Is Now A Good Time To Buy PayPal?

PayPal (PYPL) is delivering outstanding financial performance and the stock has gained nearly 50% in the past year alone. However, even the best companies can turn out being mediocre investments if the valuation is excessively high, and valuation ratios for PayPal are getting extended as the stock trades near record levels.

In this context, it makes sense to wonder if PayPal's stock still offers attractive upside potential going forward or if the best is already in the past for investors in the company.

In order to try to answer this question, the following paragraphs will be looking at PayPal's stock based on quantitative factors. Statistical research has proven that variables such as financial quality, valuation, momentum, and relative strength can be powerful return drivers for stocks over the long term. Let's find out what the numbers are saying about PayPal's stock and its potential returns on a forward-looking basis.

A High-Quality Business

The digital payments industry is growing at full speed, and PayPal is one of the main beneficiaries of such growth. The company competes against big players both in the tech industry and in financial services, but management is joining forces with many of the top players on both sides of the competitive landscape.

Over the past several years PayPal has built partnerships with Apple (AAPL), Samsung (OTC:SSNLF), Facebook (FB), and Google (GOOG) (Nasdaq:GOOGL), as well as card processors like Visa (V) and Mastercard (MA). Similarly, the company is also building alliances with the big banks, including names such as Wells Fargo (WFC), JPMorgan (JPM), and Bank of America (BAC).

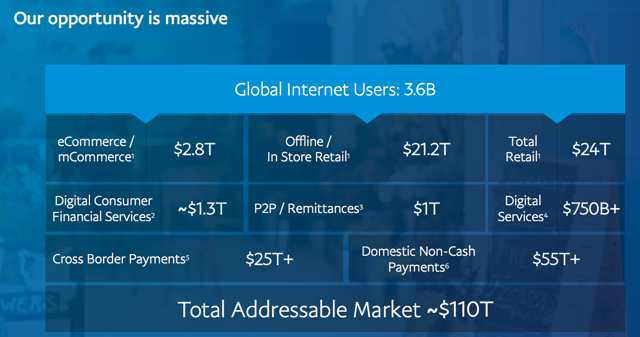

Source: PayPal

Building these alliances means that PayPal is making a smaller profit per transaction on the transactions that go through the company’s partners. However, when the market opportunity is big enough, prioritizing long-term growth above short-term margin is the right thing to do.

Speaking of which, management estimates that the total market opportunity for PayPal is worth around $110 trillion over the long term, so the company certainly has a lot of room for growth if it plays its cards well over the years ahead.

Source: PayPal

The business is clearly firing on all cylinders as of the second quarter of 2018. Total revenue during the period jumped 22.9%, reaching $3.86 billion and surpassing expectations by $50 million during the quarter. Total payment volume grew 27%, reaching $139 billion. PayPal ended the quarter with 244 million active accounts, growing by 15% year over year.

Customer engagement is increasing, which bodes well in terms of measuring user satisfaction and the company's ability to generate value for customers. PayPal processed a record 35.7 transactions per active account last quarter, an increase of 9% year over year.

The company is delivering vigorous growth rates across its most important growth engines. Merchant services grew 30.1%, cross-border trade increased 23%, and person-to-person payment volume rose 50% to more than $33 billion.

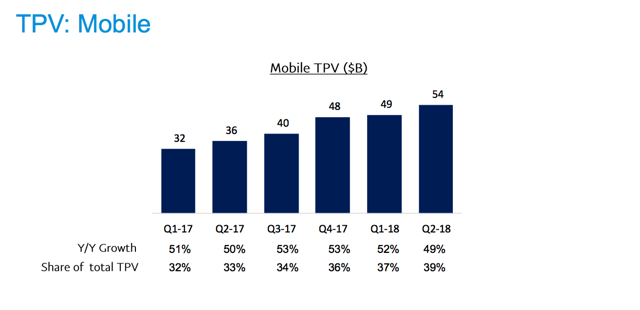

Mobile is a crucial growth driver in the industry, and the company doesn't leave much to be desired in that area. PayPal processed $54 billion in mobile payment volume in the second quarter of 2018, which represents a 49% growth rate year over year and 39% the company's total payment volume.

Source: PayPal

Profitability metrics are also showing encouraging trends, operating margin increased from 13.7% of revenue in the second quarter of 2017 to 14.8% in the second quarter of 2018. Non-GAAP operating margin stands at an impressive 21.3% of sales, and non-GAAP earnings per share increased by 28% year over year.

Valuation Is Not Excessive By Industry Standards

PayPal's stock is trading at a valuation premium versus the broad market, but this is to be expected since companies in the payments industry generally carry above-average valuations due to the industry’s attractive characteristics and profitable business model. In comparison to other companies in the sector, PayPal looks reasonably valued.

The table below shows forward P/E, Price to Earnings Growth, Price to Sales, Price to Book Value, and projected sales growth for PayPal versus Mastercard, Visa, Automatic Data Processing (ADP), and Square (SQ).

When considering growth expectations and valuation levels together, PayPal is priced in line with the sector. In fact, the company is the cheapest stock in the group in terms of price to sales and price to book value.

|

PYPL |

MA |

V |

ADP |

SQ |

|

|

Projected PE |

39.6 |

33.7 |

32.2 |

28.2 |

200.8 |

|

PEG |

1.19 |

1.06 |

1.37 |

1.36 |

N/A |

|

Price to Sales |

7.72 |

16.3 |

17.13 |

4.82 |

13.71 |

|

Price to Book |

7.45 |

43.27 |

12.32 |

18.58 |

34.02 |

|

Sales Growth Projected |

16.15% |

12.76% |

11.29% |

6.87% |

39.50% |

Fundamental Momentum

Looking at the fundamentals in isolation doesn't tell the whole story behind a stock, since the fundamentals in comparison to expectations can have a huge impact on stock prices. In other words, when the company is delivering better-than-expected earnings and expectations about future earnings are increasing, this can be a powerful upside fuel for the stock.

PayPal has a solid and consistent track record when it comes to delivering both sales and earnings above expectations.

Source: PayPal

The chart below shows the evolution of the stock price in comparison to earnings expectations for both the current year and the next fiscal year. Unsurprisingly, price and expected earnings tend to move in the same direction over time.

PYPL data by YCharts

Powerful Relative Strength

Money has an opportunity cost; when you buy a stock with mediocre returns that capital is not available for investing in companies with superior potential. Besides, winners tend to keep on winning in the stock market, so you want to invest in stocks that are not only doing well but also doing better than other alternatives.

The payments industry is on fire lately, as expressed by a 35% rise in the PureFunds ISE Mobile Payments ETF (IPAY) in the past year, far surpassing the SPDR S&P 500 (SPY) over the period.

PayPal is materially outperforming both the sector-specific ETF and the broad market, with an explosive increase of over 50% in the same period. Since strength begets strength in the stock market, this bodes well for investors in PayPal going forward.

PYPL data by YCharts

Putting It All Together

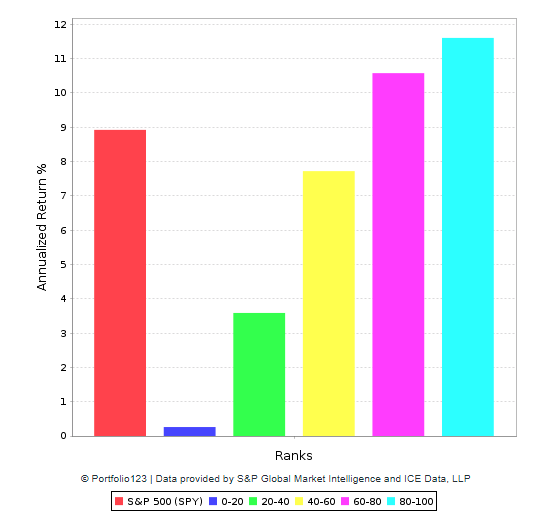

The PowerFactors system is a quantitative investing system available to members in my research service, "The Data Driven Investor." This system basically ranks companies in a particular universe according to the factors analyzed in this article for PayPal: quality, valuation, financial momentum, and relative strength.

The chart below divides the investable universe into 5 buckets based on their PowerFactors ranking, and it compares their historical performance versus the SPDR S&P 500. There is a clear and direct relationship between PowerFactors rankings and historical performance, this is to be expected when the quantitative system is robust and consistent. Also, companies with elevated quantitative rankings have substantially outperformed the market over the long term.

Data from S&P Global via Portfolio123

PayPal's stock has a PowerFactors ranking of 90.36, the stock has a relatively low ranking of 53.9 when it comes to valuation, but it gets all scores above 80 in terms of financial quality, fundamental momentum, and relative strength.

Past performance does not guarantee future returns, of course. A quantitative system is always based on past data and current expectations about future performance. If PayPal fails to deliver in accordance with expectations, then the stock will most likely deliver disappointing returns going forward, especially since PayPal's stock is priced for aggressive growth.

PayPal was recommended to subscribers in The Data Driven Investor in July of 2017 at a price of $37.24, and the stock is also a position in my personal portfolio. Even after gaining over 140% since then, I believe it still makes sense to hold on to the stock, because the long-term growth story in PayPal looks stronger than ever.

But valuation is still a relevant risk to consider. When building new positions in the stock, maybe it makes sense to start with a partial position and increase the size of such a position if there is any pullback down the road. One thing looks quite clear, PayPal is a high-quality growth business. As long as the fundamentals remain solid, any short-term dips in the stock should be a buying opportunity for investors over the long term.

Disclosure: I am long PYPL, AAPL, FB, GOOG, GOOGL, JPM, MA.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no ...

more