IZEA Poised To Ride Native Advertising Shift Higher

TM Editors Note: This article discusses a penny stock/microcap. Such stocks are easily manipulated; do your own careful due diligence.

Though social media advertising is all the rage these days, IZEA (IZEA) remains a rather obscure stock despite the phenomenal growth it is generating. The company is developing a network of content creators that match up with brand advertisers to generate sponsored social ads.

The company remains relatively small and under the radar of the general social media and advertising plays. The recent weakness in display ads plays into the native advertising concept of IZEA. By matching "influenzers" with sponsored ads, brands are better able to communicate the message that is typically lost in a picture display cluttering up a web page.

For a small cap, the company has a compelling valuation, but it is still in the early stages of sponsored social ads. IZEA interestingly has a couple of analysts forecasting significant price gains. The question is whether the company can obtain enough scale to attract not only investors, but also ensure that it isn't eventually crushed by another social advertising concept.

The stock is compelling enough and relatively small, but a big hurdle exists to overcome some of the red flags from the past.

Not So Impressive Corporate History

CEO Ted Murphy founded the company all the way back in 2006 under the name PayPerPost, Inc. The company was clearly early to the sponsored ad concept and toiled around while the other social media companies saw revenue soar. The name was eventually changed to IZEA and the company went public in 2011 via a reverse merger for the first red flag. The next major negative was a 1-for-40 reverse split in 2012.

IZEA now runs the IZEA Exchange, or IZEAx, to handle the process of matching brand advertisers to content creators with influence over a social media following. The brands pay for sponsored ads placed within social media of all the top social media platforms.

Earlier this year, IZEA purchased Ebyline to add a group of professional journalists to add to the existing content creators.

Improving Financials

The actual corporate numbers are finally starting to show signs of acceleration. IZEA has a listed market cap of only $20 million (before the warrant dilution), yet the company expects to produce revenues of $23 million for the year. It is rare to find a growth stock trading at less than 1x sales, especially one growing revenues beyond the market growth rates.

For Q2, the company already pre-announced that bookings would grow 140% YoY. Part of the gain is from the recently purchased content firm Ebyline, while the historical sponsored social sales surged 49%. In total, the pro-forma revenues are a tad over $16 million.

For Q1, IZEA produced 111% revenue growth to reach $4.1 million. This number isn't exceptionally meaningful considering the growth rate and the acquisition of Ebyline during the quarter. As mentioned in the above bookings growth, revenue going forward will accelerate from the $4 million level.

The revenue acceleration that is taking place this year in part due to the Ebyline business. The company though wasn't producing the type of growth one would expect while social media was soaring during that time period.

In the short term, margins will be lower due to the higher content costs of the Ebyline product and the push for growth. While IZEA produced gross profits of 41% in Q1, the guidance is for a further reduction to the 30% to 35% level in the current quarter due to a full quarter inclusion of Ebyline. The company though projects an increase in the future as the Ebyline margins were only 10% in Q1 and have already bounced from the 7% reported last Q1 prior to the merger.

The Ebyline margins were historically low and the movement to the managed services of the IZEAx platform will give those a significant lift. The company has over 12,000 content creators with a professional journalist background so the key is to matching those higher costs with the brands on the platform willing to pay for high-quality content.

The only hiccup with the financial metrics is that the market might not fully appreciate the expected losses. IZEA is in the growth phase typically served best in the private markets, but public investors need to realize this is a rare opportunity to buy a growth company before the market catches on. This is again where the reverse merger and stock split could hold the stock back until the company provides more solid quarterly reports.

For Q1, IZEA reported an operating EBITDA loss of $1.5 million. The company will need to reign in these EBITDA losses to keep cash burn down.

The company continues growing registered users with a surge to 446,000 last quarter, compared to only 243,000 last Q1.

Strong Analyst Forecasts

The initial surprise in reviewing this stock is that it has a couple of well-respected analyst firms that provide coverage. These days a stock with a valuation below $100 million is normally left with no research.

The next notable bit of information is that Craig-Hallum projects 2016 revenue of $37.3 million and Ladenburg Thalmann forecasts $38.0 million. The projections are astounding considering the market valuation. Consequently, both analysts have price targets of $1 or above suggesting stock gains far in excess of 100%.

Ladenburg forecasts the company reaching cash positive operations by early 2016. A good sign, but investors shouldn't be shocked if the company eventually ramps up spending further to capture the large potential in the native advertising market.

Note that it would be extremely rare for a company with revenue growth in excess of 50% similar to the above projections to trade at a PS ratio below 1. In fact, Ladenburg Thalmann makes a compelling case with a list of numerous stock buyouts in the mobile advertising sector with significantly higher PS multiples.

Compelling Insiders, But Too Many Warrants

A big issue with the company is the lack of financing that private firms are able to obtain these days. Being public is typically negative for equity financing, but the company recently got commitments for up to $11 million in cash from previously issued warrants. The insider commitments include $2.8 million from BOD members committed to provide the above cash to the company.

Remember that these warrants were already issued with a large majority of them already in the money. It doesn't change the fully diluted shares outstanding, but the 25% discount offered in exchange for exercising does impact the amount of warrants one would've expected to eventually exercise and the cash receipts.

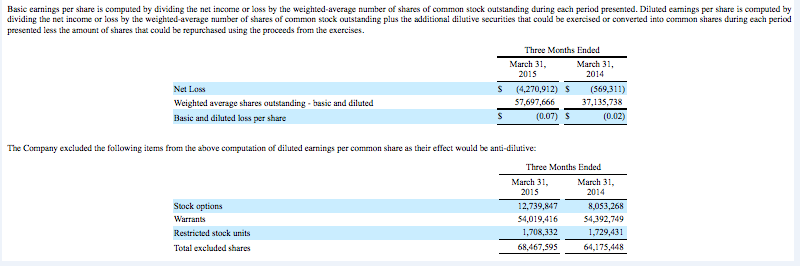

For Q115, IZEA reported diluted shares of only 57.7 million used for the $20 million market cap valuation. The exercise of 70% of the warrants as suggested by the company would place the reported diluted share amount closer to 100 million shares making the stock worth about $35 million now.

Source: IZEA 10-Q

Ladenburg-Thalmann uses 72.5 million diluted shares outstanding for its research so the firm might need to adjust its price target if it assumed fewer warrants would actually be exercised in the future.

IZEA lists Privet Fund, Goldman Partners, Diker Management, and Potomac Capital Partners as institutional investors committed to exercising warrants.

The company had $3.9 million in cash at the end of Q1 giving it roughly $15 million in cash after this financing and not including any cash burn during Q2. In addition, IZEA has a credit line of $5 million that is untapped providing plenty of liquidity for the next year.

A big key in the investment story and future financings is the ability of IZEA to uplist to the Nasdaq Capital Market. Eliminating a large portion of these warrants helps clean up the diluted share count going forward.

Where Can Sponsored Social Ads Go?

When first reviewing the social ad concept, my initial concern was whether followers would lose interest in the content creators if they were bombarded by ads via sponsored posts. This area is where the key to making the process work is matching content creators with brands they are already passionate about. The authentic posts from the influenzers are more compelling and desired by both brands and followers. If it isn't authentic, the followers will see through it.

The research actually shows that followers prefer recommendations from trusted content providers.

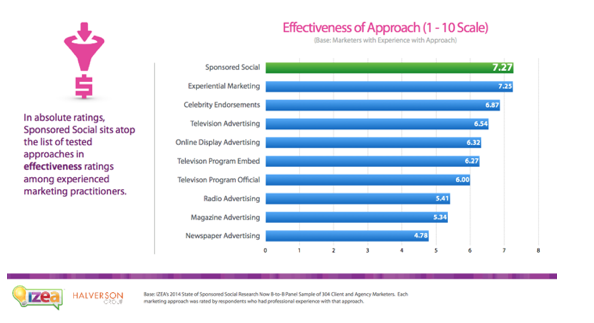

According to data collected by the Halverson Group, sponsored social was rated as the most effective marketing approach. The study far exceeded the traditional approaches of television and radio ads along with easily surpassing online display ads.

Source: IZEA presentation

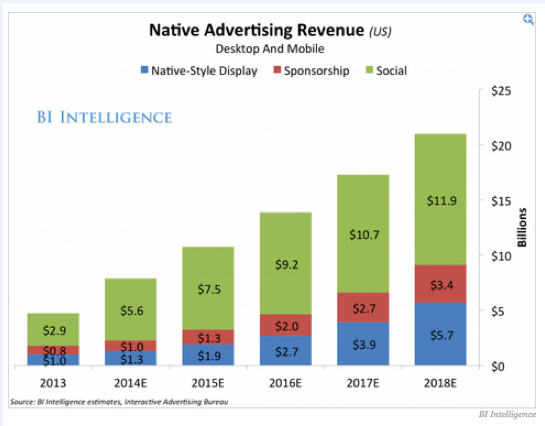

The market potential for native advertising is large and growing. According to a BI Intelligence report, the combination of native-style display, sponsorship and social equates to a $20 billion market opportunity for native advertising by 2018.

Source: BI Intelligence

According to the Association of National Advertisers, respondents to a survey were materially shifting budgets to native advertising. The research shows that 63% of respondents expect to increase budgets allocated to native advertising. The study shows that the majority of businesses still spend less than 5% on this area of advertising.

Even Yelp (YELP) mentioned on the Q2 earnings report that it was getting out of the display advertising business. The consumer review site sees the ads as reducing the consumer experience and low quality. The shift will allow Yelp to focus more on the native ads.

The above data suggests IZEA sits in the middle of a emerging trend away from traditional media sources including the original online display ads.

IZEA has an impressive list of brands wanting to advertise on the platform and partner with top content creators backing up the research. During Q1, the company added Toyota (TM), Mass Mutual, 3M (MMM), and Colgate (CL) to the list of brand advertisers. Maybe more importantly, IZEA saw a 38% increase over last year for repeat client business. The repeat customers list includes Kelloggs (K), Hershey (HSY), and Bed Bath & Beyond (BBBY).

Significant Competition Magnifies Risk

As with any business and especially one showcasing fast growth, new competitors or copy cats will pop up. While IZEA appears the leader of the category, it will need to remain sharp in order to maintain that lead considering $6 million in quarterly bookings don't provide much of a head start to any startup.

Possibly the biggest concern is that the social media networks where the sponsored social ads are placed by influenzers will possibly hit restrictions. The sponsored ads are now placed on sites such as Twitter (TWTR) and Facebook (FB). Those companies already have advertising relationships with brands so one has to see a potential conflict in the future.

One only needs to remember how Twitter originally supported live-streaming app Meerkat before buying competitor Periscope. At that point, Twitter started blocking Meerkat's access to social graph data, thereby providing an advantage to the app it bought.

IZEA has a data partnership with Twitter providing for a solid co-existence for now. As with any partnership, the co-existence only last as long as both parties want it that way.

Either way, the risk exists that a platform could attempt to block ads from influenzers, but of course these will typically be the heavy users with tons of followers. Such a move by a platform could backfire and push top content providers to other platforms.

IZEA does work with ten platforms now so a move by Facebook wouldn't exclude the company from still working with Google+, Pinterest, and most importantly bloggers on Tumblr.

Outside of those competitive risks, IZEA faces the fundamental issues that $15 million in cash and $20 million in liquidity is relatively small to what a startup can raise these days. Similar to the Meerkat example, a leader today could easily get passed by a more aggressive player with bigger investors.

Even if successful, the stock will always have an investor base concerned that the questioned financial transactions of the past including reverse mergers and large warrant issuances will pop up again. Even if IZEA reaches positive cash operations in 2016 as forecast by the analysts, the company may still need to raise cash that could be extremely dilutive if the share prices are still trading at the current levels.

Takeaway

The stock is no doubt risky and warrants above average skepticism due to its size and relative obscurity. IZEA will ultimately need more funding to compete with the big social media players and faces the risk that the market moves away from its target business or fails to scale large enough for a significantly profitable business.

The company though makes a compelling case that it has a product to ride the growing trend towards native advertising via sponsored social ads. If the company gets it right over the next couple of years, investors will see significant rewards. It is rare to get a growth stock trading at roughly 1x forecasted revenues for 2016, though it may stay at these levels until it gets an uplisting to the Nasdaq and moves away from the financing methods of the past.

The stock is only recommended for a diversified, high risk portfolio.

Thanks for putting this stock on my radar!