IPO Preview: Smart Sand

Summary

Smart Sand (Pending:SND) is expected to IPO on Friday, Nov. 4. The company expects to raise approximately $138.6 million through its sale of 10.6 million shares. Of those 10.6 million shares (subscription required), 1.5 million will be sold by company insiders (approximately 14% of the total). Shares are estimated to be sold at a price range of $15 to $18. Assuming shares are priced at the midpoint of the range, SND would command a fully-diluted market value of $522 million. The company plans to list its shares under the symbol SND.

The company intends to use a portion of the net proceeds from its IPO to repay its outstanding debt under its existing revolving credit facility and to redeem all of its outstanding preferred stock. The company plans to utilize the remaining net proceeds for general corporate uses.

Underwriters for the IPO include Credit Suisse and Goldman Sachs, Jefferies, Simmons & Co., Tudor, Pickering, Holt & Co., and Deutsche Bank.

Company Summary

Source: smartsand.com/products.html

Smart Sand Partners is an MLP, which was formed by Clearlake Capital in 2014 for the purpose of owning its own frac sand production assets in Wisconsin. Smart Sand is a low-cost producer of Northern White raw frac sand - a preferred proppant used to amplify hydrocarbon recovery rates during the hydraulic fracturing process of natural gas and oil wells. The company sells its products mainly to natural gas and oil production and exploration companies, including EOG Resources (NYSE:EOG), and oilfield service companies, including Weatherford (NYSE:WFT).

As of June 30, 2016, the company owned and operated a raw frac sand processing facility and mine near Oakdale, Wisconsin. The facility has an estimated 92 million tons of likely recoverable reserves and 244 million tons of confirmed recoverable reserves at the mine.

In addition to its Oakdale facility, the company also owns a property in Jackson County, Wisconsin, which is near a Class I rail line. Smart Sand has permission to initiate operations and develop there in the future.

Executive Management Highlights

Chief Executive Officer and Director Charles E. Young founded Smart Sand, LLC (Smart Sand predecessor) and served as its president from November 2009 to August 2011. Mr. Young also served as the company's president and secretary from September 2011 to July 2014. Mr. Young has more than two decades of entrepreneurial and executive experience in the renewable energy, telecommunications and high-technology industries. Mr. Young received a B.A. in Political Science from Miami University.

Lee E. Beckelman serves as Chief Financial Officer. Previously he served as the executive vice president and chief financial officer of Hilcorp Energy Company, an exploration and production company (from December 2009 to February 2014), and executive vice president and chief financial officer of Price Gregory Services, Incorporated, a crude oil and natural gas pipeline construction firm (from February 2008 to October 2009). Mr. Beckelman received his BBA in Finance with High Honors from the University of Texas at Austin.

Financial Performance

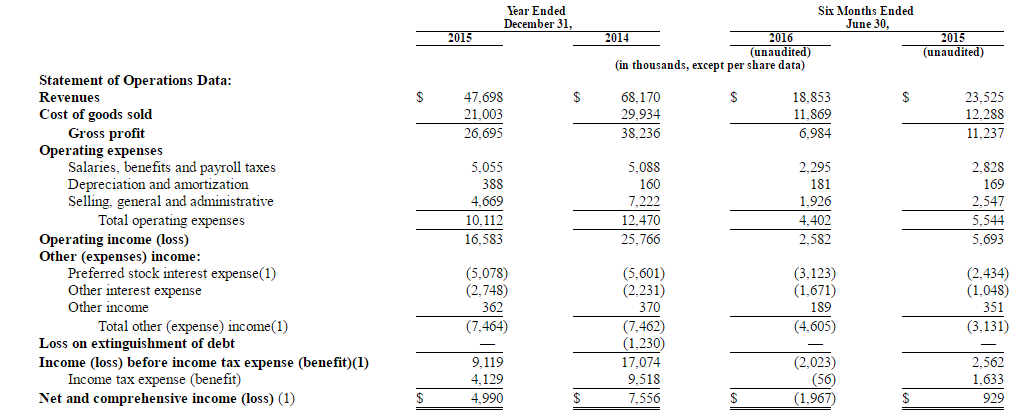

Substantially all of SND's revenues are derived from sales to companies in the oil and natural gas industry, making it highly sensitive to volatility in the industry. Due to the drop in oil prices, SND experienced declines in revenue, gross profits and net income. Revenue declined from $23.5 million (last six months of June 30, 2015) to $18.9 million (last six months of June 30, 2016), a 19.5% reduction, and from $68.2 million (in 2014) to $47.6 million (in 2015), a 30.2% reduction. Gross profits and operating income were also down (see chart below).

(Click on image to enlarge)

Valuation and Competitor Comparison

Competitors include: Emerge Energy Services LP (NYSE:EMES), U.S. Silica Holdings, Inc. (NYSE:SLCA), Hi-Crush Partners LP (NYSE:HCLP), and Fairmount Santrol Holdings, Inc. (NYSE:FMSA), among others. At an estimated market capitalization of $522 million, SND will trade at approximately 12.13x sales (using last 12 months ended June 30, 2106). This is significantly above its peers. Price to sales for competitors is: Emerge Energy Services LP (0.47x), U.S. Silica Holdings, Inc. (4.81x), Hi-Crush Partners LP (2.86x), Fairmount Santrol Holdings, Inc. (2.19). A slightly higher multiple could be justified for Smart Sand given its higher gross margin; however, in our view, this current valuation seems too high.

|

Market Cap |

Price/Sales Multiple |

Gross Margin |

|

|

SND |

522.03M |

12.13x |

55.96 |

|

EMES |

291.92M |

0.47x |

10.75 |

|

SLCA |

2.95B |

4.81x |

23.01 |

|

HCLP |

1.04B |

2.86x |

23.04 |

|

FMSA |

1.87B |

2.19x |

26.53 |

Frac sand MLPs have suffered recently due to the drop in oil prices. Fairmount Santrol, which went public in Oct. 2014, is one example of this. FMSA priced well below its initial range and then dipped 45% during its first week of trading. Two years later, the stock is still down almost 50% from its IPO price (10.31.16 pre-market session).

Conclusion: Exercise Caution in Upcoming IPO

Declining revenue and operating income, as well as volatility of the oil and natural gas industry, make us hesitant on investing. Investors may be extra cautious given the poor performance of FMSA. Additionally, SND's current valuation price is significantly above its peers.

We suggest investors sit this IPO out.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

more