Is The Craft Beer Market Due A Leg Up?

The global beer market has proved its resilience against economic shocks and regulatory challenges over the years. However, some of these challenges have been too much to bear for some of the companies thereby resulting in several consolidations in the industry.

In addition, people are becoming more health conscious thereby limiting their uptake of fizzy sugary beverages. This change in consumer behavior has triggered a paradigm shift in the beer market with several small brewers cropping up over the last couple of decades.

Craft brewing has thus become a popular business segment of the beer market, and according to statistics, it’s been one of the main drivers of growth over the last few years. According to a recent beer market report published by Beverage Marketing Corporation, the global beer market is expected to grow at a CAGR of about 6.5% through the year 2020.

Craft or Microbrewing is tipped to be at the center of this growth as several beer customers continue to switch towards drinking quality craft beer brewed in small quantities as compared to the mass-distilled beer.

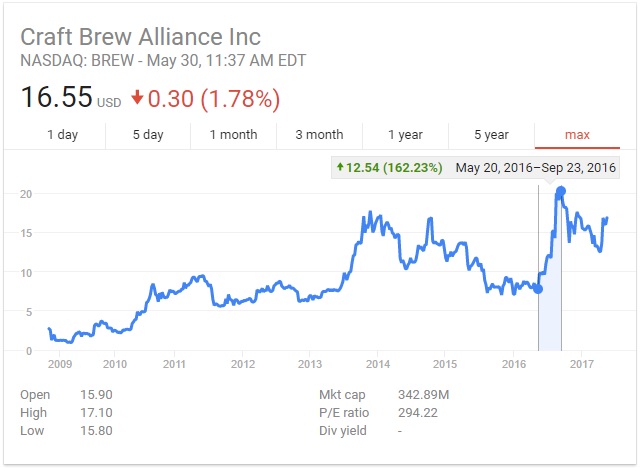

This has made craft beer stocks significantly compelling to investors as the mainstream beer market continues to experience consolidations. This can be illustrated by using Craft Brew Alliance (Nasdaq: BREW) stock, which is one of the several pure-play craft beer companies in the market. The company’s stock price rallied from a mere $7.70 per share to well over $20.00 per share between May and September last year, representing more than 160% gain in market value. Since making that run, the stock declined significantly until April in 2017 after which it began to make what appears to be a rebound.

If past trends are to be considered, Craft Brew Alliance made a similar run between 2013 and 2014, after which it pulled back and then rebounded to reach the previous high. Based on the current price level, it would be realistic to assume that the stock price could be bound for the $20.00 price level within the next few months. And at the current price of about $16.50, the target price of $20.00 would represent an upside potential of more than 20%.

The company is set to benefit from the growing demand for craft beer which makes the $20.00 price level a more realistic target in the near term. However, one of the main challenges that it could face is the increasing number of brewers in the US.

According to data published by The Brewers Association (BA), a trade association representing small and independent craft brewers at the end of March this year, the number of craft beer brewers in the US increased to 5,300. According to the report, 826 new craft beer brewers were opened in 2016 while there were only 97 closures.

The craft beer market in the country also posted a 10% growth in sales, with revenues for 2016 crossing the $23 billion mark. This accounted for more than 21% of the overall beer sales in the US while production increased marginally to account for about 12.3% from 12.2% in 2015.

Craft beer may be just peaking in the US, but in Europe, it has been one of the most popular drinks for several years, especially in the UK. Its popularity continues to grow across the world and this will only widen its addressable market. In this niche beer market, quality is a key catalyst and this dictates pricing.

Based on the revenue versus production data published in March, brewers with better quality craft beer may have edged their rivals in the share of the market, with revenue accounting for more than 21% of the overall beer sales versus just 12.3% in production.

Conclusion

The craft beer market has attracted the attention of all types of brewers. Even large players like Diageo PLC (NYSE: DEO) have joined in trying to keep up with the emerging changes in customer tastes. However, given the large portfolios of the big beer market players, small players are the ones likely to significantly reflect the positive impact of the increasing demand for craft beer.

As such, small players like Craft Brew Alliance appear reasonably attractive for growth investors willing to take up the risks associated with investing in small cap stocks.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more