Last Week's Weakness Is No More

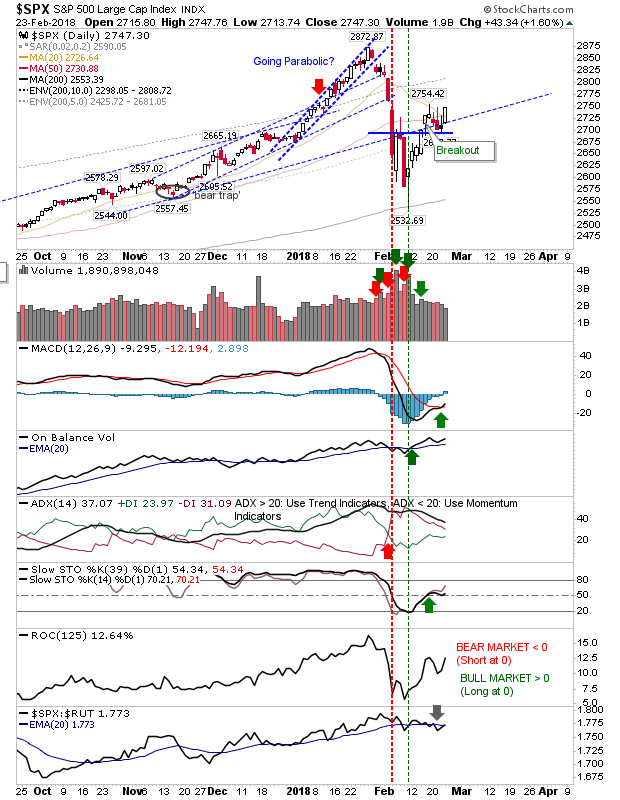

It was looking to be a struggle after last week's series of 'inverse hammers' had set up what looked like swing highs for indices but these have been cleared by today's gains.

In the process of doing so the S&P closed above the 20-day MA with 'buy' signals in the MACD, On-Balance-Volume and Stochastics. Only relative performance is underperforming.

The Nasdaq added to its breakout although unlike the S&P On-Balance-Volume is still on a 'sell' signal along with ADX. On the plus side, relative performance is sharply in the ascent - this index looks to have more left on the upside.

The Russell 2000 also managed to achieve a new high as it closed above 20-day, 50-day and 200-day MAs.Next step is to challenge the last swing highs in January.

The Dow also posted a breakout as it registered an accumulation day. Technicals remain positive with the exception of ADX. As with other indices this continues to shape a swing low as part of a broader rally.

For the week ahead, look for further gains as January swing (all-time) highs are challenged. Tech indices offer the best chance for bulls but all indices look like they will finish the week higher.