Market Briefing For Monday, June 9

Isolation of the USA in 'trade' - is presumed to be a 'non-starter'. Hence, it may well be why pundits are debating 'which' sectors do better in such a 'trade war', rather than contemplating an entire upheaval of major equities, since a majority of big-cap traditional companies rely on global sales, and relationships, for typically half or more of their gross revenues.

Thus I can only presume (and I lean that way too, as obviously do many of our trading partners given the meek reaction to the kick-off actions Friday), and that's the inherent risk, that the Chinese and Americans will not cut off their noses to save their collective faces, though so far they're doing that.

At 1 am Friday, as Bloomberg's Hong Kong bureau seemed to be holding their breadth (pun intended) pending Beijing's qui-pro-quo response, I had a fleeting thought that Chairman Xi might be clever enough to 'hold back', on tit-for-tat, and do absolutely nothing. I thought that would be brilliant in the face of Trump's move, even though of course response to China is so overdue (by decades) that it's really dangerous in an interconnected world as we now live in. Hence the risk really is there if they don't ameliorate it.

This is not so much a 'circus' as it is a 'balancing act' of how far to go. Just by by virtue of igniting the conflict, seeing who initiates talks, not who is the first to blink; it becomes useful if nobody is perceived to 'blink'; rather they quietly agree (which I'd like to believe is ongoing) to approach it smartly.

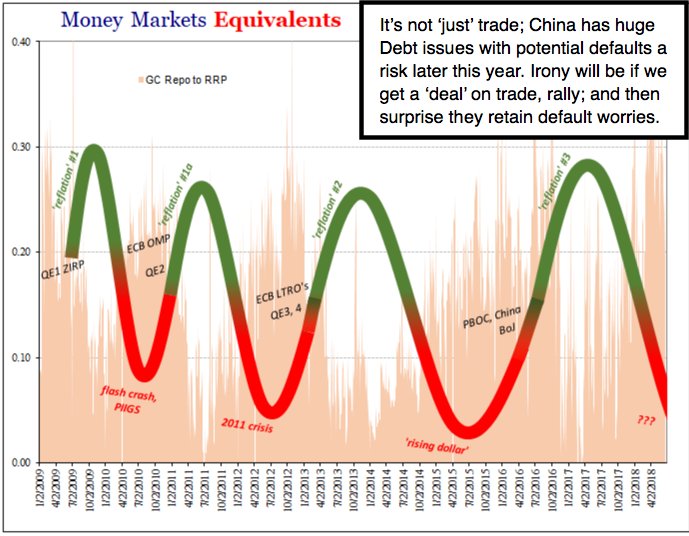

Again no argument about the need for redressing what China (more so we believe over the years than all others; due to the Intellectual Property theft) has done to us. But, never mentioned that I've noticed in the chatter today; all it takes is a Chinese instruction to the PBOC to increase liquidations of US Treasuries and guess what; they have more 'bazookas' in their pocket than the popular perception of limited ammunition to tariff coming from us. It's hard to say if China is also playing the North Korean 'card' again, with a recently reported upsurge in construction in their nuclear reactor areas.

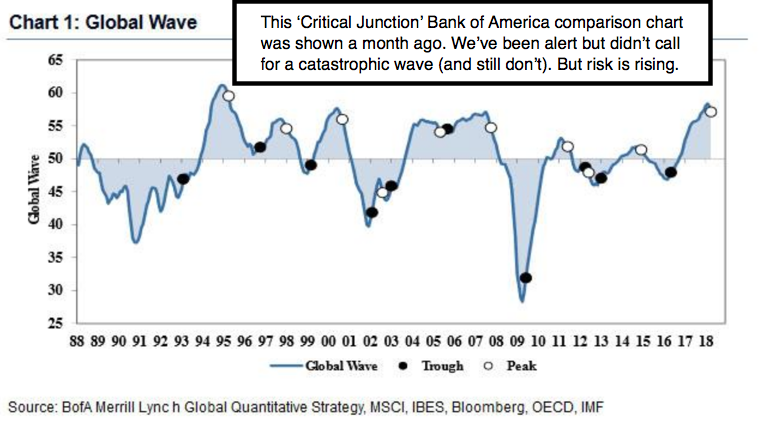

Technically the stock market has pulled this out yet-again; and we aren't disappointed at all. Mostly because the best 'odds' of playing the downside evolve from a blow-off type move; and if we can thrust even higher before a slide commences, this time it will enhance the prospects. However, there is maneuvering room for now; not just because of 'cushion' above support, but because we're not jammed overbought; and are above the overall S&P inflection zone I've outlined (from Sept. S&P 2740-60). But beware, get a day or two more like this, without a decent pause, and lookout below.

In-sum: we knew there was a prospect for the stock market to actually be able to set-up a decline by "NOT" declining much early Friday on 'trade' (in my view the labor report was entirely neutral as regards markets for now; and was unimpressive not for the new job entrants but slack wage rise).

My idea Thursday night was that if we got the shorts run-in big-time (hard to say how far, but higher), and 'then' something comes along to knock-off the S&P from its perch; well, the Bears won't be prepared for it and might have to sell into weakness. What's the advantage? As outlined earlier just minimizes the prospects for yet-another upside move that gains traction. It seemed to me (slightly cynically) that would be a good way to get not just a decline that lasts more than a couple hours; but perhaps a correction.

Finally I am actually troubled by the implications of JP Morgan buying into Deutsche Bank. Not for the deal; but shades of 'too big to fail'; that Bank is essentially the National Bank of Germany. And when you combined not just my warnings 'not' to buy Financials, and see the constant erosion; it's increasingly evident that there are problems beyond limited loan demand, or a hair-higher Fed Funds rate level. Even the cutbacks few talk about in New York (beyond the trading desk reductions we've noted before) and of course their contribution to declining real estate prices (also little noted); it smacks of a brewing crisis that's somehow being 'suppressed' from light. If members have clues, share; and we'd be glad to illuminate everyone.

Bottom line: we have to assess this daily; but again; the sell signals more or less repeat 'on the sharp rally phases', not on the swoons that drop into areas of testing support. That's why I wasn't fazed by prior week's drops, as I emphasized the warning that was coming was the lateral action earlier in June. Now let's if we either repeat something like that in the days ahead or, more ominously if it occurs, spike higher and do an up-down reversal.

Job growth without inflation is not a sufficient justification for the great fight between Bulls & Bears, risk of an Inverted Yield Curve, and of course the majority of gains being in the 'most shorted' stocks. If action contradicts all logic (it doesn't); but if it does then that supports the idea that much of this is in stocks with trapped heavy short-interest (and there it does). Hence be on alert, as this rally is build on counter-reactions to disruptive news that's absolute in-itself not constructive; at least not yet.