IPO Preview: CapStar Financial Holdings, Inc.

CapStar Financial Holdings, Inc. (Nasdaq: CSTR) filed its S-1/A with the Securities and Exchange Commission on Sept. 14, 2016, announcing its upcoming initial public offering. The company estimated net proceeds of $22.7 million, assuming underwriters exercise in full their option to purchase additional shares, through its IPO on Sept. 22, 2016.

It is offering 2,585,500 shares, 1,290,213 of which will come from selling shareholders. This represents approximately 49.9 percent of shares from company insiders. CapStar Financial also has an additional 387,750 shares that are over-allotted and that the underwriters can purchase if they choose to do so.

The company's shares have a price range of $14.50 to $16.50. Upon completion on this offering, Capstar Financial will have 10,795,870 shares of common stock outstanding. This number assumes underwriters do not exercise their over-allotment option and excludes the shares that would be outstanding through the conversion of stock options. Assuming CapStar prices at the midpoint of its range, the company would have a market capitalization of $167.34 million.

Business summary

Founded in 2007, CapStar Financial Holdings, Inc. is a bank holding company that is headquartered in Nashville, Tennessee. The company's primary operation is its subsidiary CapStar Bank. It is a commercial bank that is concentrated in locations in the greater metropolitan service area of Nashville. The bank has seven locations, five of which are retail bank branches, and two of which are mortgage origination offices.

The company reports that it had total assets of $1.3 billion as of June 30, 2016. It also reported that it had $1.1 billion in deposits, net loans totaling $887 million, and shareholders' equity of $114.3 million, as of that date.

Executive management overview

Claire W. Tucker is the chief executive officer, president, and director of CapStar Financial Holdings. Before beginning her position in those roles, Ms. Tucker previously served as the CEO and president of CapStar Bank. Ms. Tucker has 32 years of experience in business banking. She holds a Bachelor of Science from Tennessee Wesleyan University and a Master of Business Administration from the University of Tennessee.

The chief administrative officer and chief financial officer of CapStar Financial Holdings, Robert Anderson also serves as the CFO and chief administrative officer of CapStar Bank. He has more than 20 years of executive-level experience in the finance industry. Mr. Anderson holds both a Bachelor of Arts and a Bachelor of Science from The Ohio State University and has a Master of Business Administration from Pepperdine University.

Financial highlights and risks

Between December 31, 2011, and June 30, 2016, CapStar Financial Holdings reported that it enjoyed compound annual growth rates (CAGR) of 14.5 percent for its assets and total deposits and 19.1 percent for its total loans. Between December 31, 2011, and December 31, 2015, the company reports that it generated a CAGR of 38.2 percent for its net income.

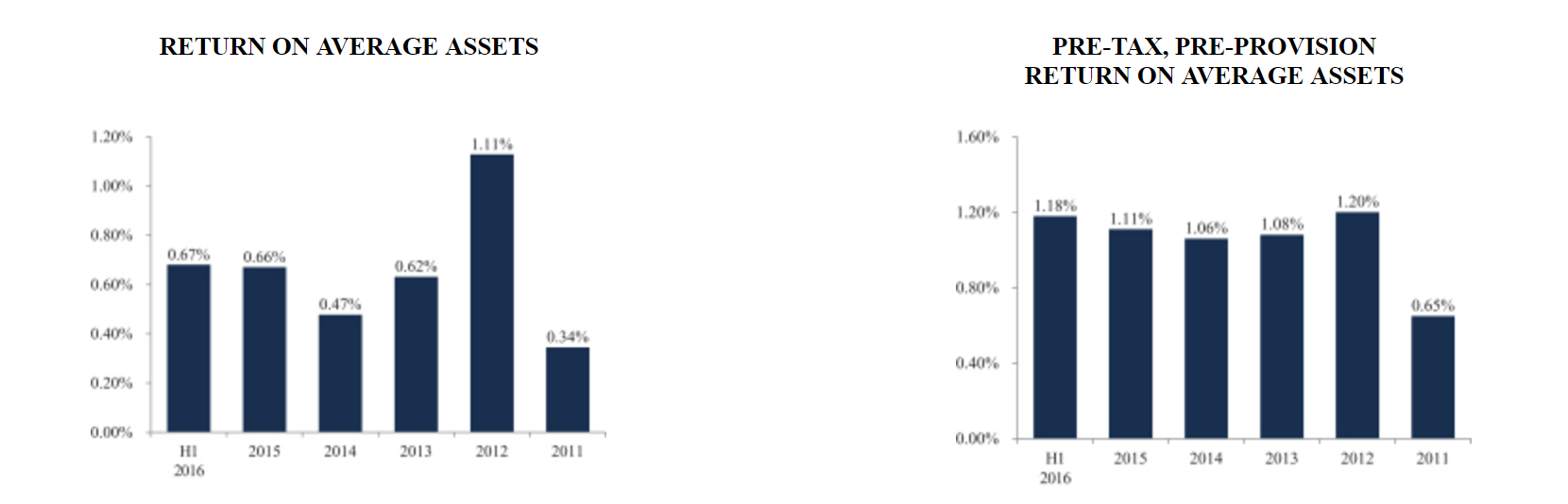

In 2015, net interest income was $34.8 million, a 7.3 percent increase from the previous year and net income was $7.6 million, an increase of 51.4 percent from the previous year. During the same time, return on average assets and return on average equity was 0.66% and 7.08% respectively.

The bank anticipates growth through capturing market share and growing its customer base in the Nashville MSA. It also looks to expand through strategic acquisitions and to diversify its revenue sources by expanding its mortgage and wealth management lines. The company anticipates an increase of its core deposits and additional revenue through cross-sales of products to existing customers.

(Click on image to enlarge)

(CapStar Financial Holdings, Inc. S-1/A Form)

The company identifies several risk factors, including the volatility of the financial markets, potential damage due to weakened economic conditions and concerns about the federal fiscal policy-making process. The bank also reports that 86 percent of its loans are held by people and businesses in the Nashville MSA, so its operations are highly concentrated in that market.

Finally, it reports that the financial and banking industry is very competitive, and the competition from larger banks and online banking platforms could negatively impact its profitability.

Industry peers

The financial services industry is highly competitive and CapStar's competitors include other regional banks, online banking platforms, large banks with long histories and name recognition and other lenders. Its IPO closely follows that of FB Financial (Pending:FBK), another Tennessee Bank, which went public just last week (9.15). FBK generated a 9.2 percent return on its first day of trading.

Assuming CapStar prices at the midpoint of its range, and using earnings as of year-end 2015, CSTR's P/E ratio of 21.23 is in line with similar Tennessee banks, such as Pinnacle Financial Partners (20.45), Commerce Union Bancshares Inc. (20.09), and Capital Bank Financial Corp. (24.45).

Conclusion

Although CapStar Financial Holdings, Inc. is a relatively young bank, in its short history, it has grown to be the sixth-largest in Nashville. The bank has shown excellent CAGRs and has a sound plan for further growth. In addition, the strength of the Tennessee economy is another positive indicator for this bank.

Nashville has one of the lowest unemployment rates among metropolitan areas, and since July 2015, more than 100 companies have announced plans to relocate to or expand within, Nashville and the surrounding area.

Of the 34 IPOs in the second quarter of 2016, first day returns average 9.4% and 71% of deals ended June above their offer price. Recent financial IPOs have done particularly well. CapStar is well positioned to continue this trend and we recommend that investors consider purchasing shares of CapStar during its IPO.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in CSTR over the next 72 hours.

more