Micron, The Upcoming Market Leader In Semiconductor Devices

This article originally appeared on iknowfirst.com

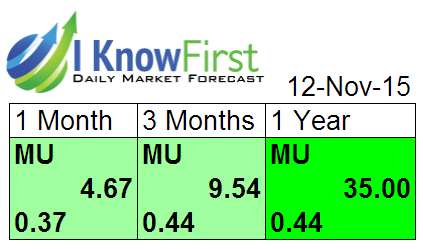

“I Know First” has had a bullish view on MU for the past 3 months. Just today we were able to reinforce that view with our daily market forecast based on our algorithm, which indicates MU as long core investment.

Equity Profile

| Equity Rating | Overweight |

| Price | $15.84 |

| Date of Price | 10 Nov 15 |

| Market Cap (mn) | 32,000.00 |

| Price Target | $23 |

| Price Target end Date | Nov16 |

Our prediction on Micron (MU) was strongly based on our Algorithm. Our daily forecasts based on machine learning provide us with very accurate predictions on the movements stocks will have within the market and different sectors. I Know First, Ltd. is a financial technology company that provides daily investment forecasts based on an advanced, self-learning algorithm.

Although the semi-conductor business has had some trouble over the past year, we believe this is coming to an end, especially in the case of MU, which after major cost cuts has managed to come back on top.

Insight Into The Semiconductor Sector With A Focus On MU

In June the SOX Index (semiconductor index) was at it’s peak before falling drastically up until August loosing 25%. To date the index has appreciated about 22%, and is now near to flat YTD. We believe this is due to buy-side investors (e.g. hedge funds) strong belief in cost cuts that turned out to be better than feared.

Following negative earnings reports for MU in 1Q, 2Q and 3Q, as well as 20% cumulative CY16 EPS cuts, we are confident that 3Q represented the last round of major spending cuts. In the last downturns (2008 and 2011) we saw the stock react favorably post major rounds of cuts. In fact, MU is already starting to see signs of shipping to consumption levels starting 1H16.

Companies in the sector such as MCHP, TXN, ON, LLTC and MU, which have been disciplined with channel/distributor inventories and shipping below consumption are indicating a return to seasonal trends moving into the 1H of next year. We believe semiconductor companies have started to positively discount this fundamental dynamic, which when combined with an M&A wave in the sector, still in the early stages of unfolding, is a recipe for success. We therefore are recommending semiconductor stocks in general. We believe the sector is in the early phases of pulling out of a mid cyclical downturn, characterized mainly by inventories normalizing with demand trends.

Below the performance of the SOX index can be seen:

Source: Sector Data, Bloomberg

We like to look at average growth’s in the sector although we always consider our algorithm as the main driving factor in our investment analysis.

Below the SOX index performance is shown against the S&P 500. We can see the August lows as described above and the comeback in price to date.

Source: Bloomberg

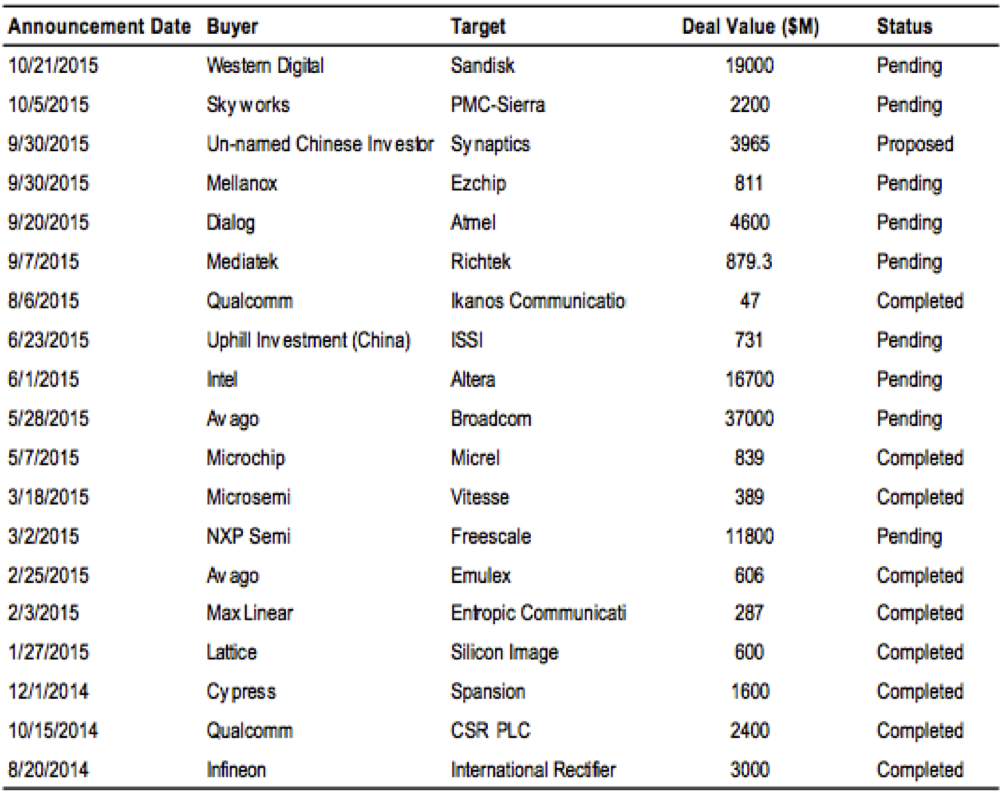

Major M&A Deals

M&A consolidation is likely to also help keep a bid in semiconductor stocks – we are still in early innings of industry consolidation. In the past year, there have been several high profile merger and acquisition announcements. We expect consolidation to continue as semiconductor companies will want to further increase scale, diversify revenue, and solidify market leadership as the semiconductor industry matures. With the slower industry growth profile, companies are looking to achieve diversification, revenue and cost synergies. Despite a slightly weaker fundamental environment, we believe that as M&A activity continues, companies in the space can benefit from less competition (less pricing pressure), more scale/diversity, and focus on profitability improvement and EPS growth resulting in higher multiples for the companies in the sector.

M&A deals likely to help keep an interest in semiconductor stocks. Although we are still in the stages of speculation and talks, we are confident mergers will be finalized and new giants in the sector will arise. In the past there have been several high profile mergers, which can be seen in the table below. We believe this trend will continue as companies will want to further increase scale, solidify market leadership, diversify revenue as well as trying to locate as many cost synergies as possible. M&A deals would be great for the sector in general as companies will have to deal with less pricing pressures implying less competition.

Chinese giant Tsinghua for instance approached MU with a very cheap offer. The offer consisted of a $23bn takeover, split in the form of $21 a share only offering to pay 4x EBITDA for the prior 12 months. The offer was rightfully refused. At the moment Micron and Western Digital (WDC) are in talks for the possible acquisition of Sand Disk Corp. (SNDK) which has hired an investment bank to help with the process. Sand Disk which produces flash memory products for cloud computing is currently valued at $12.6bn. We think the merger would be great as the companies have great synergies and would be a perfect fit for each other. It is also to be noted that MU recently acquired Elpida, a company that developed, manufactured and sold dynamic random-access memory products.

Below we can see all the companies in the semiconductor sector and what M&A deals they closed or are in the process of concluding

Source: Bloomberg, Sector Data

Investment Thesis

- New Technology, divestiture of non-core assets as well as recent cost-cuts should help MU improve its gross margins and profitability in the near future.

- The company’s increasing product range such as DRAM, NOR and NAND should decrease market volatility and position the company to outperform in markets that require multiple types of memory.

- After Elpida’s takeover Micron is well positioned to benefit from secular trends in cloud computing, mobility and networking. Micron should also benefit from secular trends in mobile DRAM.

Valuation

We calculated our Nov 16 price target of $23 based on the fact that Micron should trade at 10x (average of peers in the sector over the last 24 months) mid-cycle earnings of $2.30. Management’s focus on increasing margins across their business segments should help increase profitability. Our “I Know First” algorithm also supports our valuation and 1-year price target. We maintain Micron as core long overweight stock.

Risk To Price Target

- Any weakness in demand for PC’s could reduce estimates on DRAM price recovery

- Any Macro-economic driven event, which could reduce demand for Micron’s products could impact revenues and profitability

- It is to be noted that Micron is in a very competitive sector, which makes management execution critical

- Any decrease in demand for DRAM and NAND could cause Micron’s revenues to fall

Algorithmic Analysis

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The algorithm has more data to forecast within the long term and, naturally, outputs a more accurate predication in that time frame. Having said that, intraday traders, along with short-term players, will also benefit by taking the algorithmic perspective into consideration.

The self-learning algorithm uses artificial inelegance, predictive models based on artificial neural networks and genetic algorithms to predict money movements within various markets. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

Above we can see I Know First’s algorthmic forecast for Micron Technologies over the periods of 1 month, 3months, and 1 year. Our system outputs the predicted trend as a number, positive or negative, along with the wave chart that predicts how the waves will overlap the trend. This helps the trader decide which direction to trade, at what point to enter the trade, and when to exit.

Conclusion

After analyzing various aspects of the semiconductor sector, and Micron’s business model and financials, we maintain our overweight view for the equity. We think the semiconductor sector is on the rise and ready to gain some value. It should also be interesting to follow the “talks” regarding the possible takeover of San Disk, which could increase Micron’s market presence in the sector, as well as increase their profitability. Our overall analysis of Micron is supported by our algorithm’s strong bullish view on Micron as can be seen above.

Disclosure: I Know First is a financial services firm that utilizes an ...

more