Intrinsic Value And The Margin Of Safety

“confronted with a challenge to distill the secret of sound investing into three words, we venture the motto, Margin of Safety” Benjamin Graham, The Intelligent Investor

Of all the concepts that a value investor holds dear, intrinsic value and the “margin of safety” are the most sacred. These ideas form the bedrock of what Benjamin Graham set out over 80 years ago in his book “Security Analysis”, without which stock research would still be stuck in the dark ages. Intrinsic value provides a solid framework for investors to determine if a stock is overvalued or undervalued.

While many people like to make a great distinction between value investing and other types of investing, Warren Buffett would argue that all investing is value investing. If you don’t have a sense for the value of what you’re buying then it’s simply called guessing (or perhaps more politely ‘speculation’).

Intrinsic Value

Intrinsic value as a concept is not difficult to understand – it merely represents the future cash flows of a company discounted back to a present value. But as Buffett points out, just because it can be defined easily, doesn’t mean that it can be calculated easily. Benjamin Graham himself described intrinsic value as an “elusive concept”.

Intrinsic value will be subject to a wide margin of error because our forecasts about the future are subject to a wide margin of error. Experience tells us we simply cannot forecast the future with much precision. This is one reason why Buffett sticks to stable businesses, where future cash flows can be estimated with at least some degree of confidence. Conversely, he stays away from businesses where cash flows cannot be easily forecast. Consider a technology hardware company such as Apple. If Apple continues to release highly innovative and successful products, cash flows could be far higher in 3 years time than they are today. But if they lose out to other products over time, the cash flows of Apple could be far lower. No doubt Apple is a great company, but the chances of correctly forecasting cash flows 3 years from now are very slim.

If investing were a science, it would simply be a case of calculating future cash flows, discounting those cash flows and comparing the intrinsic value to the current share price. But investing is just as much art as science (one reason why AI cannot currently perform at the level of the top investors). Determination of future cash flows is based on millions of judgments. A naïve investor believes that they can determine the future, discount it to a current value and have certainty. However the sophisticated investor recognizes that there are infinite numbers of outcomes dependent on an infinite number of variables. They seek to form judgments about the most likely outcomes, and the likelihood of variation around that outcome. Any average analyst or investor can calculate an intrinsic value based on one outcome, but an appreciation of the variation and risks to that outcome is what makes a great analyst.

“It’s not hard to make investments that will be successful if the future unfolds as expected…But you might want to give some thought to how you’ll fare if the future doesn’t oblige. In short, what is it that makes outcomes tolerable even when the future doesn’t live up to your expectations?” Howard Marks

Margin of Safety

This brings us to the idea of “Margin of Safety”. If we accept that we cannot calculate intrinsic value with any degree of certainty, then we need to make sure that our investment works out even if we get our calculation wrong. We need to ensure a large “Margin of Safety” between the price we pay and the intrinsic value we have calculated.

“You leave yourself an enormous margin of safety. You build a bridge that 30,000-pound trucks can go across and then you drive 10,000-pound trucks across it. That is the way I like to go across bridges” Warren Buffett

And of course, even if we leave a large margin of safety, we will sometimes get our calculation of intrinsic value so wrong that we still lose money. This is to be expected, even for the greatest investors. But if we work hard to estimate intrinsic value, and we consistently leave ourselves a large margin of safety, the outcome should be positive more often than not.

“Our goal is not to outperform all the time – that’s not possible. We want to outperform over time” John Paulson

Investors who use this framework tend to have a thorough appreciation of risk. Where the business is stable and where you have a large margin of safety, risk is minimized. But where intrinsic value is hard to calculate, and where your margin of safety is narrow, risk is high. Of course, this is very different to how Wall Street thinks about risk.

Intrinsic Value and Risk

As I’ve covered in a previous post, most financial theory is based on somebody’s dumb idea of equating risk with historical volatility. The intelligent investor recognizes that these two properties are very different. In fact the longer you’ve been investing, the more you realize that there is next to no correlation between these two factors. Believing there is a correlation, or worse still, believing that one equates to the other, is to invite bizarre (and harmful) conclusions.

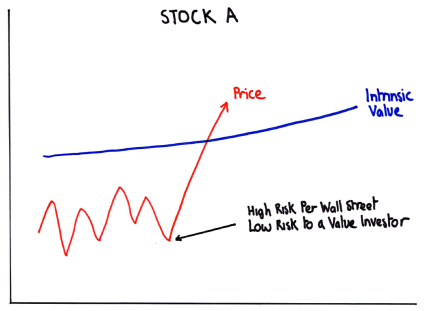

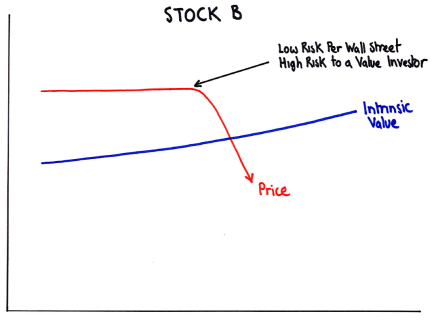

Take a look at these two charts. According to Wall Street, stock A is highly risky. But to a value investor it looks quite safe. And again according to Wall Street, Stock B looks very safe. But a value investor would take one look and run a mile. Conventional theory would argue for putting a higher discount rate on stock B versus stock A, an entirely perverse outcome.

“I find it preposterous that a single number reflecting past price fluctuations could be thought to completely describe the risk in a security. Beta views risk solely from the perspective of market prices, failing to take into consideration specific business fundamentals or economic developments” Seth Klarman

These simple concepts of intrinsic value and margin of safety are not inherently complex. Yet in my experience the vast majority of investors fail to ever fully grasp them. Maybe it’s because investors feel like it’s not really investment if it doesn’t involve Greek characters and complex language. Or maybe they don’t like a concept that can’t be reduced to a single number. For whatever reason, CAPM, Beta and the Modern Portfolio Theory seem to have more appeal to students of finance than the humble “margin of safety”. For us “value investors”, that’s just fine.

Disclosure: None.

Have something to say on a recent acquisition or merger? Let us know your views on the StockViews platform!