J.C. Penney Share Price Has Followed Underperforming Same-Store-Sales Results

Like many retail names, J.C. Penney (JCP) has reported a disappointing holiday sales period. With the retailer’s CEO previously guiding to 2-5% Q4 same-store-sales growth, the reported November-December sales comp exhibits the probability for the entire quarter to miss guidance.

“As we pivot our retail strategy towards these and other non-weather sensitive categories, we expect the strength in performance from these initiatives will help drive our fourth quarter comp store sales performance to be in the range of approximately 2% to 5%.”

The more glaring problem with J.C. Penney’s recent update is that it will mark yet another quarter where the company misses sales guidance. In all but the 2nd quarter of 2016, the company has missed guidance with both the 1st and 3rd quarters exhibiting negative same store sales growth. In the 1st quarter of 2016 J.C. Penney recorded a -.4% same-store-sales result and in the 3rd quarter the company recorded a -.8% same-store-sales result. The trend in same-store-sales declines has become the friend of those short JCP shares and the nemesis of those invested long in the name. With the share price eroding mightily since December 8, 2016, many longs have been selling out of JCP shares.

The 1-year JCP chart depicted above erroneously offers a bit of hope to shareholders. As one can see from the January period a year ago, shares fell to roughly $6 before rising sharply in March, when JCP posted their first sales miss in nearly 2 years. But the newer CEO, Marvin Ellison, offered several initiatives and reaffirmed guidance for the full-year. Shares rallied on the CEO’s sentiment that has largely been proven highly inaccurate. Given the CEO’s grossly misstated FY16 forecast, it is unlikely that shares of JCP will take their lead from Mr. Ellison over the course of 2017. Shareholders were somewhat fooled once by the newer CEO in 2016, it will require a new group of shareholders to believe in the CEO’s forecast in order to recapture share price appreciation.

When reviewing FY16 results and prior to the company disclosing total Q4 2016 results, one can’t help but to recognize the retailers initiatives are many. Having said that, few carry the potential to incrementally benefit sales long-term. The following bullet points offer all the initiatives put forth by J.C. Penney in Q1 of 2016.

- Expanding appliances to over 500 locations. Appliances will have a negative impact on our gross margin rate. Appliances will be live on jcpenney.com nationwide next week, with over 1,200 items available to purchase from partners like Samsung, LG, and GE. The sales productivity was 10 times higher than the product the new appliance set replaced. Over 70% of the appliance purchases were on the J.C. Penney credit card, and 30% of those were new credit customers. The average transaction was over $1,200, and this business added low-single-digit comp sales lift to the entire store in the pilot locations.

- Increase and enhance the window coverings presentation by an average of 25% in approximately 500 stores by early fall.

- Announced partnership with Ashley's Furniture, and testing 21 of their signature collections in select stores by Memorial Day weekend. In addition, approximately 1,500 SKUs of Ashley Furniture will be available on jcp.com in time for Memorial Day weekend growing to over 4,000 SKUs later this summer.

- Empire Today inside J.C. Penney will operate independently, and will be responsible for staffing, the environment, marketing and customer service. They will occupy between 750 square feet to 1,000 square feet of location in a Home department, and they will display samples of hardwood, tile, laminate, vinyl and carpet competitively priced to fit the J.C. Penney customer demographic.

- Expansion of Collection by Michael Strahan in nearly 500 doors by this Father's Day. In addition, based on the strength of the relationship with Michael, J.C. Penney is launching an exclusive active lifestyle brand called MSX by Michael Strahan, which is being developed by best-in-class sourcing and design team. Launching these goods in nearly 500 stores just prior to Father's Day.

- Rolling out a new in-store plus-size concept called Boutique in nearly 200 stores. This will be a one-stop shopping destination for plus-size fashion, which will include casual sportswear, denim, and active wear. Additionally, merchant and design teams have conceived and developed J.C. Penney's first plus-size private brand for millennial women called Boutique+. Plus-size apparel represents a $17 billion industry, and will be a destination for millions of fashion-conscious plus-size women who are not finding what they need in terms of style, quality, and value.

- Focused on winning market share, but will intensify the focus and commitment to reducing expense and being a more operationally disciplined company. For the second quarter and for the remainder of 2016, the company will focus on being an aggressive expense reduction company, and will focus on key initiatives to make that a reality. Remain committed to growing top line, while aggressively reducing controllable expenses i.e. payroll and logistics.

I believe a good many of the noted J.C. Penney initiatives are well-intended and even sound smart on the surface. When you dig into the reality of not only rolling out these initiatives, but reaping gains, the story is less impactful than one might initially understand them to be.

While a great many analysts and investors were touting J.C. Penney’s decision to get into the appliance business, I was very skeptical given the low margins offered by the business. Additionally the large floor space the product offering would consume eats away at the high margin apparel and soft goods business. Here is what I offered to investors and readers of my reporting back in May of 2016:

J.C. Penney's recent discussions and announcements concerning the greater expansion of appliances to be sold in 500 stores brings with it lower gross margins. Additionally, if we understand the nature of appliance sales, the risk is that they take up a great deal of floor space and produce high dollar value sales, however infrequently. Apparel sales can achieve greater than 50% gross margins and often do. As such, the early success with J.C. Penney appliance sales may prove fleeting longer term and find the retailer adjusting back to more apparel in the future.

The rollout of the appliance business to 500 stores was a difficult operation in and of itself. This operation contributed, in part, to J.C. Penney’s reported Q3 negative sales comp of -.8 percent YOY.

In truth, most of the offered J.C. Penney initiatives are akin to what most big-box-retailers are forced to attempt today. Changing the product assortment, store footprint, sku counts and shopping experience; these initiatives are being put forth by all major retailers of scale. Shy of the home goods overhaul that occurred in years past and continues to this day, most initiatives by J.C. Penney mirror those in other retail names like Target (TGT), Kohl’s (KSS), Bed Bath & Beyond (BBBY) and Macy’s (M) just to name a few.

Online retail sales in North America are hurting J.C. Penney along with most department store retailers of scale. This is nothing new as the trend has persisted for a few years now. To the degree that retailers have invested quite heavily on their e-commerce and omni-channel sales over the last 5-7 years, it simply hasn’t been enough to bridge the gap from decaying brick and mortar sales. J.C. Penney has not been immune to the issue and has admitted the company has been lagging its peers within the realm of e-commerce. It’s for that reason the company has increased its e-commerce presence in 2016. In the 1st quarter alone, the company increased its sku count/product offering by 50% YOY.

Third, our online business continue to generate strong results. On a year-over-year basis, for the first quarter, our online SKU count increased over 50%, and our online supplier base was up nearly 20%. In addition, our mobile traffic continues to increase dramatically, but even more important our conversion on mobile improved nearly 50% in the quarter.

While the numbers look impressive as reported in March of 2016, the reality is that it is easy to show such improving metrics off a very small base. One could argue, the company’s 2013-2015 SSS comp stack of roughly 4% was also off of a very small base and occurred right after a bottoming of sales results. Small bases are great for magnifying otherwise dismal results i.e. the hundreds of millions of dollars J.C. Penney has lost from 2013-2016. Be careful with understanding the difference in great sales comps vs. great sales comps coming off of small bases.

Moreover, J.C. Penney maintained its dedication to growing its e-commerce business through the year. This initiative was highlighted with a 40% sku count increase online during the Q4 2016 period. Again, the initiative is in-line with the changing retail landscape and where consumers are spending monies, but the effort isn’t incremental enough to bridge the gap created from negative brick and mortar results. Today, I would estimate J.C. Penney’s e-commerce business accounts for less than 4% of its total sales. Here is what the CEO expects from its e-commerce business over the next 5 years.

Buy-online-and-pick-up-in-store transactions and merchandise returns in stores help alleviate shipping costs for retailers. Penney added those capabilities to its stores last year. Ellison forecast Penney's online sales will increase to more than 20 percent of its total sales over the next five years, as consumers increase their use of mobile technology.

Even after a 5-year period, e-commerce will account for less than a quarter of total sales. Again, be careful with Mr. Ellison’s forecasting, as it has largely proven erroneous to date. More importantly, if investing in JCP for the sake of current, double-digit e-commerce growth, one can see that without brick and mortar growth sales will likely continue to decline and pressure profits further. No, e-commerce will not save JCP shareholders, unfortunately.

More recently and post the ICR Conference, Mr. Ellison has proposed to the media and investors that the retailer is looking to close stores going forward. The number of store closures was not offered, but to make the offering publicly in this manner demonstrates that more news will develop from this headline. By and large, the company has only closed a few dozen stores since 2014 and while its peers have closed a great many more. Macy’s will be closing 68 stores in 2017 after shuttering 37 or so in 2016. As I presciently warned investors that the number would grow from the initially offered 40 stores, it certainly has. In total, the Macy’s store closings have risen from 40-100 and will likely rise further into 2018.

The key problem with forecasting store closures is the drag on profits it creates for neighboring, sister stores. When Macy’s closed stores initially the consideration was on the stores profitability and to a lesser extent the lease terms. With Macy’s closing one store in a particular district that houses 4-6 Macy’s stores, the remaining stores are forced to take on additional logistics and other operating costs that were previously spread across a larger base of stores due to the infrastructure to support these store operations. With a new and higher cost structure thrust upon fewer stores in a district, profitability is curtailed on the remaining stores. If the sales from these remaining stores begin to wane or continue to lose ground, the profit picture also diminishes and tends to result in more store closures. This is actually the normal process and should be widely understood by management teams and investors. Additionally, store closings put pressure on distribution centers. Where once a distribution center was shipping merchandise to 20-30 stores, when stores are closed, this number is reduced for the distribution center and pressures its profitability. For this reason, during a period of store closures, distribution centers merge into one operating distribution center on a regional basis.

Never in the history of department store retailing has a company offered a set number of store closings and not increased that number greatly in proceeding quarters. As such, when J.C. Penney puts forth a set number of store closings, scrutinize it carefully. I offered to Macy’s investors in January of 2016 with regards to store closings the same sentiment:

The numbers almost always, always changes post the original planning. With Macy's operating roughly 900 stores and scheduling the closing of just 40 store units, it seems unlikely that when the company gets into the weeds with these store closures the numbers won’t change somewhat.

With not a single analyst understanding this probability of occurrence, I felt investors would benefit from a greater understanding regarding the history of retail store closings. With regards to J.C. Penney store closings as an investor, one should not consider such a development as positive. It never has been in the past. Again, I offered the same sentiment to Macy’s investors whom erroneously envisioned lesser expenses and refined focus would grow the company’s profits. Unfortunately that has largely proven to be a misnomer for retailers of such scale and scope. A decaying store base immediately impacts sales for which no other operation can ramp quickly enough to offset the sales declines.

One should also consider or model into this analysis that retailers are exhibiting a lesser multiple than in previous, favorable economic cycles. Sales are governing investor consideration more than ever and this is in large part due to the rise of e-commerce and the dominance of “etailers” like Amazon (AMZN). What investors have become hip to is the fact that much of the earnings growth exhibited by big-box retailers in recent years has come with low to negative revenue growth. The other cause of earnings growth has been through share repurchases. The financial engineering aspect of earnings growth has forced investors to consider sales in favor of earnings and to some extent even dividends. In short, if an investor is focusing on the PE multiple, they may be missing the larger institutional investor consideration that dominates the retailer’s valuation. Ok, we got a little off point here, but it is important to understand how retailers are being valued.

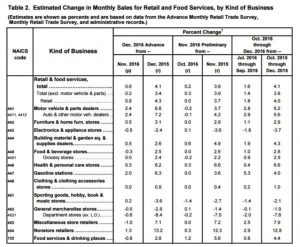

As I noted previously, the department store retail environment has remained troublesome for some time now. December’s monthly retail sales report identified the trend against department store sales continues. (Census Bureau Monthly Retail Sales table below).

Month-to-month department store retail sales fell by .6% in December. The greater decline in department store retail sales is indicated in the 8.4% decline on a YOY basis. And this, while Nonstore/e-commerce retail sales rose 13.2% year-over-year. J.C. Penney is right in the middle of the fight between department store retail sales and Nonstore/e-commerce retail sales.

In summation, shares of JCP look to be at their lowest valuation since January of 2016. The share price has decayed on the back of underperforming sales and the potential for sales to continue to exhibit lower levels of growth if not further declines. J.C. Penney has a good deal of initiatives in place, but is still considering closing stores and likely more than in recent years past. It’s a bit of a contradiction or at least a “doubling back”, which is alarming. Given that the company is carrying an extreme debt: equity ratio with over $4.5bn in debt on the books, J. C. Penney has a tough road ahead, as if the road behind wasn’t tough enough on the turn around story.

The short interest in JCP shares is just above 21% and as such largely controlled by long investors. Despite the cries about short sellers, the longs control almost 80% of the float and are the dominating force behind the share price decline as they continue to sell stock. The prospects for a near-term rally in shares of JCP are slim and largely depend on what the company reports and states with its Q4 2016 results and FY17 guidance.

Disclosure: