Is Now The Right Time To Consider Lam Research?

The shares of the leading supplier of wafer fabrication equipment and services, Lam Research (LRCX), have fallen sharply after the company's recent disappointing revenue and earnings guidance for its fiscal 2019 first quarter. On its July 26, 4Q-2018 report the company guided for its next quarter revenue of $2.15-$2.45 billion while the consensus among analysts was for revenue of $2.78 billion. What's more, Lam Research expects Non-GAAP Earnings per Share of $3.00-$3.40 for the June 2018 quarter lower than $5.31 in the March 2018, quarter, and $3.46 in the June 2017 quarter. The decline in memory chip prices especially NAND flash prices was the primary cause of the disappointing outlook since 80% of the company's products had been supplied to memory producers in the June 2018 quarter, 55% to NAND, and 25% to DRAM.

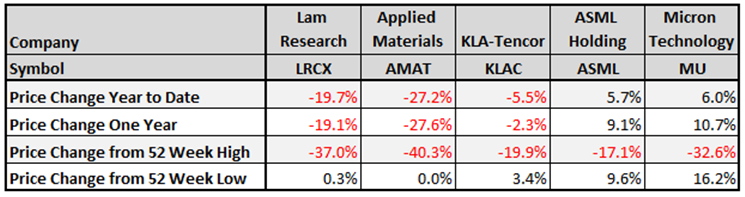

The performance of Lam's shares, in comparison to other semiconductor and semiconductor equipment manufacturers, year-to-date, one year and from 52 week high and low are shown in the table below.

Only Applied Materials (AMAT) shares have shown a steeper decline from its 52 week high than those of Lam Research, 40.3% vs. 37.0%.

However, in my opinion, the decline in the demand for Lam's products is temporary since new applications like the Internet of Things (IoT), Artificial Intelligence (AI), Big Data and Cloud will need an increasing amount of memory.

Meanwhile, Lam's fundamentals are excellent, and its valuation ratios indicate an undervalued stock. Lam's trailing price to earnings is very low 8.67, and its forward P/E is even lower 8.19. The Enterprise Value/EBITDA ratio is extremely low at 5.59. According to James P. O'Shaughnessy, the Enterprise Value/EBITDA ratio is the best-performing single value factor. In his impressive book "What Works on Wall Street," Mr. O'Shaughnessy demonstrates that 46 years backtesting, from 1963 to 2009, have shown that companies with the lowest EV/EBITDA ratio have given the best return.

Moreover, the company generates strong free cash flow and returns substantial capital to its shareholders by stock buybacks and dividend payments. The annual dividend yield is about 3%, and the payout ratio is only 19% which suggests that the dividend payment is sustainable. The annual rate of dividend growth over the past three years was very high at about 52%. In March this year, the company announced a very significant expansion of its capital return program. Lam Research intended to return at least fifty percent of free cash flow to shareholders over the next five years and announced an additional $2 billion share repurchase authorization.

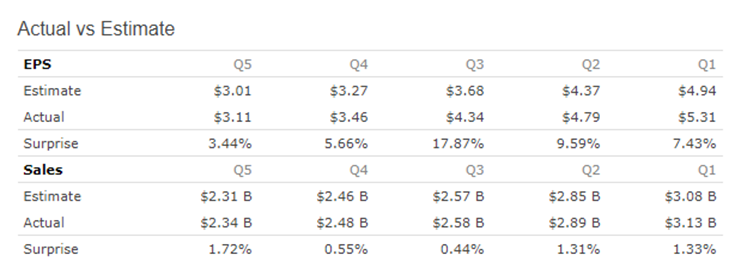

Lam Research is scheduled to report its first-quarter fiscal 2019 financial results on Thursday, October 25, after market close. According to 18 analysts' average estimate, LRCX is expected to post a profit of $3.21 a share, a 7.2% decrease from its actual earnings for the same quarter a year ago. The highest estimate is for a profit of $3.41 a share while the lowest is for a profit of $3.15 a share, not a big difference. Revenue for the quarter is expected to decline 6.8% year over year to $2.31 billion, according to 16 analysts' average estimate. There was one up earnings per share revision during the last seven days and one up earnings per share revision in the previous 30 days. Since LRCX has shown earnings per share surprise in all its last five quarters, as shown in the table below, there is a good chance that the company will beat estimates also in its first-quarter fiscal 2019 quarter.

Source: Portfolio123

Summary

Lam Research will benefit from increasing future demand for memory chips due to new applications like the Internet of Things, Artificial intelligence, Big Data and Cloud which will need an increasing amount of memory. Lam's fundamentals are excellent, and its valuation ratios indicate an undervalued stock.

Moreover, the company generates strong free cash flow and returns substantial capital to its shareholders by stock buybacks and dividend payments. According to TipRanks, the average target price of the top analysts is at $214.62, an upside of 45.1% from its September 5 close price, however, in my opinion, shares could go even higher. As I see it, the recent drop in its price creates an excellent opportunity to buy Lam's stock at an attractive price.

Disclosure: I am long LRCX stock.

I have no business relationship in any stock or company mentioned in this article. This article is intended for informational and entertainment use only, and ...

more