Market Briefing For Friday, Sept. 15

Persistent bearish perspectives have crippled a fair number of the large hedge funds over the months (especially immediately after Trump's election) and even though many are confused politically by his flip-flopping this fails to significantly 'bear' the market, at least so far.

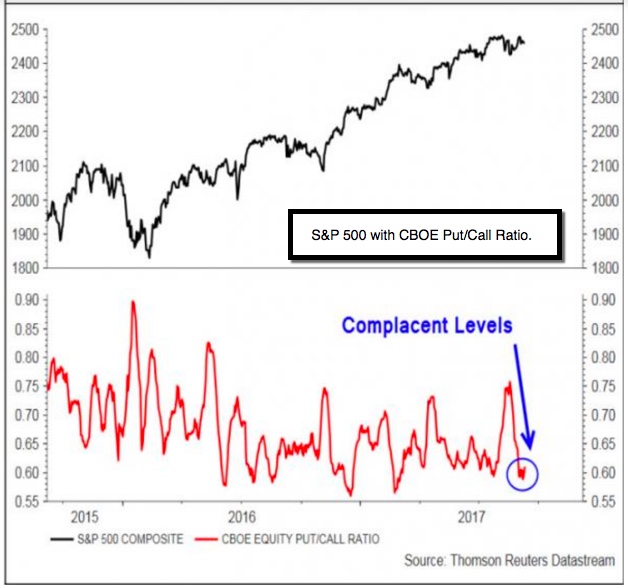

To us this is not a reason for complacency but a reflection of the rotational correction ongoing since March, with the S&P hanging-out near the 2500 level now, which seems about all that can even be rationalized, barring an actual tax-cut/reform package, which so far is, at best, in the wings.

| While this occurs the failure of some 'often bullish' new bears this year to at all prevail makes others reticent to short the market or turn too dour. Even a prominent bank or two has turned negative prematurely beyond merely a raising of cash at the same time as a couple big managers bragged about having huge Put positions in the SPY; which incidentally didn't work out, as of course the clock is always ticking with options.

As time degradation goes forward the risks actually increase now because a somewhat revived overbought condition gets reestablished, with relatively skittish money managers less willing to be heroic and stand in its path. That can be a setup for new risk to actually start to appear. Daily action was solid but not robust on Thursday and may try to extend a bit on Friday; but profit-taking later in the session wouldn't be surprising. We have essentially been neutral with a bias for selling rallies to build cash but not shorting. And we're still waiting to at least briefly hit and surpass the S&P 2500 level, which (barring anything overnight) I'd expect immediately. Now sustaining that is another story as I suspect it will be on a short fuse.

|

|

Bottom line: Market conditions haven't changed, with risk actually building. |

|

Thursday (final) MarketCast |

Disclosure: None.