Market Briefing For Monday, January 9, 2017

The upside 'optics' have been clear since we visualized a 'Trump Romp' not only from the election forward, but in the event he won envisioning a switch to a far more bullish stance than seen in years. Rightfully so as markets and corporate responses to the 'Bully Pulpit' of the President-elect have shown.

We have another round of CES starting... their 50th Anniversary. The focus remains on 'autonomous or driver-assisting systems' in automotive; at the same time virtual reality 2nd Generation systems should be premiered. I will take a look at all of these, beyond drones which are a poignant topic. (A friend of mine was in a helicopter crash a couple days ago while taping with a drone from the chopper that crashed into a snowbank on Mount Baldy just East of Los Angeles; they are all ok while the pilot had more injuries; luckily the heavy snow accumulation likely saved it from being a disaster).

That takes us to the utopian (for now) visions of today's technology focus at CES, which increasingly has drifted away from computers, and the latest or greatest in flat-panel televisions, to the often-controversial varying methods of what's increasingly becoming 'assisted' or eventually fully-autonomous (a class-action or several waiting to happen before this is perfected perhaps) driving systems. Whether these are included in combustion engine vehicles, or increasingly hybrids, with fully-electric models; all will grow prominently in the years ahead.

For the stock market so far this has been a discussion mostly of full-electric vehicles; though personally I suspect the degree of competition ultimately is not just going to sort this out, but bring price-points so low from some of the manufacturers; that long-range and high-cost won't be synonymous.

Many investors will find that 'betting' on any single company (like Tesla TSLA as is or was the rage) will be dicey; because there is no doubt that the big players are hurriedly rushing to offer a mix of all the power-train variants I noted. As a for-instance (and realizing some are hybrids while others are 'just' electric) markets and consumers will pit Tesla against General Motors GM (Volt and Bolt to start with); and even Ford F, which quietly has offered well-regarded hybrid vehicles you don't hear much about (including in the Lincoln line).

All these 'virtualization and visualization' technologies have one thing that I 'sense' in common. All are very dependent upon sensors and optics; not just the powerful miniaturized computer chips that make this possible. Years ago we wrote about Flir Systems, MobileEye, Micron and others; but things are moving along; so I see potential given expansion by some manufacturers into the core areas with multiple uses in both consumer electronics, with the automotive transformation, and increasingly medical and military roles.

Secular 'saturation' of consumer demand seems satiated in conventional retail; albeit not when you look at the post-Election demand for automobiles and consumer electronics. Again, like my comment at the election's onset, if Trump won, this was going to go up after a bit of nervousness, not down. It was going to initiate a triumph of the Middle Class (whether it turns out to be that or not, of course) and cause us to become the most optimistic in years.

And no, that shouldn't evoke a concern about being 'contrary'; because we'd rightly assessed the difficult false stability of a prior market levitated merely by buybacks and overly-expansive (and debt-building) monetary policies. Of course in absence of Congress' willingness to be fiscally responsible. As that evolved we shorted (faded) a number of rallies; and successfully. The exceptions especially were Brexit, which I thought would pass and Trump, who I thought had far better odds of winning.

So from that day on we've been overall bullish; allowing for a pullback here and there, of course. We're not cheerleaders; but we used a common-sense blend of technicals and recognizing early on what would happen, especially to old-line stocks dormant for decades, if he won. That's not to say the prior Administration couldn't have embarked on pro-growth policies, nor consider Republicans blameless (such as a cobbled healthcare plan flawed from the start). The point was that everything would change based on 'perceptions'. There were and remain zero conclusions about whether or not his reign will succeed (of course I hope so; and any citizen who values the future beyond grovelling about what 'might' have been) but again from the start I viewed it as a foot being lifted from the market's jugular; which changes everything.

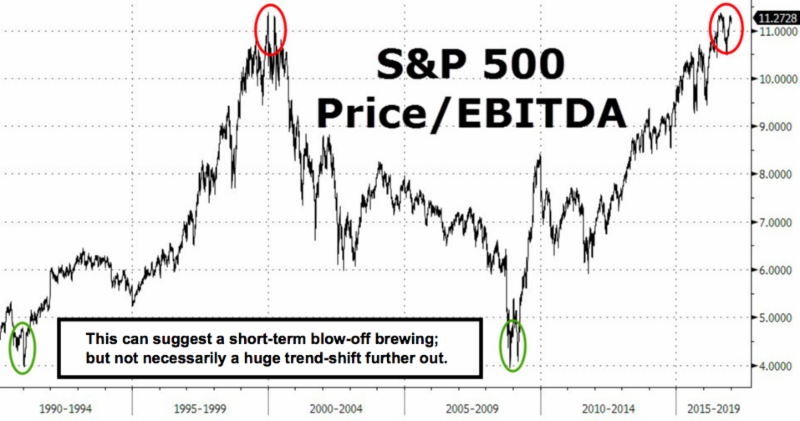

So is there a problem? Sure. The move is coming from already high levels; even though the entire year was jittery and defensive until the election. But a lot of the 'overbought' indications are misleading, because of the reasons I've given regarding the potential (eventually) for so many core Industrial US stocks that have languished forever it seems. That means technicals really got distorted, because along the way both the S&P and the DJIA replaced a bunch of basic industries with more 'modern' technology-focused stocks. In fact that's why the New York Composite is at new highs; while the DJIA and S&P lag just a bit. As this evolves, small caps (even some that were 'micro' in nature but survived) may come to the fore, for percentage speculation.

Yes, at the same time that infers so many of the stocks that benefited so far are not so attractive 'after' nearly two months of projected advance overall. And sure, there's going to be corrective behavior along the way. But as I've said consistently; any correction (barring exogenous 'black swan' events of course) should be comparatively limited with no prospect of Armageddon or any of that so many of the extreme pessimists and naysayers suggest. From a technical perspective Thursday, with an Oil-based dip; followed by recovery later (as outlined); it's far preferred over any sort of blow-off spike. Of course we'll get to a market high but it won't be because of a possible last-minute zinger from President Obama (let's hope not in any case); nor Chinese attacking Trump trade prospects.

|

|

Disclosure: None.

thanks for sharing. Merry Chritmas