IPO Quiet Period For Gardner Denver Holdings Could Expire With A Bang

Overview

The quiet period for the Gardner Denver Holdings (NYSE:GDI) IPO is scheduled to expire on June 6, 2017.

This event will allow underwriters the opportunity to release their detailed reports and analyses for the first time since Gardner Denver began to trade publicly.

Our firm has studied price movement around company quiet period expiration events and have found abnormal positive returns in a short window of time surrounding the date, particularly for companies with strong backing and good performance since the IPO. GDI possesses the requisite strong syndicate, solid early market performance, relative popularity, and attractive fundamentals for further growth.

We see an opportunity for experienced investors to purchase shares of GDI ahead of the event date on 6.6.

Company Overview

As we described in our IPO preview, Milwaukee, Wisconsin-based Gardner Denver Holdings Inc. manufacturers flow control and compression equipment, as well as their associated services and parts. The company sells its products under a number of different leading brand names. According to its SEC filing, the company has more than 155 years of experience in the engineering industry and loyal customers in more than 175 countries.

GDI was LBO'ed by KKR in 2013.

Executive Management Overview

Since Feb. 2017, Vicente Reynal has served as a member of Gardner Denver's board of directors and as chief executive officer since Jan. 2016. Mr. Reynal joined the company as the president of the industrials division in May 2015. Previously, Mr. Reynal spent 11 years at the Danaher Corporation and held executive positions at AlliedSignal Corp. and Thermo Fisher Scientific. He attended the Massachusetts Institute of Technology and the Georgia Institute of Technology where he earned an M.S. in mechanical engineering and technology and policy and a B.S. in mechanical engineering, respectively.

Since Oct. 2016, Philip T. Herndon has acted as Gardner Denver's chief financial officer. He joined the company as the CFO of the industrials division in Jan. 2016 and has previously served in executive positions at Capital Safety, Inc., Sealed Air Corporation and Diversey, Inc. He earned a Master of Business Administration degree from Marquette University and a Bachelor of Business Administration degree from Indiana University.

Solid IPO Performance

On February 28, 2017, Gardner Denver filed an S-1/A with the Securities and Exchange Commission, announcing its IPO to offer 41,300,000 shares at $20 per share. Joint book-running managers for the deal include Citigroup, KKR, Goldman Sachs & Co., UBS Investment Bank and others. The company also offered an additional 6.195 million shares to its underwriters as an overallotment option.

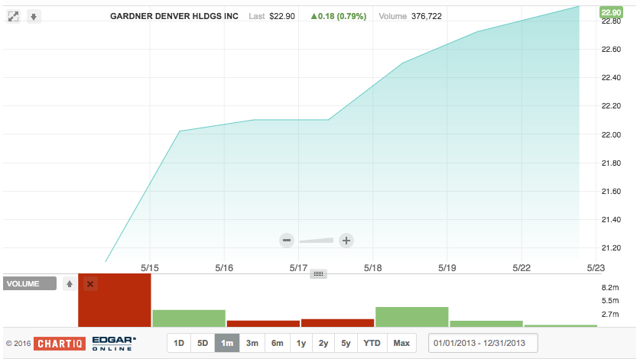

The deal brought first day returns of 5.5% and an additional 5.0% in the after-market.

(Click on image to enlarge)

The company intends to use $335.3 million to pay back its debt under its dollar term loan facility and $575 million of its proceeds to redeem all of its senior credit facility's notes. In addition, Gardner Denver will pay certain expenses related to the offering of its IPO.

Financial Highlights

For the year that ended on December 31, 2016, the company reported a net loss of $31.3 million, gross profits of $716.7 million and total revenues of $1.9394 billion. For the previous year that ended on December 31, 2015, the company reported a net loss of $352 million, gross profits of $779.1 million and total revenues of $2.1269 million. In 2013, Gardner Denver was acquired by KKR, and KKR will maintain a majority of the ownership after the IPO.

Its peer group consists of large manufacturers of blower, vacuum and compression products, including Accudyne and Kaeser Compressors, Inc., IDEX Corporation (NYSE:IEX), Flowserve Corporation (NYSE:FLS), Colfax (NYSE:CFX), Ingersoll-Rand PLC (NYSE:IR) and Atlas Copco AB.

Conclusion: New Chance To Buy In

As described in the introduction, we see an event-driven buying opportunity for GDI prior to 6.6.

The company made a solid market debut, has strong backing by KKR and an impressive team of IPO underwriters.

Its history of net losses raises some concern, however, the losses have significantly declined from 2015 to 2016, and its plan to use its proceeds to pay off its outstanding debts keeps us optimistic.

We strongly suggest investors consider purchasing shares of GDI five days prior to 6.6 and hold for two days after the event. (See further research on this play here.)

Disclosure: I am/we are long GDI.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more