IPO Quiet Period Expiration: Medpace Holdings, Inc.

Medpace Holdings Buy Recommendation

The 25-day quiet period on underwriter analyses that began with the August 11, 2016 IPO of Medpace Holdings (MEDP) will come to an end on September 5, allowing the firm's many IPO underwriters to publish detailed positive reports and buy recommendations of the company on September 6. Our extensive research shows above-market returns during the period surrounding the company's quiet period.

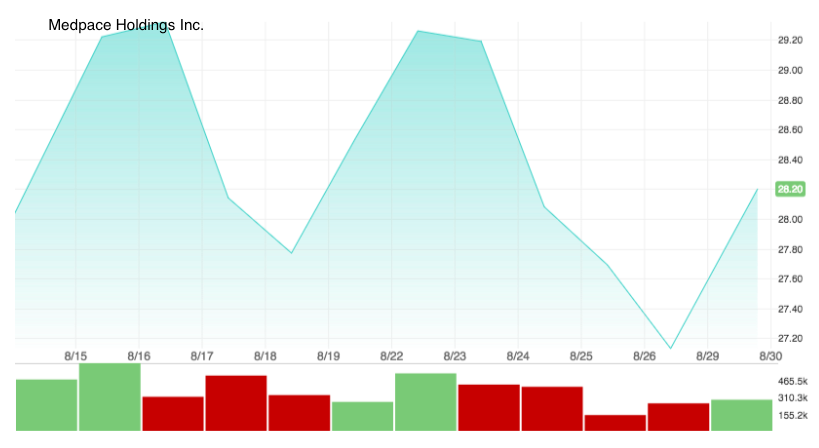

Medpace's share price will likely see a temporary increase as a result of the release of underwriter reports. Since its IPO, Medpace Holdings has shown relatively strong performance. It opened at $27.79, higher than its IPO price of $23. Over the past month, the stock has bounced around, but reached a high on August 16 of $29.32 and a low of $27.13 on August 26. Currently, the shares trade around $28.

(Click on image to enlarge)

(Nasdaq.com)

Powerful Underwriters Could Boost Share Price at Quiet Period Expiration

We expect that Medpace's IPO underwriters will seek to capitalize on the stock's recent strong performance through the release of positive detailed reports beginning at the conclusion of the quiet period. These major underwriters include Credit Suisse Securities, Jefferies LLC, UBS Investment Bank, Wells Fargo Securities, and William Blair Inc.

Business Overview: Provider of Services to Biotechnology, Pharmaceutical, and Medical Device Industries

Medpace Holdings provides scientifically-driven, outsourced clinical development services to the biotechnology, pharmaceutical, and medical device industries. The company offers a portfolio of services that support the clinical development process from Phase I to Phase IV along an array of therapeutic areas. Its services include quality assurance, core laboratory, biometrics, medical writing, global regulatory affairs, clinical monitoring, study start-up, study feasibility, clinical trial management, and medical affairs.

Medpace was founded by Dr. August Troendle in 1992 as a Phase II to Phase IV-focused contract research organization (CRO). The company maintains a strong, scientifically-driven business model, and Dr. Troendle retains a significant ownership stake in the company. Medpace focuses on conducting clinical trials across all therapeutic areas, including Endocrinology, Oncology, Metabolic Disease, Cardiology, Central Nervous System, Anti-Viral and Anti-Infective, and therapeutic expertise in medical devices. The company has approximately 2,300 employees in 35 countries in order to deliver broad access to diverse patient populations, market knowledge, and local regulatory expertise.

Medpace notes in its SEC filing that its full-service operating model is its key differentiator by providing its services from beginning to end of the clinical trial process, whereas other CROs offer functional or partial outsourcing services.

Management Team

President and CEO August Troendle, M.D., has been president since founding the company in 1992. His previous experience includes clinical development positions at Novartis, and the United States Food and Drug Administration. Dr. Troendle received his Medical Degree from the University of Maryland, School of Medicine.

Senior VP Susan Burwug has been with Medpace Holdings since June 2015. She joined Medpace in 1993. Prior to joining Medpace, she held clinical roles at the University of Cincinnati. Ms. Burwig received her Bachelor of Science in Nursing as well as an MA in Sports Administration from Kent State University.

Competitors: Pharmaceutical Product Development, Quintiles, PRA Health Sciences

Medpace competes primarily against full-service contract research organizations in addition to in-house R&D departments of teaching hospitals, universities, and biopharmaceutical companies. These competitors include Covance Inc. (NYSE:CVD), Icon PLC (Nasdaq:ICLR), INC Research Holdings (Nasdaq:INCR), InVentive Health Inc., PARAEXEL International Corporation, Pharmaceutical Product Development, PRA Health Sciences (Nasdaq:PRAH), and Quintiles Transnational Holdings (NYSE:Q).

Financials

In its SEC filing, Medpace Holdings reported revenue of $359 million and net income loss of $8.6 million for the year ended December 31, 2015. For the three months ended March 31, 2016, the company reported revenue of 99.59 million, up 19% from $83.0 million for the same period the previous year. The company reported a positive net income of $3.4 million for the three months ended March 31, 2016.

Conclusion

We expect Medpace's underwriters to publish detailed positive reports after the company's quiet period expiration on September 5, 2016. Depending on the reports, we expect Medpace's stock price to increase approximately 3% to 5% which is in line with the returns we have seen in our past research.

We recommend investors to consider investing prior to the expiration to benefit from this expected price increase.