Market Briefing For Tuesday, April 18

An upside 'lockout' for sellers was not at all surprising, since virtually the entire 'air pocket' last Thursday was as anticipated; an 'absence of bids' just ahead of the dreaded military weekend. I suggested that sellers would get nowhere early Monday, and we'd go right back up again in a short-squeeze, 'if' we managed to avoid armed conflict with North Korea over the weekend.

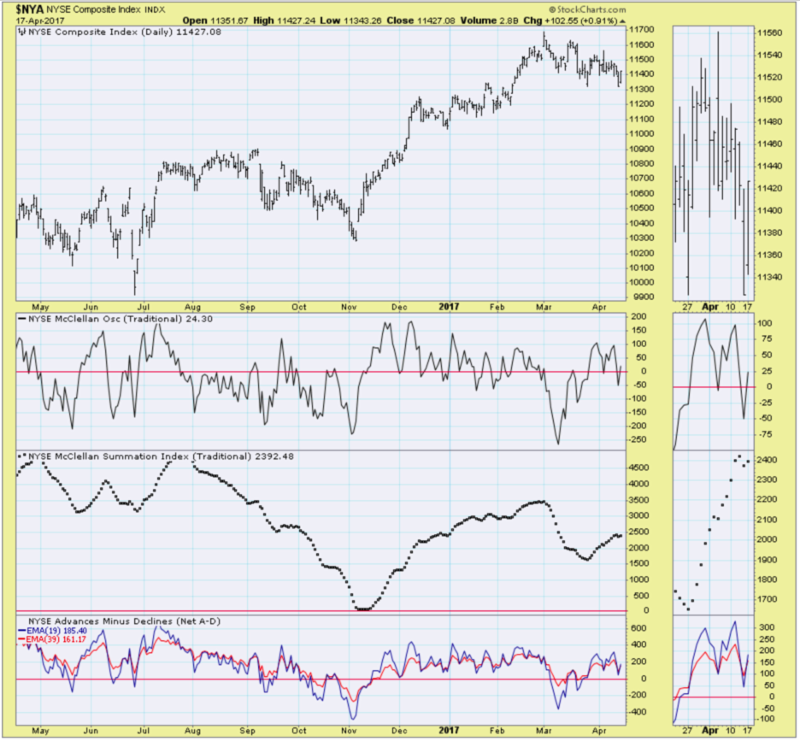

This remains an extended market and it's coming back for outlined reasons as well as the technical 'necessity' to bring it back above a June S&P 2350 level and essentially try to reassert the ranging-pattern that prevailed earlier.

That's why I observed in the weekend comments not to get overly focused, or fearful, about the technical breakdown, because the real test was not the 'buyer's strike' ahead of Good Friday, but rather the stamina for the rebound, which is what we're looking at right now.

Daily action now focuses on the behavior in the wake of the projected lift, if we got through the weekend unscathed. So far so good, but more is needed to deny a bearish alternative very near-term.

Should this falter (unlikely) shy of 2350 or a bit better, then that's a negative; but I think the next 'falter' will be after we get through that level likely on Tuesday. That doesn't mean you don't get an intraday pullback and turnaround effort, but it does mean we should watch levels like 2365-75 as perhaps more key.

Tuesday's pattern should work higher. Clearly that's subject to news sensitivity as most US media for unknown reasons is not reiterating the stories in the South Koran press, that two more US Carrier Battle Groups are deploying to the Peninsula's area.

The media is also minimizing or not reporting the 'cold shoulder' given from all EU countries to Erdogan, regarding his 'claim' to have won the Election, in Turkey, which would pretty-much complete 'his' purge of free politics and a balanced system with the Legislature.

In sum: looking for a key continuation, even if we rest or consolidate 'a bit', which markets often do after a big day like Monday, but then, actually for no particular reason other than to deny a technical barrier, they resume upside so that the looming possibilities of heavier corrective actions are denied or delayed as the case may be. Tax Day is almost irrelevant to markets now.

Disclosure: None.