J.C. Penney Downgraded: Nike Partnership Not A Savior For The Retailer

After several reiterations in the last week of trading, on January 18, 2017 Credit Suisse’s Christian Buss has downgraded J.C. Penney (JCP) from Neutral to Underperform. The downgrade comes alongside the analyst also downgrading another struggling retailer in Kohl’s (KSS). While maintaining no price target for shares of JCP, the analyst does lower his price target on shares of KSS and moves from Neutral to Underperform with the brand.

The downgrade of J.C. Penney comes just a day after the retailer announced an expanded relationship with Nike (NKE). J.C. Penney will open Nike outlets in more than 600 of its stores.

The new Nike outlets, which will occupy 500 square feet of space within the men's department, will feature "pumped up visual elements", including Nike's Swoosh sign and motivating graphics of athletes. The outlets will feature an expanded assortment of performance and "athleisure" apparel. The Nike shops will also stock an array of accessories, including weighted jump ropes, water bottles, workout gloves, gym socks and sweat bands, J.C. Penney said.

The shop-within-a-shop (SWAS) concept is nothing new to J.C. Penney. Ron Johnson began converting the store footprint inside J.C. Penney locations back in 2012 and before his removal from the CEO position only a couple short years later. As Nike has been having its own set of struggles with sales in recent quarters, this expanded partnership with J.C. Penney will likely serve to boost the athletic apparel makers volumes at J.C. Penney locations. With J.C. Penney having already been selling the brand in most locations for years, highlighting the brand with elevated merchandising media and fixtures may not move the needle all that much for the retailer. Apparel sales for J.C. Penney have been flagging downward in recent quarters with most apparel categories in the red including women’s, men’s and children’s apparel. Regardless of the trends toward “athleisure” the category is still too small to generate an incremental boost for J.C. Penney as its Michael Strahan clothing line has proven. In analyzing the potential top-line value creation this initiative with Nike has for J.C. Penney, only time will tell. But historically, national brand labels haven’t provided retailers with the necessary gross margins that benefit the retailer.

Shares of JCP were higher on January 17th, but this share price appreciation had nothing to do with the announced Nike partnership. In fact, the totality of the retail sector moved in unison on January 17th. The following chart denotes the trading pattern for JCP and KSS shares on January 17, 2017.

As one can see, the peaks and valleys are pretty much exactly the same for the two retail stocks, and yet Kohl’s did not make any significant announcements.

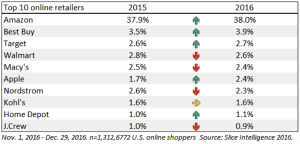

J.C. Penney has a bumpy road ahead of itself. The company’s recent sale of real estate assets to pay down debt may not have been the smartest move in light of flagging sales. Recall that in 2016, thus far, the company has reported a negative same-store-sales comp in both Q1 and Q3. With a negative holiday comp also reported, the retailer may likely report 3 out of 4 quarters in 2016 with negative sales comps. Negative sales growth is a high probability for J.C. Penney in 2017 given the state of retail consumption heavily leaning toward e-commerce, for which J.C. Penney is behind its peers. The table below from Slice Intelligence indicates the top 10 online retailers during the latest holiday period.

As one can see from the table, J.C. Penney fails to achieve a meaningful market share in the e-commerce arena. This even after the retailer has boosted its offering through 2016. It serves to presume this issue is something that may prove to plague the company’s turnaround efforts if it has not already to some meaningful degree.

J.C. Penney shares are hovering near 52-week lows after several fits and starts in 2016. The recent downgrade on the shares of JCP highlights concerns not only with JCP but the brick and mortar retail space as a whole. For this reason, it is increasingly likely that J.C. Penney will announce greater store closures when it outlines its guidance for fiscal year 2017. The increase in store closures will likely serve to impact both free cash flow and revenues. As such, paying down debt may become increasingly cumbersome, something bears are counting on more heavily than in recent past.

J.C. Penney is behaving and moving towards the right direction with its many initiatives, but the debt burden will likely prove to impede its progress. More importantly, the trends in consumer behavior and where consumption is increasingly taking place will continue to weigh on the retailer’s results. It’s for these and many other reasons that I’ve chosen to avoid shares of JCP in favor of greater returns on invested capital. JCP has proven to be a battleground stock and one that does not pay for investors to wait for share price appreciation.

Disclosure:I have no position in any equity mentioned within this article