IPO Preview: Tigenix

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Background

Leuven, Belgium-based Tigenix (OTC:TGXSF) filed to go public in the U.S. in late 2015, only to become entangled with Bavarian Nordic (OTC:BVNKF) and Basilea Pharmaceutica (OTC:BPMUF) as the European drugmakers pulled back from NASDAQ. Tigenix subsequently increased its bank account following a €23.75 million placement in Belgium, and added an additional €25 million via a relationship with Takeda, before coming back to Wall Street in October 2016 with a revamped slate of underwriters.

Currently, the IPO has matured into a plan to offload 2.75 million American Depository Shares at $19.20 a piece, an offering that would gross a little more than $52 million. Once the costs are deducted, Tigenix would emerge with approximately $42.9 million net, although that figure could fall or rise depending on the final offering price. Tigenix reportedly based its $19.20 target price on the closing price of its stock in Brussels in early December 2016.

The new underwriting team includes BofA Merrill Lynch, Cowen & Company, Canaccord Genuity, and BTIG.

We previously highlighted this deal on our IPO Insights platform.

Company Goals & Use of IPO Proceeds

(Source)

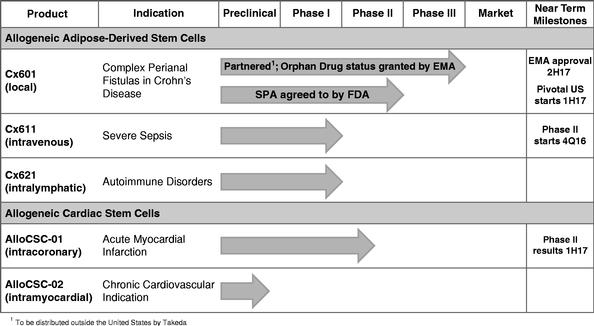

Tigenix aims to meet its goal of beginning a phase 3 trial of Cx601 in the U.S. in the first half of 2017. Cx601 has already met the main endpoint of combined remission of complex perianal fistulas in Crohn's disease patients during one phase 3. Currently, Tigenix is transferring technology to Lonza, its CMO, in anticipation of the beginning of a second phase 3 study in the U.S. Clinical risks for Cx601 are limited, thanks to a solid phase 3 success in Europe.

At $42.9 million, the upcoming IPO would carry Tigenix through to the initial enrollment of phase 3, while leaving more than $6 million, which will allow the company to dive into a phase 2 trial of Cx611 in sepsis. The company also plans to set aside $4 million for a phase 1/2 trial of AlloCSC-01 in acute myocardial infarction.

About Tigenix

Founded in 2000, Tigenix was initially a spin-off from a Belgian university lab. The company's primary goal was to achieve commercialization and clinical development of cell therapy products in the field of bone and cartilage defect treatments. In 2009, the company introduced the first Europe-approved cell therapy product, ChondroCelect. This autologous chondrocyte implantation therapy was intended for cartilage repair in the knee, and in 2014, Tigenix eventually out-licensed to Sobi in an attempt to refocus its resources on stem cell assets.

Although the biotech has greatly increased the scope of its clinical development pipeline over the last two years, Tigenix continues to be a strong player in the cell therapy sector for more than 15 years, and the company has accumulated a number of regulatory and clinical experiences. Potential investors should be interested in Tigenix's solid track record of successful clinical trials. These could point to actual market approval for its products. We also note its experienced staff with significant knowledge of industrial and cell therapy regulatory challenges.

Conclusion: Caution

Statistics estimate that more than two million people live with Crohn's disease in Europe and in the U.S. combined. Among those patients, approximately 12% will develop complex fistulas, and an estimated 60% of these patients will relapse from all available drugs. The patients will meet all criteria to be eligible for Cx601 treatments.

Assuming a sales price similar to Remicade, at $20,000 per treatment, Cx601's potential market opportunity could represent more than $3 billion in Europe and the U.S. Tigenix owns 100% of its worldwide rights to Cx601, and its assets provide ample opportunities with reasonable risks.

These risks include delays or failure in the preclinical and clinical development, and ability to gain regulatory approval for product candidates, as well as significant deficit.

At an 110.26 price/sales multiple, using last twelve months' sales ended June 30, 2016, Tigenix does not appear cheap; however, this is in line with the average for many earlier stage biotechnology firms, largely due to much of their value being in potentially successful portfolio candidates.

Our recommendation is to be cautious and wait for the company to make more progress.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this ...

more