Jakks Pacific: A Speculative 2018 Buy

JAKKS Pacific (JAKK) is a company we have long considered the third choice you should make when investing in a toy company. We have long preferred Hasbro (HAS) and Mattel (MAT) before considering JAKKS. That said, JAKKS is a fantastic trading idea, as it frequently makes high percentage runs up and down, making it a great long and short candidate, depending on the situation. Have a look at the recent chart:

Source: Yahoo Finance

In this column, we discuss the recent performance of the company. We also investigate recent portfolio developments, and opine on 2018 projections. Ultimately, we think JAKKS Pacific is at a level where a speculative buy can be made for a quick trade. However, given how ugly the chart is, and the performance of the stock, we would not recommend a buy long-term. Let us discuss

Q4 performance

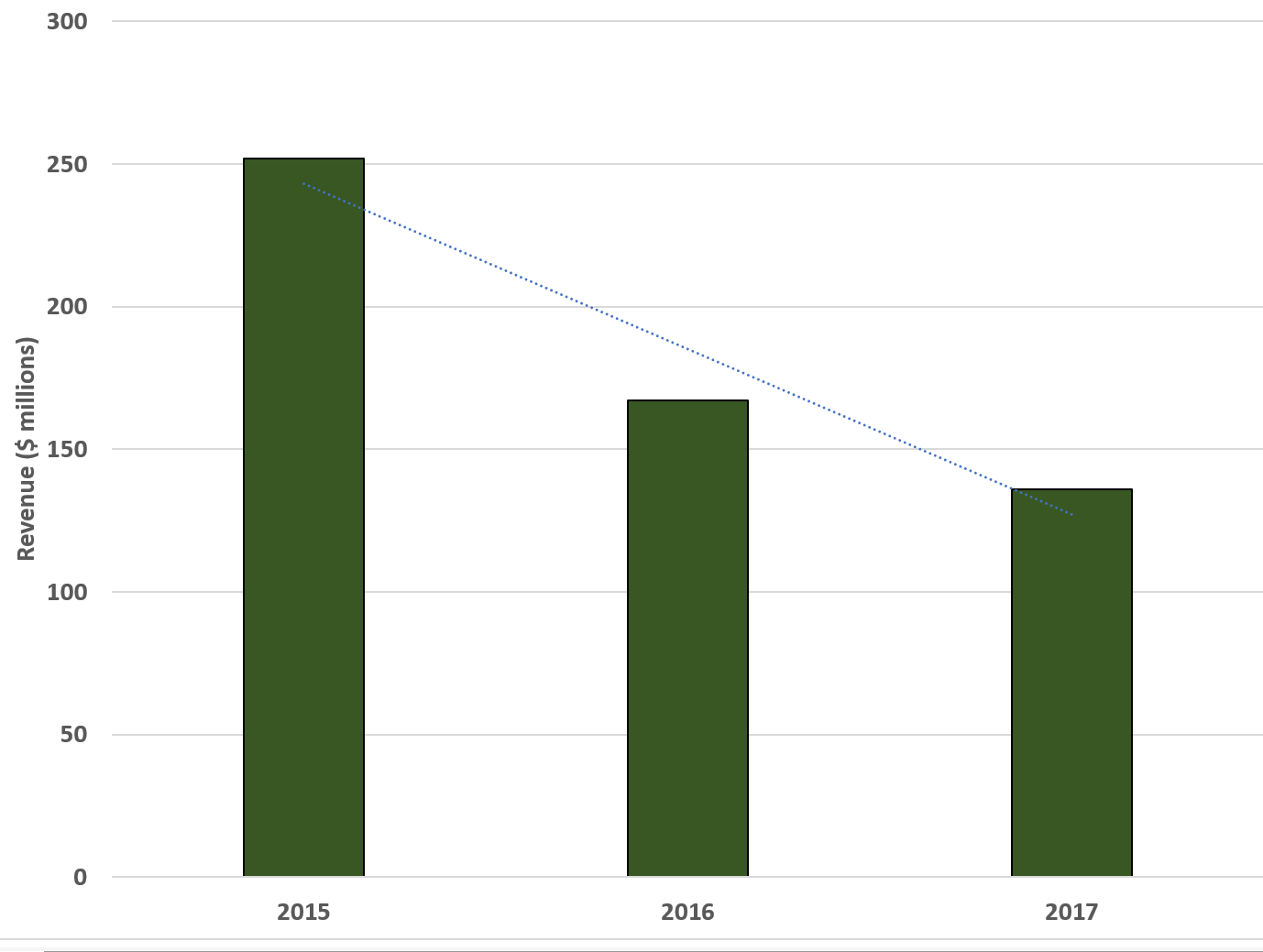

Net sales for the fourth quarter were $136.6 million compared to $167.0 million reported in the prior year period, continuing a downtrend:

Source: SEC filings

As reported GAAP gross margin in the fourth quarter 2017 was 22.1%, down from 31.2% last year, primarily as a result of minimum guarantee shortfalls, inventory impairment and the impact of low margin sales recognized in the quarter. Operating costs for the quarter were $56.7 million, which included certain pre-tax charges totaling $2.5 million related to restructuring and bad debt write-offs.

Products that had a significant positive contribution to fourth quarter sales included Squish-Dee-Lish, Tangled, Stanley, Chocolate Egg Surprise, Moana and various DC Comics products. Products that showed significant declines included Tsum Tsum, Graco, Frozen, Elena of Avalor and Gift ‘Ems. When considering revenues and expenses, earnings took a hit.

GAAP net loss attributable to JAKKS Pacific was $30.4 million, or a loss of $1.33 per basic and diluted share, which included pre-tax charges totaling $17.2 million relating to the impairment of inventory, minimum guarantee shortfalls, restructuring charges, bad debt expense, and the impact of the exchange of convertible notes. This compares to GAAP net loss attributable to JAKKS Pacific of $7.6 million, or a loss of $0.47 per basic and diluted share, reported in 2016. What about for the full year 2017?

2017 performance also weak

Perhaps one quarter is not enough of a trend. Well, the entire year 2017 was pretty slow too. Net sales for 2017 were $613.1 million compared to $706.6 million in 2016. Operating costs for 2017 were $219.8 million, which includes certain charges totaling $25.8 million related to goodwill and intangibles impairment, restructuring charges, and bad debt expense, compared to $205.9 million in 2016. As revenues fell, and expenses rose. Ouch.

As reported GAAP gross margin for 2017 was 25.4%, down from 31.6% last year. Included in the 2017 gross margin are charges for minimum guarantee shortfalls and inventory impairment totaling $30.1 million, as well as the impact of low margin sales recognized during the year. Putting it all together, it was a bad year.

For 2017, GAAP net loss attributable to JAKKS Pacific was $83.1 million, or a loss of $3.89 per basic and diluted share, which included pre-tax charges totaling $30.1 million relating to the impairment of inventory and minimum guarantee shortfalls, and other significant and unusual pre-tax charges totaling $33.7 million relating to goodwill and other intangibles impairment, write-off of investment in DreamPlay LLC, restructuring charges, bad debt expense, and the impact of the exchange of convertible notes. This compares to GAAP net income attributable to JAKKS Pacific of $1.2 million, or earnings of $0.07 per diluted share, reported in 2016.

Investments for the future being made

If we dig a little bit into what the future may hold after this disastrous 2017, we see that the company is working diligently to generate a strong portfolio of owned intellectual properties. In 2017, JAKKS successfully launched multiple properties across many categories, many of which are positioned to have great extension programs for 2018 - including Squish-Dee-Lish and Real Workin’ Buddies. Additionally, JAKKS entered the games category with the release of Pull My Finger, an innovative action game, paving the way for more games to come.

The company is also entering new categories. We are excited about the cosmetic line they are taking on, and think this is a speculative new venture which could be a strong benefit to the 2018 outlook. With production currently underway and initial distribution partners secured, early shipments of C’est Moi reformulated skincare and cosmetic products began in January 2018, which the Company expects will have significantly higher margins than its toy business. In addition, Studio JP is in development of a new franchise which will be comprised of original animated content created specifically for digital distribution, an app featuring augmented reality and a line of toys slated for a Fall 2018 launch. Also, the company will begin shipments of Morf, an outdoor sports action product.

We also want to point out that JAKKS continues to expand internationally, with newly established sales offices in France and Italy that are going to drive up international sales. JAKKS Mexico continues to grow as well and contributed several million in revenues in 2017. We see the company further expanding to this market in 2018. However, financially, it could be another tough year.

2018 outlook

We think in 2018 that the company will be moving in the right direction, but it is still going to be a tough year for the toy maker, but it could turn a profit. We see revenues rising slightly in 2018, and are targeting $623 million and $638 million. Earnings are a bit tougher to pinpoint as the expenses out of the company are a bit wild, but we are targeting a loss of $0.05 to a gain of $0.10 on the year. Overall, we think that the investments the company has made will begin to payoff, and the trajectory of the company will turn positive this year. As such, we think it is a speculative buy at $2.15 a share, and can be bought for a swing trade.

Quad 7 Capital has been a leading contributor with various financial outlets since early 2012. If you like the material and want to see more, scroll to the top of the article and hit ...

more