Market Briefing For Monday, August 14

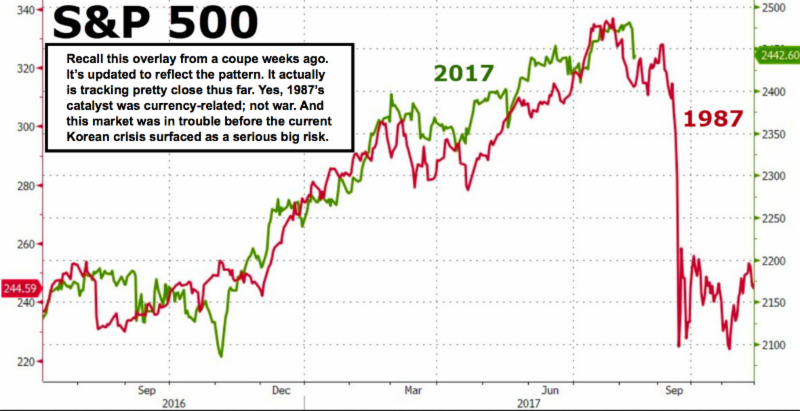

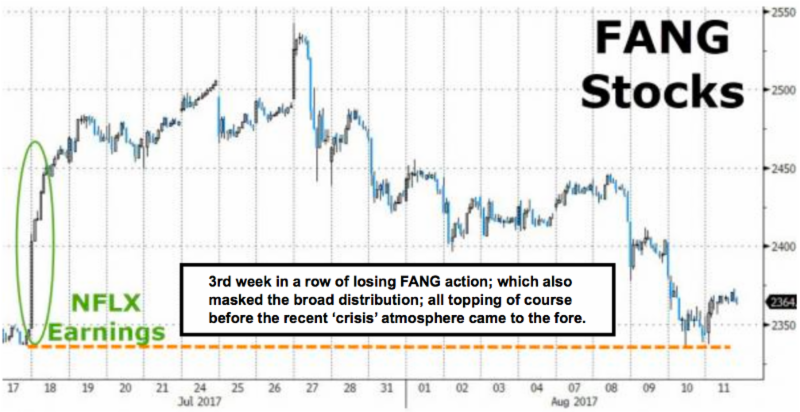

Secular predictions for the very long-term, increasingly include nervous (after-the-fact of months of distribution) analysts confident that the highs are 'in' essentially for all eternity. Not only due I think that's a premature outlook, based on demographics and economic malaise, not merely war prospects; but it's likely an irresponsible overreaction to what's already happened, even if it were to prove valid down the road.

And not to sound a bullish note (which is also premature); but for a couple of days I've suspected 'back-channel' talk ongoing to try to mitigate actual risk of wide-open uncontrolled conflict between the United States and the rogue North Korean state. On Friday we got heard more scuttlebutt along that line; plus evidence of behind-the-scenes efforts likely being reviewed by Secretary of State Tillerson and UN Ambassador Haley. My earlier focus was a suspicion related to the Canadian Envoy in Beijing as the same time as North Korea's Foreign Minister; with suspicion they did not reach an accord; but tried. That indicates efforts (and those weren't likely the only ones) to avoid war.

Does that mean those who sold or shorted 'after' the week's earlier reversal and into weakness promulgated by the second round of barbs between the antagonists, or as the Volatility Index popped as we suspected anyway to be on this week's menu, were going to get run-in and spooked yet-again? Yup.

Sure, we didn't get a Friday downside follow-through because of technicals; not a sudden peace overture, though we know a new proposal between China and Russia has been presented to North Korea which would trade security of their regime for a cessation of US/Allied 'exercises', though that's been an approach tried and failed before.

However this time there is a scheduled South Korean / US exercise later in this month that coincides (actually started yesterday and expands next week to include almost all US Forces in South Korea) with North Korea's threat to fire 'near' Guam. If they do I'm pretty confident it is not a possibility, but is an 'obligation' and responsibility of commanders in both Japan and Guam to try intercepting any such missiles and destroy them; regardless of whether they carry a live warhead or not (no way to now pre-impact; so shoot them down) as they approach US airspace (or overfly the Japanese mainland).

Thus the coming week is not entirely bereft of possibilities; and that's likely a reason for the 'locked and loaded' comment from the President; basically a way of conveying to Pyongyang that they will be intercepted if they launch.

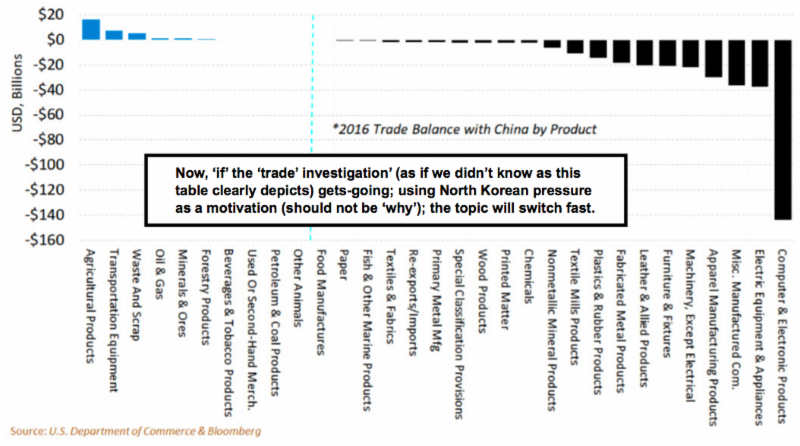

So my point is several-fold: first of all I do not presume a major war is upon us; but if it is; it will be an attack by North Korea; not a preemptive US strike. China's comment that 'no regime change' will be permitted sends a note of its own of course; mitigated (nice straddle) by saying they'd be neutral if the North Koreans attacked the United States 'first' and the US retaliated.

Bottom line

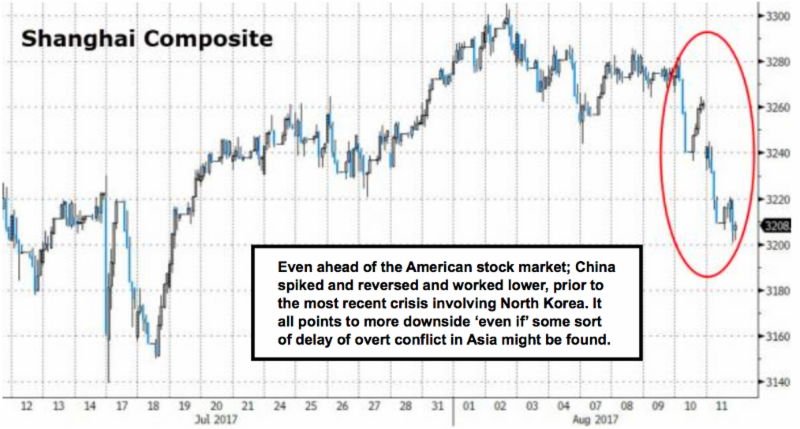

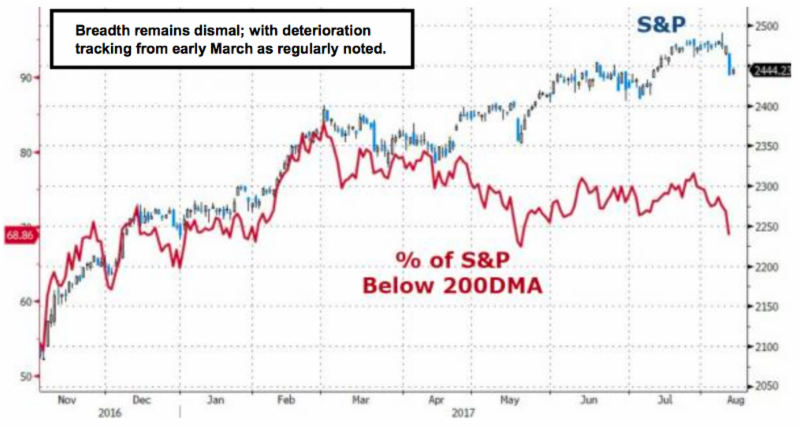

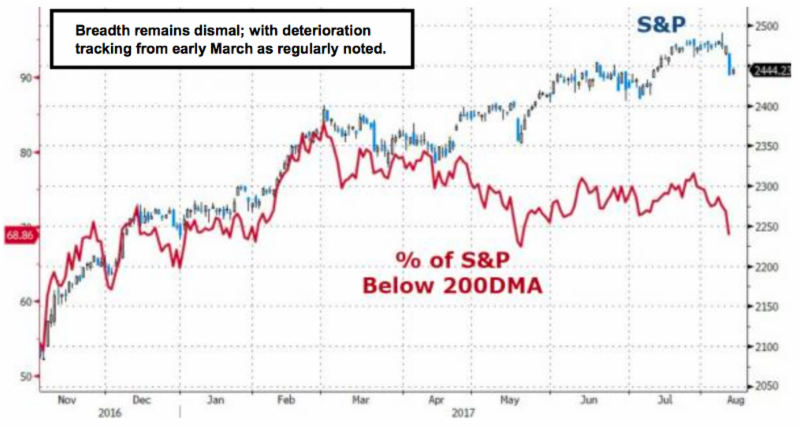

My original forecast has been for a significant correction likely; but not necessarily a catastrophic decline. There's no change in that view. In fact we could get a sharp short-term relief rally should it be shown that some sort of 'tense peace' is perpetuated for now with the unruly communists.

For now you simply got a rebound off the short-term rising-bottom trend-line; the edge of the crater as I described it. Everyone assumes a diplomatic sort of solution; and even if it's not, provided nuclear war is averted, markets for that matter might rally not decline, just having the tension abated either way.

Now; the idea that we're not necessarily out of the long-term secular market structure hinges on domestic issues such as 'tax-reform' and suddenly calm discussions about such things as Healthcare and Infrastructure. There is a 'credit unwind' risk; and if something like that strikes, then yes, you have lots more of a secular risk than that of a correction.

I'm aware of both variations of what can happen on the downside soon, and interestingly those are separate from the obvious impact of a conflagration. I also am pleased that one or two media outlets 'finally' noted that the North Koreans tempered their threats with a note that plans would be presented to the leader, not that they would attack at mid-month. That caveat was mostly redacted from most of the media; seeking to alarm people excessively. The President also ignored those caveats publicly; but privately knows that well. That's why he also then tweets he hopes they find the 'path' via negotiation.

In sum, going into the weekend it's impossible to know what happens next, aside from suspecting the answer is lots of talk and not much else, for now, from the antagonists.

Disclosure: None.