current prices, but valuation is not excessive either for such a high-quality business. Based on earnings expectations for next year, the stock is trading at a forward price-to-earnings ratio of 27.

This is relatively expensive in comparison to the broad market, but not in comparison to other companies in the industry. As a reference, the average company in the software and services sector is currently trading at a price-to-earnings ratio of 33.96.

Offering a similar perspective, the price to earnings growth (NYSE:PEG) ratio based on long-term growth expectations is 1.76 for Microsoft versus 2.92 for the average company in the industry according to data from Portfolio123.

Microsoft stock is reasonably priced by industry standards, and the company is one of the leading players in the sector. If Microsoft can continue delivering low double-digit revenue growth over the coming years on the back of healthy performance from Azure, Office 354, and LinkedIn, then the company can clearly justify its current valuation levels.

Strong Fundamental Momentum

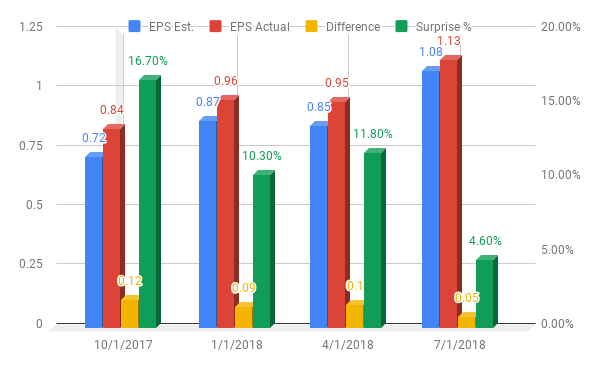

Looking at the fundamentals in isolation doesn't tell the whole story behind a stock, since the fundamentals in comparison to expectations can have a huge impact on stock prices. In other words, when the company is delivering better-than-expected earnings and expectations about future earnings are increasing, this can be a powerful upside fuel for the stock.

Microsoft has delivered earnings numbers considerably above expectations in the past four quarters in a row. The chart below shows the expected earnings number, the actual reported number and the difference between the two, both in absolute terms and in percentages.

Wall Street analysts have substantially increased their earnings expectations for Microsoft in both the current fiscal year and next fiscal year over time. Like it usually happens, rising earnings expectations are a powerful upside fuel for the stock price. As long as this trend remains in place, it bodes well for investors in Microsoft going forward.

MSFT data by YCharts

Outstanding Relative Strength

Money has an opportunity cost. When you buy a stock with mediocre returns, that capital is not available for investing in companies with superior potential. Besides, winners tend to keep on winning in the stock market, so you want to invest in stocks that are not only doing well but also doing better than other alternatives.

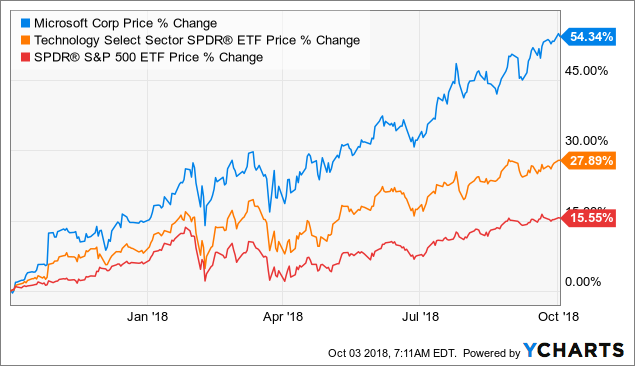

Microsoft stock has substantially outperformed both the SPDR S&P 500 Trust ETF (NYSEARCA:SPY) and the Technology Select Sector SPDR ETF (NYSEARCA:XLK) over the past year. In comparison to both the broad market in general and the tech sector in particular, Microsoft is displaying impressive relative strength.

MSFT data by YCharts

Putting It All Together

The PowerFactors system is a quantitative investing system available to members in my research service, "The Data Driven Investor." This system basically ranks companies in a particular universe according to the factors analyzed in this article for Microsoft: financial quality, valuation, fundamental momentum, and relative strength.

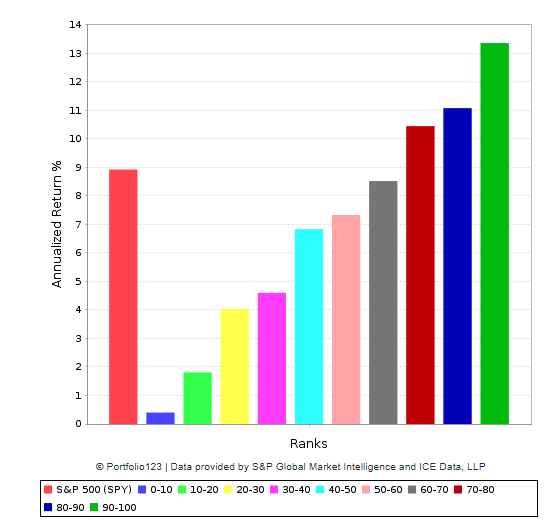

The system has produced solid performance over the long term. The chart below shows the annualized returns for companies in different PowerFactors ranking buckets since January of 1999 in comparison to the SPDR S&P 500.

There is clearly a direct relationship between the PowerFactors ranking and annualized returns, meaning that companies with higher rankings tend to produce superior returns and vice versa. In addition, stocks with relatively high quantitative rankings tend to materially outperform the market over the years.

Data from S&P Global via Portfolio123

Microsoft is among the best 10% of stocks in the market based on the quantitative algorithm. The company has a PowerFactors ranking of 99.7, and it enjoys strong metrics across the four factors considered: financial quality, valuation, fundamental momentum, and relative strength.

Historical performance does not guarantee future returns, and performance numbers for quantitative systems should always be interpreted with caution, since the future is always a matter of possibilities and probabilities as opposed to certainties.

Because of its own nature, a quantitative system is always backward-looking. This means that a system can tell you that a specific group of companies with certain quantitative attributes has a good chance of delivering market-beating returns over long periods of time, but it does not tell you much about a particular stock.

In the case of Microsoft, it operates in a high-growth industry prone to technological disruption. It's important for investors to monitor the competitive landscape in order to make sure that the company remains strategically well-positioned for growth in the years ahead. Besides, legal and regulatory risk is always an important factor to watch for an industry leader such as Microsoft.

The quantitative system alone does not tell you the whole story - it's important to understand the business behind the numbers in order to truly understand the main risks and return drivers in Microsoft stock.

That being acknowledged, making investment decisions based on quantified data is certainly a sounder approach than relying entirely on emotions and subjectivities when picking stocks. If the statistical evidence is any valid guide, Microsoft is well-positioned for attractive performance over the middle term.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more