Matinas MAT2203 Could Be A Game-Changer

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Last month, Matinas Biopharma (MTNB) held a corporate update conference call outlining for investors the company's clinical development program with MAT2203, a lipid crystal nanoparticle formulation of amphotericin B. The call was extremely informative and highlighted what I believe is a potential transformative program for the treatment and prevention of invasive fungal infections. I think MAT2203 is a potential blockbuster drug.

Shares of Matinas reacted well in anticipation of the event. The stock tripled in value between late August to early October 2016. It has pulled back significantly since that time, be it profit taking or fears of the pending election, and I think that has created a real opportunity for investors today. MAT2203 has real differentiating characteristics from existing formulations of amphotericin B (AmB). Below I provide for investors an overview of the Matinas story and why I believe the shares are attractive for long-term investment.

Introduction To Matinas & The Cochleate Technology

In its current form, Matinas Biopharma is less than two years old. Matinas focuses on the treatment of chronic and acute infection. The company's two lead products are MAT2203, an oral formulation of the antifungal agent amphotericin B for invasive fungal infection (IFI), and MAT2501, an oral formulation of the antibiotic, amikacin. For the purpose of this article, I will focus solely on MAT2203.

Matinas acquired MAT2203 through the acquisition of Aquarius BioTechnologies, Inc. in January 2015. Aquarius held the rights to the cochleate-mediated drug delivery platform, a nanoparticle delivery technology that facilitates the active uptake of anti-infectant drugs into macrophages to combat potential fungal, bacterial, and viral infections.

The cochleate technology was previously known as Bioral™ owned by BioDelivery Sciences International (BDSI) from 2002 to 2009. BioDelivery was unable to move forward with the advancement of this platform because sourcing the key raw material to create the cochleate technology, dileoylphosphatidylserine, was just too expensive (~$60 per gram). Inventors of the technology were able to redesign the formulation to source phosphatidylserine from soy protein. As such, the cost is now less than $1 per gram, thus making it viable drug delivery technology worth pursuing in clinical development.

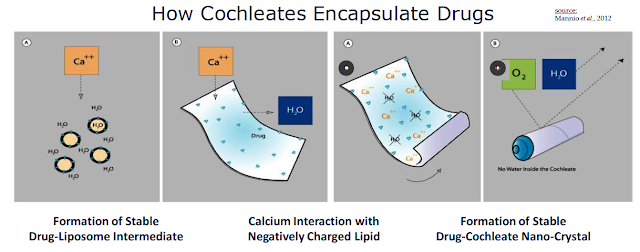

Cochleates are stable, crystalline phospholipid-cation delivery vehicles that are composed of soybean phosphatidylserine (PS) and calcium. Calcium is used to create a calcium-phospholipid anhydrous crystal structure that traps the active pharmaceutical ingredient (API) inside the nano-crystalline structure. Once formed, the compound has a unique multilayered structure and no internal aqueous space. Cochleate drugs can be taken orally because the high calcium concentration inside the digestive tract keeps the cochleate structure in crystalline form. This protects the API even though the outer layers of a cochleate crystal may be exposed to harsh environmental conditions or enzymes found in the digestive tract.

"Encochleated" molecules within the interior of the cochleate structure remain intact resulting in an increase of oral bioavailability, lower toxicity, and the opportunity for intracellular targeting. The arrangement of a drug product inside the cochleate elongated shape creates a tightly packed bilayer. Macrophages readily engulf cochleate through phagocytosis. The vesicles form endosomes, which merge into lysosomes inside the macrophage.

Once inside the macrophage, the nano-cochleate structure unrolls due to the low calcium concentration of the cytoplasm. This releases the active pharmaceutical drug inside the macrophage. The macrophage then travels to the site of the infection, slowly releasing the active anti-infectant where it is needed most.

Management refers to the cochleate-mediated delivery of API as the "Trojan Horse" hypothesis. The API is protected from the harsh environment of the GI tract, actively taken up by macrophages, and trafficked to the site of infection by humoral response. The lower plasma API level results in less systemic toxicity and increased efficacious concentration around the site of the infection. This is in stark contrast to the traditional model for drug delivery in which high concentrations of the API in the extracellular milieu are necessary for intracellular penetration. The conventional approach results in a relatively low percentage of circulating drug entering the cell and nonspecific toxicity.

The potential to change the pharmacokinetics and biodistribution of drugs provides some significant advantages of encochleated molecules. Cochleates themselves appear to have a nontoxic profile and to improve the safety of toxic drugs. They are composed of safe products: phosphatidylserine and calcium. Phosphatidylserine is a natural component of all biological membranes and is most concentrated in the brain. Thus, there is little worry for adverse effects from the cochleate itself.

MAT2203 - Cochleated Amphotericin B (CAmB)

Matinas lead cochleate product candidate is MAT2203, a nanoparticle formulation of Amphotericin B (CAmB). Amphotericin B is the gold standard for systemic antifungal infections. It is a well-established, highly efficacious systemic antifungal drug that has a 50-year history of intravenous (IV) therapy. AmB is a polyene antifungal agent that works by binding to ergosterol, a component of the fungal cell membrane. This binding leads to increased cellular permeability and inhibition of fungal cell growth. Polyene antifungals do not harm human cells because humans cells use cholesterol instead of ergosterol in the cell structure.

As noted above, AmB is the gold standard for invasive fungal infections (IFI). The drug is highly potent and has utility as an anti-parasitic agent as well. Intravenous formulations such as AmBisome® and Fungizone® remain among the most effective agents in the treatment of life-threatening systemic fungal infections, including aspergillosis, cryptococcosis (torulosis), North American blastomycosis, systemic candidiasis, coccidioidomycosis, histoplasmosis, zygomycosis including mucormycosis due to susceptible species of the genera Absidia, Mucor, and Rhizopus, and infections due to related susceptible species of Conidiobolus and Basidiobolus, and sporotrichosis.

Unfortunately, AmB has a rather high rate of toxicity that can limit its use in some patients. Liposomal formulations of AmB, such as AmBisome (LAmB), have been shown to reduce the toxicity associated with the compound. Worldwide sales of AmBisome peaked at roughly $500 million in 2014, with approximately $350 million coming from the U.S. at Gilead Sciences.

Surprisingly, no oral formulations of AmB are commercially available. Although some patients can tolerate the IV injection, many still experience localized and systemic side effects associated with IV administration of the drug. For example, the Side Effect & Drug Interactions section of the AmBisome prescribing information includes warnings on renal impairment, hepatic impairment, febrile reactions, fever accompanied by shaking chilies, normochromic and normocytic anemia, musculoskeletal pain, anaphylactic reactions, dermatologic reactions, including Steven-Johnson syndrome, neurologic reactions, including convulsions, tinnitus, and vertigo, hematological reactions, and injection site reactions. Some of these side effects can be reduced or eliminated completely by CAmB. For example, the injection site reactions and potentially the hematological, hepatic, and renal impairments are attributable to the IV delivery. AmBisome is also a rather cumbersome and time-consuming drug to administer. This 10-minute YouTube videoprovides a glimpse into the inefficient process necessary to administer AmBisome to an infected patient.

- MAT2203 Preclinical Data

Aquarius BioTechnologies and its predecessors have amassed a significant and impressive preclinical package with MAT2203.

→ A preclinical study of CAmB showed the drug to be efficacious in vivo against C. albicans infection (Zarif et al., 2000). ICR mice were infected IV through the tail vein with C. albicans and then treated 24 hours later with various doses of CAmB or intraperitoneally-delivered amphotericin B (DAmB, Fungizone®). The graph below shows that at a dose of 0.5 mg/kg, 100% survival was observed in mice treated with CAmB (◊) versus only 60% with Fungizone® (♦) at the same dose. Mice treated either with 0.1 mg/kg CAmB (▲) or Fungizone® (○) showed decreased survival rates, while all mice treated with empty cochleate (■) died by day 10. The authors also found that CAmB was superior to Fungizone and AmBisome in targeting infections of the spleen.

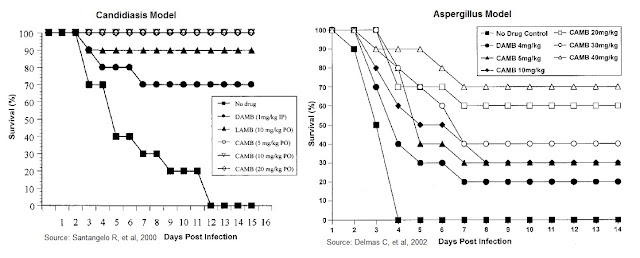

→ A preclinical study of CAmB in a mouse model of Candidiasis was published by Santangelo R., et al., 2000. The authors examined the survival of mice infected with C. albicans, treated oral CAmB at 5, 10, and 20 mg/kg, compared to LAmB (AmBisome®) at 10 mg/kg and DAmB (Fungizone®) at a dose of 1 mg/kg per day. The results show impressive survival for the oral CAmB formulation, superior to both the LAmB and DAmB formulations.

→ A separate preclinical study of CAmB in a mouse model of Aspergillosis was published by Delmas G., et al., 2002. The authors examined the survival of mice infected with A. fumigatus. The mice were pretreated with cyclophosphamide at 200 mg/kg and given oral CAmB daily at a dose of 5, 10, 20, 30, or 40 mg/kg/day compared to DAmB at a dose of 4 mg/kg/day. Results show a significant increase in survival relative to that of untreated (sham-treated) control animals, with high statistical significance.

In September 2015, Matinas released preclinical data also shows that orally administered CAmB taken up from the GI tract can be found in significant concentrations above that of Fungizone for similar doses, well above the MIC, in the lungs, spleen, and kidneys. The concentrations were reproducible and quantifiable, and evident early in the treatment schedule. The data also show that plasma AmB levels were at or below the limit of quantitation (50 ng/ml) and that drug accumulation does not tend to occur in organs of healthy animals. This is consistent with the targeted "Trojan Horse" therapy concept.

- MAT2203 Phase 1 Data

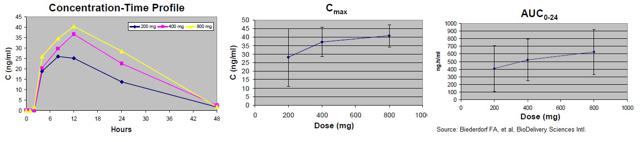

A single dose, double-blind, dose-escalating Phase 1 human clinical trial was conducted with oral CAmB to study the safety and pharmacokinetics of the compound. A total of 48 subjects were planned for participation across three dosing cohorts, with 16 subjects per cohort. Within each cohort, 12 subjects received active drug (200, 400, or 800 mg CAmB) and four received placebo. Each subject was given a single dose. Safety and pharmacokinetic evaluations were conducted for 2 weeks after administration.

Overall, CAmB was well tolerated at single oral doses of 200 and 400 mg. All treatment-emergent adverse events (TEAEs) were mild except for one instance of "upper respiratory tract infection" that was moderate in a patient taking 800 mg CAmB. Gastrointestinal adverse events were seen in 6%, 38% and 56% of subjects at 200, 400 and 800 mg respectively, and all were mild at doses of 200 and 400 mg. The most common AE was nausea, seen in 6% of subjects taking 200 mg and 19% of subjects taking 400 mg, and were of mild severity in all cases at those dose levels. Below is the TEAE table.

Overall the safety and tolerability of CAmB look excellent at the planned therapeutic doses. There were no abnormalities in clinical laboratory testing of blood or urine. Pharmacokinetic assessment indicated increases in Cmax and AUC with increasing dose.

MAT2203 Development Plan

Matinas has a multi-pronged development plan in place with MAT2203. This is consistent with the company's belief that the drug has broad-spectrum antifungal activity with underlying advantages in dosing, tolerability, and targeted delivery versus both IV formulations of AmB and other commercially available antifungal agents. Matinas has preclinical data supporting advancement in Candidiasis, Aspergillosis, Cryptococcal Meningitis, and has presented concept work in using the drug as a prophylactic in at-risk patients.

The NIH Study: This is an open-label, dose-titration Phase 2a (NCT02629419) National Institutes of Health (NIH)-sponsored study examining the efficacy, safety, and pharmacokinetics of MAT2203 in the treatment of mucocutaneous candidiasis infections in patients who are refractory or intolerant to standard non-intravenous therapies. This includes patients that no longer respond to azole treatment. The NIH will provide funding, clinical sites, physicians, and patients. Matinas only has to supply the drug. That's a heck of a good deal, as it not only greatly reduces the cost to the company but also provides access to some of the best doctors and facilities in the country to run the trial.

The trial includes 14-day dosing and evaluation periods. Depending on clinical response during each treatment period, investigators will have the ability to continue the effective dose for 28 total days or increase the dose of MAT2203 up to two times and extend treatment to a maximum of 56 days. The typical response rate in these patients with oral antifungal therapies, azoles, is only approximately 5%. Therefore, the statistics for this trial have been designed in such a way that if 20% of the patients experience a clinical response, the primary endpoint will be achieved.

Target enrollment is up to 16 patients, most likely who are immunocompromised (e.g. advanced cancer, organ transplant, or viral infection). The first patient was dosed in early October 2016. The trial should only take a few months to complete. Keep in mind, a 20% response rate equates to only 3-4 patients. Topline data are expected during the first half of 2017.

IFI Phase 2: Matinas will also conduct a small multiple dose safety, tolerability, and PK study in patients with mucocutaneous candidiasis undergoing treatment for hematologic malignancies to add to the data package. This will include patients being treated with the chemotherapy regimen that typically induced neutropenia, causing suppression of the immune system and subsequently puts patients at risk for developing an IFI. Approximately 12 to 16 patients will be enrolled. Data from this program will help management determine the next steps in the development of MAT2203 as a prophylactic regimen in at-risk patients, an indication for which MAT2203 was granted QIDP designation in September 2016.

VVC Phase 2b: In an effort to further strengthen the data package and to increase the number of patients exposed to MAT2203, Matinas plans to conduct a second Phase 2 clinical study in patients with vulvovaginal candidiasis (VVC). This study will compare MAT2203 to 150 mg fluconazole (Diflucan®), an approved medication for that condition, as an active control. The VVC study is expected to be a much larger study than the mucocutaneous candidiasis study, with a target enrollment of up to 75 patients. Management anticipates initiating this study before the end of the year. The primary objective is safety, but clinical cure rates and mycology eradication will also be assessed. Topline results are expected around the middle of 2017.

The inclusion of these additional studies should allow the company to add depth to the data packets and put management in a prime position to move into registration trials as soon as 2018. Importantly, these studies add little in terms of time or development cost to Matinas R&D budget, so I see this as a rather efficient development program for a potential blockbuster drug. Keep in mind, the entire Phase 2 program will likely complete in the next 6-8 months.

Phase 3: Following completion of the above Phase 2 studies, management will sit down with the U.S. FDA and outline the path to approval, which likely will include two large Phase 3 studies with MAT2203. Assuming this meeting takes place late 2017, it is likely the first Phase 3 program will begin during the first half of 2018. I expect that one trial will be a 400-500 patient study to evaluate the efficacy and safety of MAT2003 versus a control group for the prevention of IFI in patients with hematologic malignancy being treated with a chemotherapy and the second will be in the treatment of invasive fungal infections in patients with hematologic malignancy.

Market Opportunity

Compounds like AmB work by binding to ergosterol, a component of the fungal cell membrane. This binding leads to increased cellular permeability and inhibition of fungal cell growth. AmB has activity against a broad spectrum of invasive fungi, and thus it is the standard of care for many systemic fungal infections. The drug is fungicidal, which means it kills the invading fungal infection, as oppose to azoles like fluconazole or voriconazole that are fungistatic (only halt the spread of the infection). Unfortunately, the high toxicity of intraperitoneal amphotericin B, which shows up at around 1 mg/kg is roughly equal to the therapeutic dose, thus creating a very small therapeutic window for the drug.

Gilead's liposomal formulation, AmBisome® (LAmB) has improved tolerability up to the 10 mg/kg range. However, early work done with CAmB shows that oral delivery of the resulted in no overt adverse events at doses up to 90 mg/kg in animal studies; and, as noted above, in a mouse model of Candidiasis (Santangelo R., et al., 2000), CAmB was superior to LAmB. It seems that Matinas has figured out a way to greatly improve the therapeutic window for an incredibly powerful drug.

It is clear that AmB use today is limited because of the nasty and sometimes lethal side effects of the drug, including nephrotoxicity, hepatotoxicity, risk of anaphylaxis, and anemia. As a result of this toxicity, AmB is primarily used either very early on in the treatment paradigm until toxicity shows up, or as a last resort for patients with few other options. Because the drug is administered via intravenous infusion, there is no out-patient use. As a result, when patients leave the hospital, they often leave on less effective azoles or echinocandins. Despite these limitations, the drug did $500 million in sales in 2014.

In 2013, Pfizer (PFE) reported $775 million in sales of voriconazole (Vfend®), while Merck (MRK) reported $309 million in sales of posaconazole (Noxafil®). The former market leading product, Pfizer's Diflucan® (fluconazole), now available as a generic, reported peak sales of $1.17 billion in 2003. In 2013, Merck reported $660 million in sales of caspofungin (Cancidas®) while Astellas reported $307 million in sales of micafungin (Mycamine®). These are less effective drugs with usage far greater than AmB due to the fact that they are much less toxic.

The value proposition for CAmB - being able to prescribe an oral amphotericin B product both in the hospital and after the patient goes home, in a broad population, without overt fears of nephrotoxicity or anaphylaxis - is rather powerful. CAmB, a fungicidal drug, has significantly less developing resistance, unlike what is now being seen with azoles and echinocandins. I believe this is something payors will look very favorably upon, as long hospital stays and resistant infections add significant cost to the system.

Depending upon the efficacy and safety profile, I believe an orally-available encochleated amphotericin B could have tremendous uptake. As noted above, Pfizer's Diflucan® (fluconazole) posted peak sales of nearly $1.2 billion, and the drug is far less powerful than AmB. Matinas is astutely studying MAT2203 head-to-head vs. Diflucan in the planned Phase 2 VVC study noted above. If successful, this sets up MAT2203 as a potential for a paradigm shift in how invasive fungal infections (IFI) are treated in this country. Of course, this is all highly contingent upon clinical trial results.

This is why I see the Phase 2a NIH study as a significant catalyst for Matinas shares. Data are expected in the first half of 2017. I think the entire Phase 2 program will offer data by the middle of 2017. Keep that in mind. By the middle of 2017, investors will know if MAT2203 is superior to AmBisome and Diflucan, two drugs that did combine $1.7 billion in peak sales. That's an incredible valuation infection coming in the next 6-8 months!

The IFI prophylaxis market is an even larger potential opportunity for Matinas. IFI treatment is limited to active infections and dosing typically only lasts for 1-3 weeks. Despite high mortality rates, a typical course of treatment may still run in excess of $50,000. The IFI prophylaxis market is not only 7X the size in terms of the number of patients, but treatment regiments may run concurrent with chemotherapy and last as long as 6-14 weeks. We are talking about a potential 20-50X increase in market size. This takes a multi-hundred million dollar opportunity, like AmBiSome's $500 million in peak sales in 2014, and turns it into a multi-billion dollar opportunity.

IP & Financial Position

An important part of the intellectual property protection around MAT2203 is based on regulatory exclusivity granted by the QIDP designation. This is five years of rock solid protection. Additionally, Matinas plans to file applications for Orphan Drug designation on MAT2203 for IFI treatment, which would provide another seven years of rock solid protection.

Beyond regulatory exclusivity, the company has 19 issued U.S. and foreign patents. There are another 20 pending U.S. and foreign patent applications, with an active research pipeline for new patent applications. The cochleate technology is covered by a wide spectrum of filings and applicable to many compositions of proteins and small molecules. MAT2203 is protected by two issued patents, as well as pending applications and manufacturing know-how.

Matinas reported cash and investments at June 30, 2016, of only $0.6 million. However, in September 2016, the company raised $6.9 million net through a private placement of 1.6 million Series A Preferred shares at $5.00 per share. These shares are convertible to common at $0.50 per share. The current cash position now looks sufficient to fund the entire Phase 2 program. Matinas will no doubt need to enter into a transaction to the fund the Phase 3 program, but I suspect the company will have significantly better opportunities to raise cash following the release of positive Phase 2 data in the second half of 2017.

Conclusion

I am incredibly intrigued by MAT2203. The product has clear differentiating characteristics to existing formulations of AmB, an estimated $750 million market in the U.S. The leading formulation of AmB is Gilead's AmBisome, a liposomal injection formulation that generated $350 million in sales in the U.S. in 2014. Global sales peaked at $500 million in 2014. MAT2203 looks to have superior safety and tolerability, targeted delivery, and oral administration. Importantly, AmB itself has broad-spectrum activity and limited drug-drug interactions, which all-in makes me think MAT2203 is a potential blockbuster (sales in excess of $1 billion) if approved.

In terms of valuation, successful completion of the CAmB Phase 2a study would validate the opportunity that Matinas has with MAT2203. Matinas currently trades with a market value of $110 million. Post the Phase 2a data expected during the first half of 2017, I believe this asset alone could be worth $350-400 million in value. Importantly, Matinas has a second cochleate product, MAT2501, an encochleated formulation of the antibiotic amikacin, in preclinical studies.

In future articles, I plan to provide for investors a more details look at the peak sales potential and valuation of Matinas Biopharma. As of today, I think MAT2203 has peak sales of $1.25 billion, about the same size as Diflucan® (fluconazole) at Pfizer prior to the patent expiration.

The Phase 3 program is expected to begin in 2018. I suspect that the U.S. NDA filing will take place in 2020, putting U.S. FDA approval in 2021. I think MAT2203 will take seven years to achieve peak sales. Below is a breakdown of my NPV analysis using only a 25% probability of approval, a 15% discount rate, and 5X multiple on peak sales. I've also increased the basic shares outstanding by 50% to account for future dilution and the planned financing of the Phase 3 program in 2018.

My valuation has no input for MAT2501 or MAT9001.

Despite all these aggressive measures, I still find the shares to be 140% under-valued today. Major catalysts are underway and I expect significant value inflection in the next 6-8 months.

Please see important information about BioNap and our relationship with CLCD in our Disclaimer.

BioNap holds no position in ...

more