Market Briefing For Wednesday, July 11

Erratic reallocation might be just jitters on tariffs, or issues surrounding President Trump's profound rigidity when it comes to dealing with Europe; much less not simplifying the Chinese trade relationship (make a deal and say things wouldn't be so bad if the iPhone alone didn't contribute sizable distortions to the actual trade relationship). Move iPhone production over to Taiwan or the USA; and China goes crazy. But so many firms are really involved in China now (BMW expanding big-time, even though Tesla is all you hear about in US media), that conventional tariff impositions merely do throw things off-balance, and into uncertainty the markets don't like. But in the final analysis guess what? The two nations must resolve this.

Of course the risk now is not just the post-Close story that Trump is ready to list a huge rise in Chinese tariffs, but that a serious move on taxing US Oil by China (reported today from China), could not only throw a wrench (we've already noted the Chinese actually have more cards to play than is generally acknowledged by the Administration) into this battle (becoming more than a skirmish), but actually invite purchases from Iran.

That's headline risk at the moment for the market; but it matters. Not only that, but my comments near the day's high on the afternoon rebound might have sensed something, as I noted we actually might not hit 2800 on Sept. S&P. And that any breakout above 2800 would be a fake-out anyway.

This is a tricky market; I am not in the perrenial bear camp that constantly calls for catastrophe; nor do I agree with former Government officials now proclaiming that a trade war is a 'war' that cannot be stopped. Really? He is wrong; and it can end with a series of Agreements almost overnight. It's not that the permabears don't have a point; but it's the same debt-based or whatever they can come up with (presently trade) for eons for a break.

Of course we'll get a correction; and my point has been that the optimism we predicted 'if Trump won' back in 2016 was entirely valid; and now has a problem or two. First of all Trump might succeed with the trade effort; and it may subside, then you have more upside (even after a correction). And if it does not, you'll be pleased (I would presume) that we've forewarned that if we move higher in early-mid July that would be temporary (even partially seasonal), but was NOT a Summer rally, rather a last gasp rebound as far as the near-term is concerned.

So sure; the market can be sensitive to any story; and what I spotted early last month is similar to what I spoke to in the last hour's intraday comment today; and that was the beginning of 'lateral patterns' where you get some rotation, but no general progress of the market. It's a warning technically.

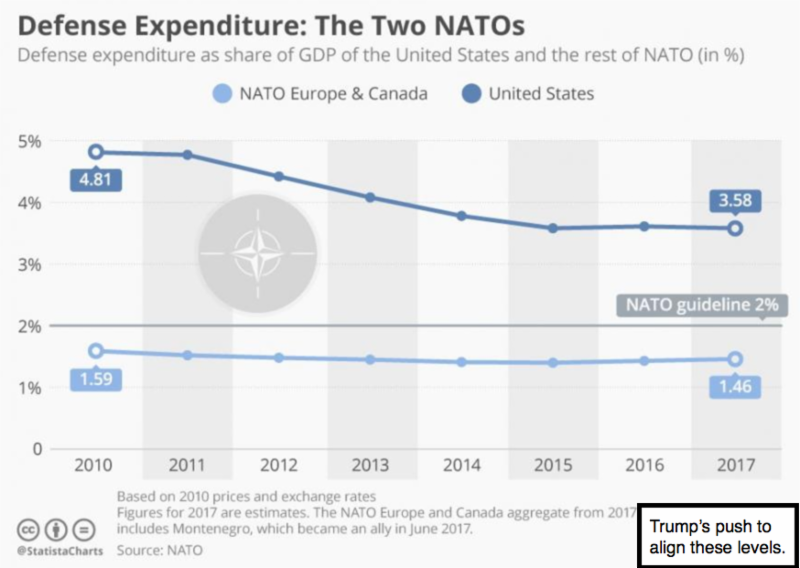

Bottom-line: the Chinese 'oil story' is timed to hit when Trump's distracted by his trip to Europe, where he becomes a distraction for PM May; already distracted by upheaval in her own Conservative Party over Brexit. And it's hard to know if the purported new tariffs were decided while he was on the way to Brussels or before. Regardless the rallies in the market are clearly fake-out moves, with desperate efforts Monday and Tuesday to rotate into less dangerous stocks than the incredibly bloated FANGS and so on.

You can't yet quantify the Chinese impact; although in our view (stated all the time lately) any one of these rallies can be the final one before we get a more notable decline for the primary market Indexes. Imposing heavier tariffs as rumored being readied here superficially seems wrong, but might prove to be how we get some concession from Beijing; though the way it's being done is the opposite of personal diplomacy between the leaders.

And by the way even as much as I believe Apple is making proper moves in their business mix (the ecosystem and services); if China were to even threaten the iPhone; you'd get a huge plunge straight-away. Honestly the Chinese are so tied to global trade and the USA; that this is all a bit late to be occurring; as it's an effort to counter Chinese opportunism (to be kind) I have warned about for (seriously) over 30 years now. I'm not sure it's just a 'better late than never' situation; at least maybe we'll get IP theft relief.

In-sum: if there's an iceberg this time of year (hardly); it's dead ahead. At least for the near-term. I doubt the market will wait until Fall to correct and realize even most major bears suggest that's when volatility risk rises. For now a lot depends upon the trade conflict and actually market technicals. I have been looking for a break after running-in shorts, so why not now.