IPO Preview: Quantenna Communications

Quantenna Communications (PENDING: QTNA) is expect to IPO on Friday (10.28). The company is a leader in ultra-high performance Wi-Fi through the design of its next-generation chipsets. In its SEC filing, the company estimated net proceeds of $90.9 million (or approximately $105.0 million if the underwriters' exercise their option to purchase additional shares in full) through the sale of its 6.7 million shares. The target was recently raised to$123 million. It announced an estimated price range of $14 to $16 per share.

Upon completion of this offering, QTNA will have approximately 33.78 million shares outstanding. Assuming, it prices at $15, the mid-point of its range, QTNA will command a fully diluted market value of $506.79 million.

Since its founding in 2005, QTNA has raised $161.55M in nine rounds of funding from fourteen investors. Its most recent funding round took place in Dec. 2014.

Underwriters for the deal include: Morgan Stanley, Barclays, Deutsche Bank, Needham & Co., William Blair, and Roth Capital.

Business Summary: Designing Next-Generation Chipsets for High-Speed Wi-Fi

Quantenna designs next-generation chipsets for high-speed Wi-Fi that will support an increasing number of connected devices accessing a growing pool of digital content.

QTNA has developed significant enhancements to features such as higher-order Multiple Input and Multiple Output and transmit beamforming, to achieve superior Wi-Fi performance relative to competitors. Additionally, the company created a cloud-based Wi-Fi analytics and monitoring platform that diagnoses and repairs network inefficiencies remotely.

ABI Research estimates that the global market for Wi-Fi chipsets will grow from $3.8 billion in 2016 to $5.2 billion in 2021, a CAGR of 7%.

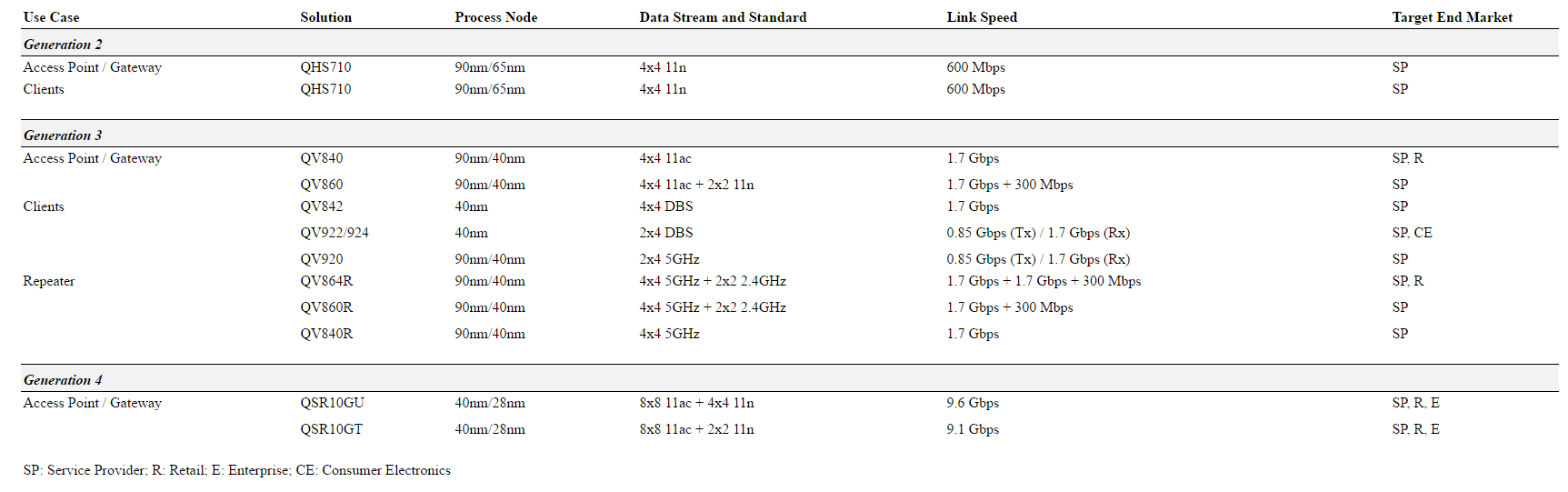

So far, QTNA has shipped over 80 million chips to customers across four semiconductor process generations. Its products are included in wireless set-top boxes, gateways, video bridges, access points and other devices. The majority of its revenue is derived from sales to customers who serve the service provider home networking market. Sales to Asia accounted for 82% of revenue in 2015. Quantenna designs a family of high-speed chipsets which are shown below.

(Click on image to enlarge)

(QTNA, S/1-A SEC Filing)

Executive Management

Sam Heidari serves as Chief Executive Officer and Chairman of the board of directors. Previously he served as served as Chief Technology Officer and Vice President of Engineering at Ikanos Communications, Inc., an advanced semiconductor products and software company. Mr. Heidari also serves as the Chairman of the board of SiTune Corporation, a privately held integrated circuits company, and a member of the board of directors of several other privately held companies. He holds a B.S. in Electrical Engineering from Northeastern University and an M.S. and Ph.D. in Electrical Engineering from the University of Southern California.

Sean Sobers serves as Chief Financial Officer since July 2016. He previously served as Corporate Vice President of Finance and Controller at Cadence Design Systems, Inc. ('09-'16), an electronic design automation software and engineering services company. Mr. Sobers is a certified public accountant (inactive) and holds a B.S. in Accounting from the University of Southern California.

Financial Snapshot

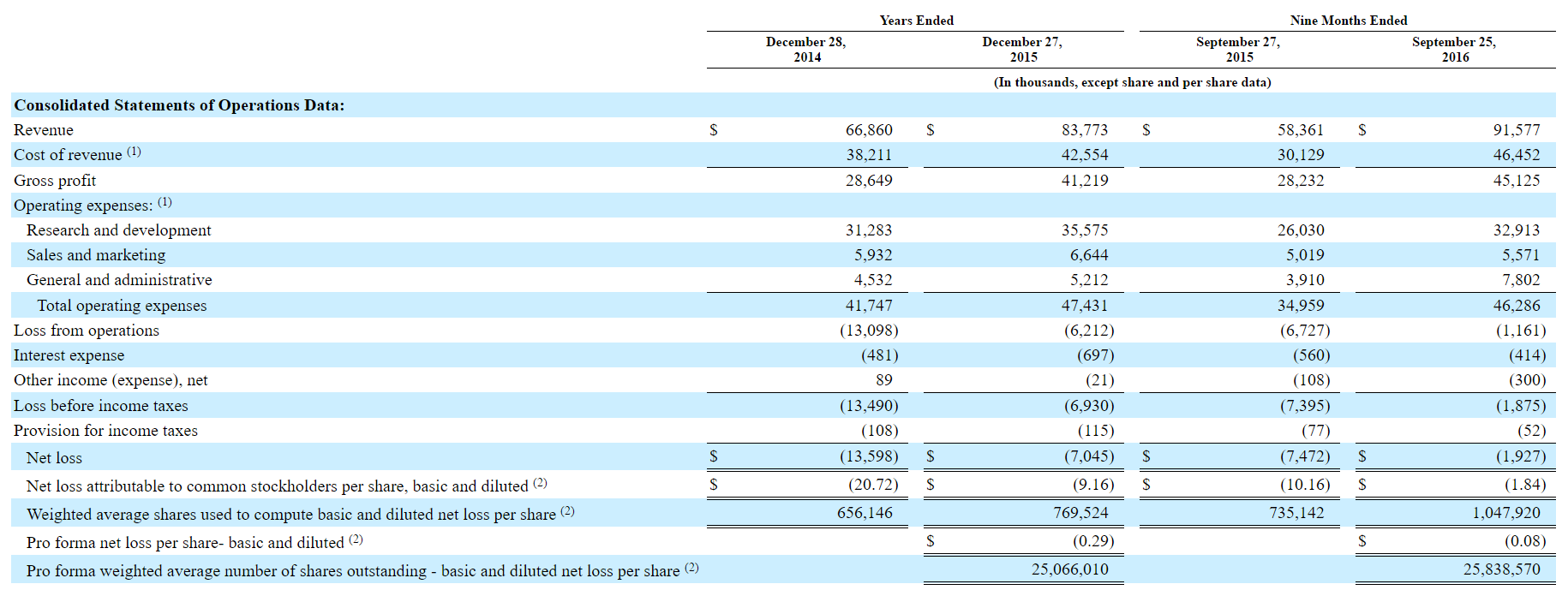

QTNA has shown tremendous growth in revenue. For the last nine months ended September 25, 2016, revenue was $91.6 million, a 70.5% increase from the same period the previous year. For the year ended December 27, 2015, revenue was $83.8 million, a 25% increase from $66.9 million the previous year. In addition, gross margins are high, with QTNA generating 49.2% and 47.2% in gross margin for the year ended 2015 and last nine months of September 25, 2016, respectively. QTNA recorded a net loss of $7.0 million and $1.9 million for the year 2015, and last nine months ended September 25, 2016, respectively. As of September 2016, QTNA had an accumulated deficit of $161.6 million.

(Click on image to enlarge)

(QTNA S-1/A SEC Filing)

Valuation Compared to Peers

Competition in the Wi-Fi chip-sets is diverse and comes from both large, established companies as well as private companies. Some of the more established players in the space include: Marvell Technology Group Ltd. (NASDAQ:MRVL), MediaTek USA Inc., and Qualcomm Incorporated (NASDAQ:QCOM). QTNA chipsets offer several differentiating factors, however these companies may have greater financial and marketing resources as well as name recognition.

At an estimated market capitalization value of $506.79 million, QTNA will trade at approximately 4.33x sales. This is slightly lower than QCOM, which trades at 4.43x sales despite a significantly slower revenue growth of 3.64%. On average, the Semiconductor Equipment industry trades at 4.38x price/sales ((NYSE:TTM)), and is growing revenue at 24.98%. QTNA will be trading at a similar price/sales multiple, despite significantly higher growth.

|

Price/Sales |

Revenue Growth (Last Qrtr vs. Same Qrtr Prior Year) |

Market Cap |

|

|

QTNA |

4.33x |

70.5% |

506.79 million |

|

QCOM |

4.43x |

3.64% |

100.16B |

|

Semiconductor Equipment industry |

4.38x |

24.98% |

$14.56B |

(Source)

Conclusion: Buy

The Wi-Fi chipset market is growing quickly, and QTNA is well positioned to benefit from this growth. So far this year, there have been only four other tech IPOs in the Bay Area, including: San Francisco-based Twilio (NYSE:TWLO), San Jose-based Nutanix (NASDAQ:NTNX), Redwood City-based Talend (NASDAQ:TLND) and San Mateo-based Coupa Software (NASDAQ:COUP). All four exceeded their price range and are now trading well above their IPO prices.

We expect similar strong results from QTNA and view it as a buying opportunity at its current estimated IPO price.

We are hearing the deal is oversubscribed several times; interest continues to grow.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in QTNA over the next 72 hours.

more