Sunday, June 18, 2017 4:17 PM EDT

Terrains are in transition all over the place. Most evidently with Friday's earthquake that dug another fissure in an already-fractured and largely desolate retail landscape. It's not about Whole Foods per se; it's about distribution as well as supply-chain economics in the 21st Century.

Others are in a panic for sure, as was already evident from preeminent grocer Kroger's conference call a day earlier, and even Target repeatedly stumbling with their business model (I suggested long ago they'd not really recapture their customer base after the database breech).

|

The competitive challenge others can bring to the table are likely not going to prevail, versus the implications of Amazon penetrating the higher- of food markets, and then bringing perhaps 'Depression pricing' for a time to the food industry in order to lock-in 'share' and assure control of prices. It's an upheaval that should get Federal attention due to the wild implications. If and as it does, that might be a market factor to contemplate at the time.

|

|

For now, we did NOT expect the resultant Friday morning shakeout to really impede most market sectors from recovering Friday just as hoped would be the pattern into this Quarterly Expiration's finale.

|

Daily action has successfully identified trading probabilities that continue evolving. At the same time we have encouraged selling (especially pricier FANG type stocks) over recent weeks, only on rallies. That's worked-out very well as almost all such stocks (especially in technology) are lower now.

The general idea was to avoid short-selling, avoid broad liquidations and to recognize that money is still flowing in, albeit from foreign central banks and so on, some of which seems to be migrating toward lower flows. This might itself be a factor as we work through a time of year when there generally is a paucity of new liquidity coming from domestic sources.

Yes, there is historic margin and lots of leverage hedger strategies ongoing. That both keeps the pattern alive, but it grows debt and increases the risks, in the event of something like a 'fat-finger' (that's when they try to excuse it, 'as if' nobody could see the risk of something nasty forthcoming) liquidation or 'flash crash' wave of selling. We suspect that's looming out there.

Nearer term, the pattern outlined for the past week certainly persists, which as you know called for the market to 'absorb' the Fed's likely rate hike, and largely ignore their 'statement' or 'intent' to hike rates frequently (as if USA economics were sufficiently strong to envision that). We thought that would allow the digestion of the news (you can throw in another bit of concern that relates to the administration), and a generally upward tilted expiration.

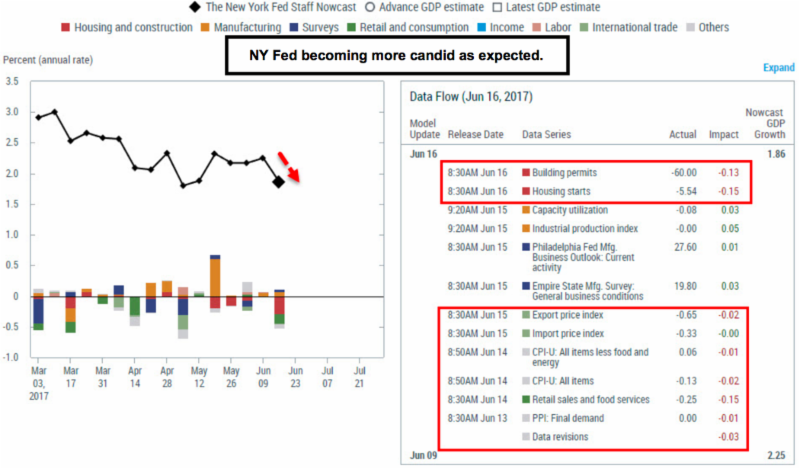

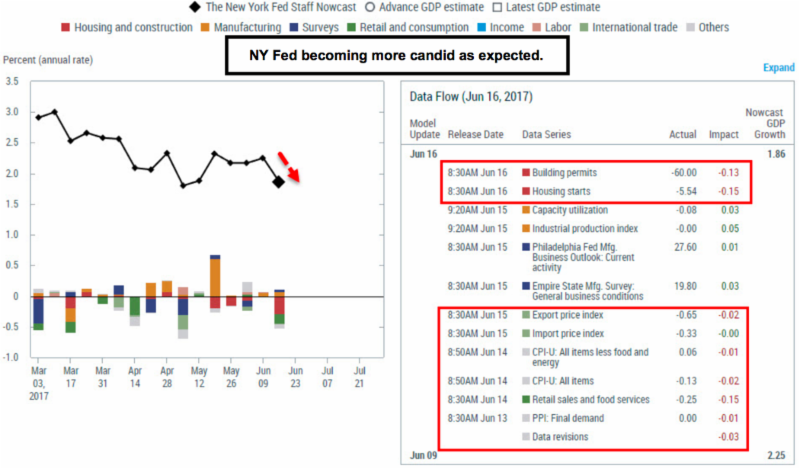

Meanwhile the GDP expectation has been ratcheted down as projected so likely (NY Fed, with extrapolations suggesting Atlanta follows), and markets are ignoring that, so far. We thought markets would ignore it, perhaps drift a bit lower in the early part of the week coming up and then another important intraweek rally, which has the potential to reverse into a short-term shakeout and that's where the technical levels will subsequently become pertinent.

|

|

How did you like this article? Let us know so we can better customize your reading experience.