Sunday, May 21, 2017 5:57 PM EDT

Almost like a 'volcano' appears before and after it erupts, Friday's very strong upward extension saw prices start to flow down the other side of that pyramid; albeit the news-based selling was somewhat contained nearer the session's close.

|

This leaves Monday somewhat up in the air although it probably remains a lot more internalized about concerns over Trump's domestic policy agenda, if it gets through Congress, than it is about the international affairs.

In a way that's sad; as it's pretty clear that Trump (with Kushner) are trying to change the dynamics in a big-time way that has eluded Administrations of both parties for decades, not just years. And it definitely is an effort to shift a good bit away from the former policies mollifying the Iranians or bordering on encouraging societal angina, undercover of human rights which matter a lot but without more education about tolerance and how a republic, not just a simple democracy, works, it's not 'as if' the Middle East was suddenly now reading the Federalist papers or becoming a Jeffersonian Democracy.

|

In sum, you have a market that had a fairly mild post-breakdown snap-back which largely evaporated in the final minutes. It was more a short squeeze, as contrasted with a true infusion of investment grade capital.

|

|

'It ain't over 'till it's over', as the old saw goes; with this market's stamina of an unprecedented nature, leading to a downside performance very much as outlined in the last two days. That 'show' is barely underway; while sure sensitive to all sorts of developments that unfold almost by the hour or day.

In a true 'raid' on the 'House of Ill Repute' (and I'm referring to the market in this case not Congress or the White House), the saying goes: they 'take the good girls, the bad girls, the Madam, and sometimes even the piano player'.

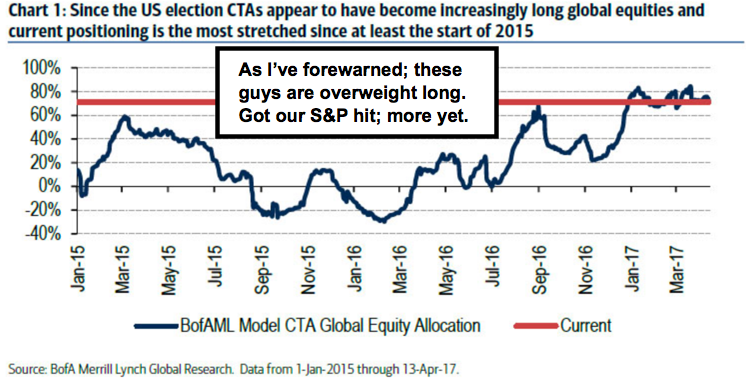

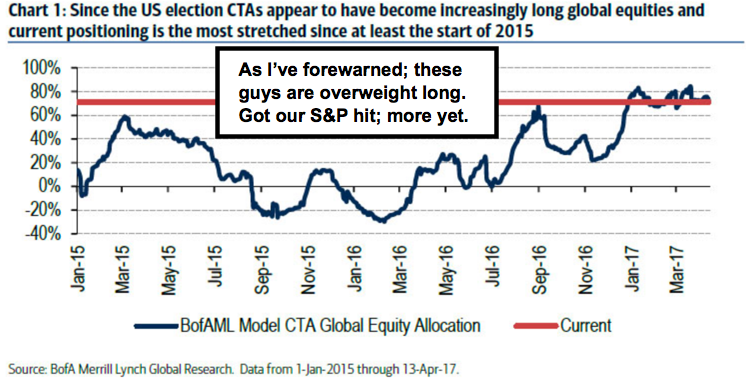

That's a way of describing our warning about the concentration in ETF's and Index funds; with managers falling-back on this modern version of 'bankers hours' (recalling the old saw about how they started at 10 and left at 3 just to play golf and not work beyond the minimum). That's my way of humor about 'passive investing' risks; which reflects the discrediting of active managers in recent months and is something I warned about because it would enhance the downside once the market faltered below key algo-triggering levels.

We had a preview days ago and another shot-across-the-bow Wednesday. I wrote a special report Tuesday to emphasize how everything lifted post-Election that we accurately predicted would soar if Trump won and was in essence based on 'optimism', not on earnings like the majority proclaimed.

It meant that risk was far greater than all monkey-see / monkey-do manager approaches (peer performance matching rather than heroics) was a threat, not a true reduction of risk by diversification. Passive was a lazy way mostly, of appealing to investors (and sure, ETF's do that) looking for simplification, at the same time it allowed managers to work less at analyzing stocks. |

In sum, politics here and geopolitics everywhere, are extremely fluid now. In the process, the stock market swings in alternating significant moves, which almost makes 'every day' look like a 'one-day' wonder, not just a single day. The other side of the volcano is barely cracked-open, more may lie ahead.

|

How did you like this article? Let us know so we can better customize your reading experience.