Market Briefing For Thursday, May 17

A Bull/Bear creature wanders around the Streets of lower Manhattan these days; with few willing to challenge the power of leveraged Bulls (in a sense that people believe the overall uptrend can't be broken; while the reality is they're ignoring everything from credit markets to geopolitics, to seasonals (money flows that normally are slim this time of year, and to a degree pulled into Treasury Auctions rather than pressed into equities).

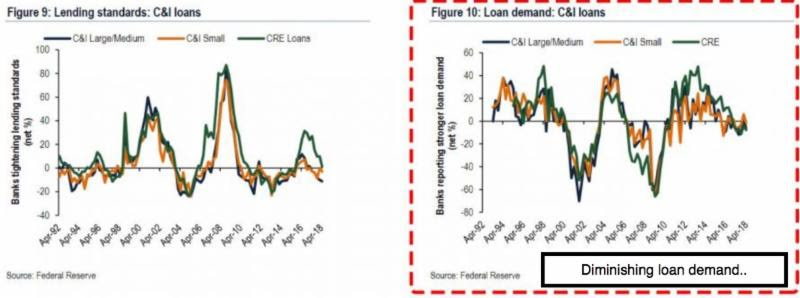

Meanwhile, as they ignore the Bears, believing they can be kept at bay if not totally hibernating; a strange thing has persisted through what sure is a ragged projected series of moves throughout the Spring so far. That has been 'rotational' selling; a diminishing of buybacks (which will persist with higher interest rates incidentally); and a 'technical' inability to take rallies and run with them.

That inability to extend moves is precisely a characteristic I expected from virtually every move since the forecast twin-bottom 200-day lift-off back in February; following our forewarned 'flash crash' prospects issued in late January for a prospective breakdown in early-mid February.

This matters since January was the primary sell-signal (unsustainable as well as parabolic rally), which correlated with my warning to stop 'writing' Puts, unless one wanted to risk the kind of damage warned of regarding the 'short volatility' strategy so many money managers were employing.

(I was in favor of that earlier; but not from the end of 2017 going forward. It was used by many pension managers to augment total return in efforts to struggle to attain absurdly high actuarial returns by generating income by such tactics. That really was useful; but only in protracted uptrends.)