Market Briefing For Monday, Oct. 9

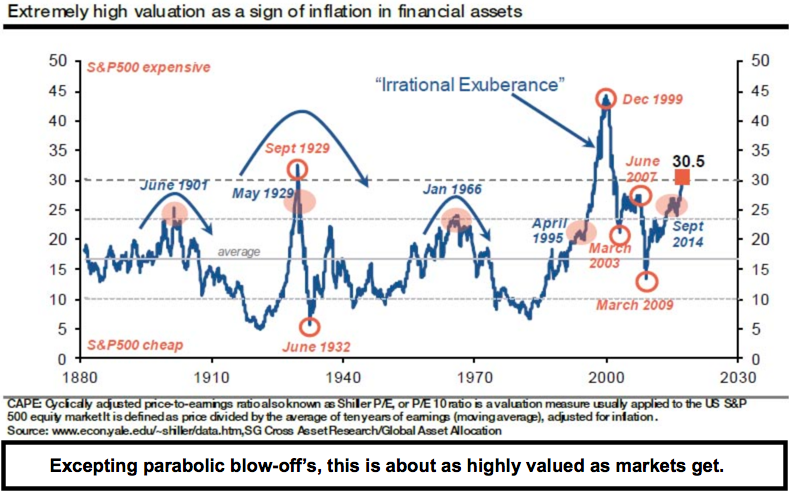

Projecting the path of this weekend's hurricane (Nate) is more accurate than the old explorer routes; and probably more precise than gauging direction a fairly exhausted stock market advance will take over the very near future. In my view this past week was one of lower-volume thrusts to new high levels; a form of exhaustion; rather than precursor to a super-parabolic leap higher.

An equity blowoff doesn't have to navigate a classic pattern that drags in all reluctant so-called retail investors, but can be an exhaustion in this case for a few reasons. One has to do with the Indexing and ETF'ing of the markets I have addressed, so that individuals generally don't pick stocks but sectors. I view that as a risk too; because stocks in an ETF will often move with others in the group, even with differing fundamentals. This trend has been one that allows the 'easy way' for analysts to approach stocks; with less analysis and that I don't view as a positive factor for investing in general.

|

In sum, we have a number of trial balloons and possible events coming up in the next few days; and we have an extended market that is presumably in a short-term exhaustion phase, whether it's preceding a more dramatic 'top' or not. As I've discussed, (barring exogenous events that shake markets real quickly to their core) you should see one or two failures, and then rebounds that fail to make higher highs, before you'll see this technically evidenced.

Plus it contributes to excess uniformity on the upside and greater inclusion on the downside, within some of those groups. There are individual issues of course that underperform or outperform indexes but generally fee-based managers gravitate towards Indexes and ETF's, and that's smoothed out a bit of volatility in this market; but also increase exposure if the game shifts.

The game can of course shift from meaningful monetary policy approaches. It's not because you have a slowing in job growth as some thought Friday. I have no idea why many thought the NFP number would be stronger; but the consensus expected much better. Aside from the hurricane impact (seen clearly in the 'service' sectors) this remains a relatively tight labor market. Salaries are not so high but picking up slightly. Post-hurricane reconstruction clearly will help going forward.

|

Disclosure: None.