IPO Quiet Period Expiration: First Hawaiian Bank

First Hawaiian Inc. (Pending:FHB) - Buy Recommendation - $28.50 PT

The 25-day quiet period on First Hawaiian Inc. will come to an end on August 29, 2016, allowing the firm's IPO underwriters to publish reports and recommendations on the institution for the first time on August 30.

We previewed this event on our IPO Insights platform.

FHB provides banking products and services to businesses and individuals (see below). The company's solid IPO brought a return of 15.6% on 8.3.2016.

First Hawaiian's share price will likely see a temporary increase as a result of the release of underwriter reports, as evidenced by our own and historical research. The event opens a buying opportunity for the growing financial firm, already dominant in its sphere.

We are particularly keen on FHB, given its powerful syndicate and promising debut (in contrast with other upcoming quiet period expirations for GEMP and ATMR). FHB's quiet period event is a critical catalyst for the stock's continued upward trajectory.

Towering Above Local and International Peers

First Hawaiian has 62 branches throughout Hawaii, Guam, and Saipan. Hawaii boasts the largest number with 57 of the branches. 70% of the institution's loans and 83% of deposits derived from Hawaii as of March 31, 2016.

Also of March 31, 2016, First Hawaiian noted $19.1 billion in assets, $16.1 billion in deposits, $11.0 billion in gross loans, and $2.5 billion in stockholder's equity. This size is significant as none of the largest banks in the United States, which could compare in AUM, maintains a retail presence in Hawaii. (I.e. Bank of America (NYSE:BAC), Citibank (NYSE:C), Chase and Wells Fargo (NYSE:WFC)). With few immediate sizeable competitors, FHB should have room to dominate.

Smaller peers with fewer assets and market share in Hawaii include American Savings Bank, Central Pacific Bank, Territorial Savings Bank, Hawaii National Bank, and Finance Factors.

A Sweet Early Market Performance

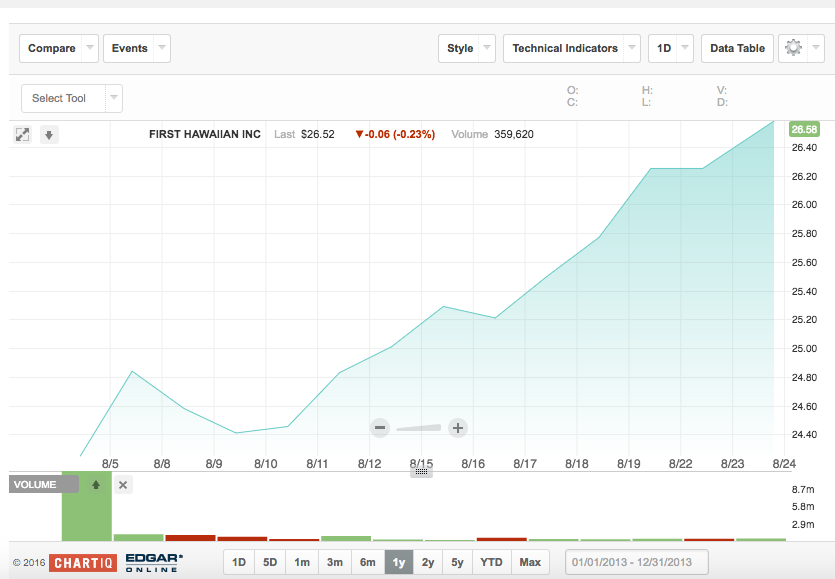

First Hawaiian was priced at $23, at the high end of its expected price range of $21 to $23. The stock opened at $24.84 on its first day of trading. The stock has climbed since then to trade at $26.52 (market close - 8.24.2016)

(Click on image to enlarge)

(Nasdaq.com)

We were impressed by this debut, given the scarcity of successful financial IPOs in 2016 (just thirteen in the last twelve months, as compared with 50 healthcare deals over the same time period).

Solid Fundamentals, Boosted By An Equally Strong IPO

The market capitalization of the bank, which trades under its holding company name of First Hawaiian Inc., is now more than at $3.38 billion. That is the largest market cap of any publicly traded company in Hawaii, barely surpassing the $3.31 billion value of Hawaiian Electric Industries Inc. (NYSE:HE).

FHB's IPO raised $485 million for BNP Paribas, making FHB's valuation approximately $3.2 billion. BNP's ownership of FHB decreased to 84.9% after the sale of 21 million shares. FHB has confirmed that it sold the shares at $23 - the high end of its range.

First Hawaiian Inc. provided the following figures from its financial documents for the fiscal year ended Dec. 31, showing a slight (1%) decrease in annual income. At the same time, interest income is up 3.5% over the same time period.

|

2015 |

2014 |

|

|

Income before income taxes |

$ 343,227,000 |

$ 344,244,000 |

|

Net Income |

$213,780,000 |

$216,672,000 |

Conclusion: Buy FHB Ahead Of Its IPO Quiet Period Expiration

We believe First Hawaiian's powerful IPO underwriters (BNP Paribas Securities, BofA Merrill Lynch, Goldman Sachs, Banco Santander, Barclays Capital, BBVA Securities, Citigroup Global Markets, Commerz Markets, Credit Suisse Securities, Deutsche Bank Securities, HSBC Securities, ING Financial Markets, J.P. Morgan Securities, Keefe Bruyette and Woods, Morgan Stanley, USB Investment Bank, and Wells Fargo Securities) will release several positive reports after August 29th. This belief is based on years of data our firm and academics have compiled (see introduction).

A flood of good news could boost FHB's stock price ~3% as we've seen with so many other IPO quiet period expiration plays. Yet FHB stands out for us, given its enormous syndicate and outstanding market performance next to few financial IPOs in 2016.

This upcoming positive catalyst builds on FHB's healthy 6.1% CAGR in gross loans since 2005 and a 3.5% increase in interest income 2014-2015.

The combination of fundamental and event-driven factors lead us to a strong buy for FHB ahead of its IPO quiet period expiration on 8.29.