March Retail Sales May Signal Further Economic Slowing

It was another ugly retail sales report for the month of March and with February’s retail sales being revised sharply lower as delivered by the U.S. Commerce Department. Combined, February and March marked the worst two-month stretch in two years, suggesting that first-quarter U.S. growth will be less robust than previously hoped. Sales at retailers nationwide declined 0.2% last month, mostly because of cheaper gas and incentives by car dealers and slower-than usual issuances of tax refunds. To make matters worse, the February retail sales results were revised lower from a .1% to negative .3 percent. That’s quite the revision and largely unexpected by most economists.

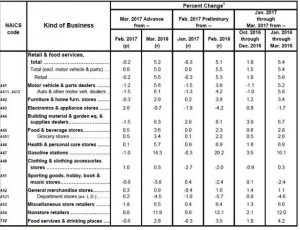

What was not unexpected in the March retail sales tally was the continued outperformance of nonstore retailers when compared to its brick and mortar peer group. Nonstore retail sales rose .6% MoM and a blistering 11.9% YOY. With nonstore retailers performing well this naturally came at the expense of the worst performing category YOY, department store retail sales. Department store retail sales fell 4.5% YOY while rising a modest .2% MoM for the month of March. Gas station sales fell MoM but soared YOY by 14.3 percent. This, as auto sales rose 6.1% YOY but fell 1.5% MoM. If autos and gas are excluded, retail sales rose 0.1% last month, the Commerce Department said Friday. And sales on that basis are up a solid 4.1% in the past year.

Despite the rather poor two-month stretch for retail sales, some economists are expecting a near-term bounce back with consumer confidence surveys showing positive sentiment. Most economists expect retail sales to accelerate soon in light of high steady hiring gains, rising wages and the arrival, albeit late, of most 2016 tax refunds.

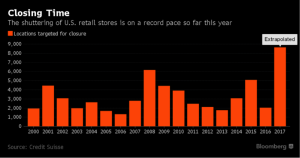

In terms of retail sales and the trending consumer spending habits, department store retailers continue to witness the shift toward nonstore/digital sales. Month-after-month and year-after-year the trend has failed to curtail in favor of department store retailers. It’s why in 2017; store closures will rise above levels seen in 2008.

Recently, Payless Inc. filed for bankruptcy and it would appear as though Rue21 Inc. will follow suit in the coming months. HHGregg filed for bankruptcy in early March 2017 and as part of its restructuring process the home appliance retailer will be shuttering 88 stores. As the company gets deeper into this process, I would expect that number to rise to roughly 100 stores.

Department store retailers are experiencing turbulent times. Macy’s (M), Sears Holdings (SHLD), J.C. Penney (JCP), RadioShack, Gander Mountain, Gordmans Stores, Abercrombie & Fitch (ANF), Crocs (CROX), Guess (GES), The Limited, Wet Seal, Game Stop (GME), Staples (SPLSSPLS), Family Christian Kenneth Cole and Bebe Stores are all closing portions or all of their stores in the case of the latter mentioned brands. In total, Bloomberg Intelligence analytics show that more than 8,000 retail stores will be closing in 2017. This compares to some 6,200 retail store closures in 2008. But already in 2017, the retail environment is taking its toll on jobs. According to Labor Department figures released earlier in April, retailers cut around 30,000 positions in March. That was about the same total as in February and marked the worst two-month showing since 2009, which falls in-line with the underperforming retail sales as a whole.

As investors and their corporate counterparts enter the all-important earnings season, all eyes will be on the retailers to outline their path toward a return to growth. Investors desire to hear more than non-incremental initiatives from brick and mortar retailers at this point and as it becomes more and more clear that the initiatives of the past simply haven’t kept pace with consumer spending trends. Some key reports to discover in the coming weeks will be from the likes of Macy’s, J.C. Penney, Target and Wal-Mart (WMT).

Last week J.C. Penney discussed with CNBC the likelihood of delaying its 138 store closings and liquidation process. While noting traffic improvements post the initial dissemination of these store closures, investors would be wise to recognize that this is a normal part of the store closing process. Additionally, the store closing process will take a deeper dive into supply and logistic chain operations impact. Like Macy’s discovered in the past, the initial plans are often wrought with error and unforeseen consequences and as such the plans have to be reviewed constantly and revised to the betterment of the total business operation. Back in January of 2016 and when Macy’s offered its restructuring plans, I authored an article titled Macy's Taking Cue From Peers Who've Seen Mixed Results. The article warned investors that never before in retail history had a retailer announced a specific store closure number and not found that number in error and without a need to increase the number of store closings. It’s with this revisiting of previous warnings that I offer to J.C. Penney investors a cautionary note on the current plans J.C. Penney has offered. Having said that, this is not a warning regarding the near-term stock price performance, but rather near-term operational performance. Eventually these correlations do come together overtime.

Retail sales continue to exhibit pressure on total gross domestic product, jobs and supply & demand equations. Given the data at-hand, I would expect GDP expectations to curtail over the mid-term and retailers to report results in kind to more recent past performances. Slowing to negative sales growth will likely way on the retail sector for the greater part of 2017. We’ll have to see how retail stock valuations hold up under the circumstances.

Disclosure: