Market Briefing For Monday, Nov. 5

Drilling down into variables - one can readily see the market challenges; which go way beyond simplicity expectations of a late year rally. That's not at all out of the question as I've noted before; but how we get there (if at all) varies upon the two most obvious issues that remain unresolved. (Midterm Elections; the implications therefrom; and of course trading with China.)

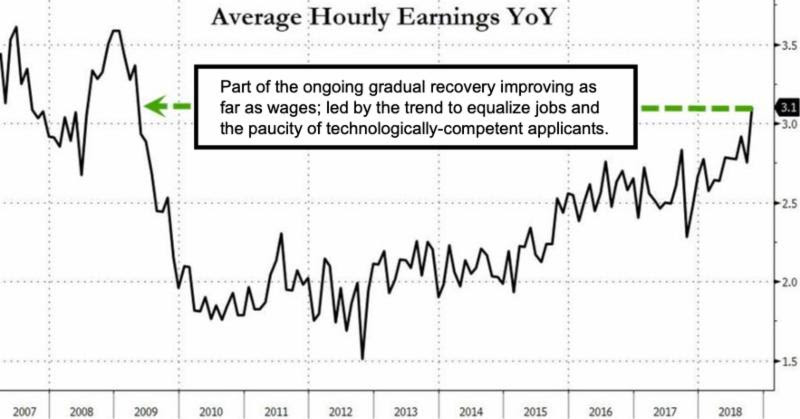

The chart behavior we've shown gave a good picture of how uncertainty has or will roil this market; and how it can defy orthodox seasonal expectations. I am not talking about Apple (a trigger for generalized worries about growth in a slower nature, not just for the Cupertino darling, but for tech in-general).

Sure, it alone can move markets (because at 5% of S&P total capitalization it has outsized impact); nor do I refer solely to in-place buyback programs, that can turn slow-growth into yet-higher earnings growth (again, artificial ways of window-dressing a stock's results while at the same time enhancing executive compensation via keep share prices at a higher level than they might otherwise command).

I'm addressing variables that a slower-growth (even if we don't get an immense blue-wave) environment can have on valuations; and whether or not 2018's persistent internal corrections (rolling bear market / 'Rinse & Repeat' style) I outlined from the initial 'crash alert' in late January; before the Feb. break, in a broad way are sufficient.

I think maybe; for many smaller-cap stocks, and a slew of major industrial companies that soared on Trump's win; then gave a lot (or more) back this year; as the excessive optimism unwound long after optimum entry points back in November of 2016, as we enthusiastically called for (a 'to the Moon if Trump wins' outlook). January's 'top' call highlighted 'not interstellar space' as you know; and outlined the rotating 'high-wealth' exodus all year.

The point of this is that oscillating pattern was masked by a concentrated as well as suspicious movement (stealth distribution) in FANG and momentum stocks (a relatively small handful of issues); led by Apple's domination and a ridiculous price extension on stocks like Amazon, Netflix and Alphabet. As the 'stealth' distribution took place, we pointed-out how 'insider selling' really was at historic levels (they used the share-repurchase buybacks to levitate a slew of stocks even when earnings really weren't otherwise assisted by a company's sales, with buybacks and tax-related boosts masking revenue).

In sum: all of this means part of the distribution anticipated the Bear Market of 2018 for about 9 months now; as a bifurcated nature of FANG leadership suggests many stocks have more room to adjust.

And that can be the 'macro' issue, regardless of any potential year-end rise, presumably related to getting past 'Midterms' and making a China trade deal that also won't immediately trigger better earnings; though would be a relief.

This is the mega-cap technology challenge in a nutshell. Slower growth with these dominant stocks (5 companies are about half the S&P's capitalization) creates downtrends that should at least surrender the excess 2018 gains.

Per Larry Kudlow, we have seen nothing in response from the Chinese yet; which contradicts the Bloomberg story before the opening (intended to spike stocks beyond Apple), which questions not necessarily the reporter integrity as much as perhaps highlights differing opinions on the 'status' of talks with the Chinese, coming from different officials in the White House.

Bottom line: Friday was absolutely defensive, with the 'trade-related' story (real or contrived) spiking the S&P sufficiently for the day's start to offset of course pressure (about 100 DJIA points worth) from Apple; and thus letting traders anxious to lighten-up (weeks after the last train out of Dodge) get an opportunity to do so; and even to sell short intraday.

Late session alternating swings occurred as the President 'seemed' eager to contradict Kudlow's remarks; so again you had a brief sharp snapback, prior to more mixed defensive behavior.

The session shows the sensitivity both to 'China trade / tariff' negotiations of course; as well as in my opinion significant trepidation ahead of Midterms. I realize this cause stress and angina for many investors; but not here. All of this is generally the fight I anticipated this week; both with respect to earlier forecasts plunges (led by FANG etc.); and a desperate rally trying to retain a semblance of technical trend strength (it's not there; but borderline) leaving it in position to respond not only on 'trade', but especially after Midterms.

One change is needed in the regulation of oil futures, which would be that nothing can be done using borrowed money. Cheap credit allowing risk-free speculation is what gave us $5 per gallon gas a f few years back. We certainly don't want that to ever happen again. So they can pay 100% cash for those futures and assume 100% of the risk. And they get no sympathy from me.