Intel To Buy Rival Altera In Latest Big Deal

Intel Corporation (INTC) is one of the world's largest semiconductor chip maker. The Company develops advanced integrated digital technology products, primarily integrated circuits, for industries such as computing and communications. It also develops platforms, which it defines as integrated suites of digital computing technologies that are designed and configured to work together to provide an optimized user computing solution compared to components that are used separately. Intel designs and manufactures computing and communications components, such as microprocessors, chipsets, motherboards, and wireless and wired connectivity products, as well as platforms that incorporate these components. The Company sells its products primarily to original equipment manufacturers, original design manufacturers, PC and network communications products users, and other manufacturers of industrial and communications equipment. Intel Corporation is based in Santa Clara, California.

Altera Corporation (ALTR) designs, manufactures, and markets a broad range of high-performance, high-density programmable logic devices and associated development tools, focusing on ease of use, lower risk, and fast time-to-market. Altera's solution to customer needs includes a combination of silicon and software products. The company sells the widest range of product families, allowing customers to find the density, speed, and package type to meet almost any need.

A new week, and yet another big deal on Wall St. It was announced today that semiconductor giant Intel will purchase the smaller rival Altera in a deal worth @$16.7 billion. This deal allows Intel to wipe out a portion of its competition, as some manufacturers were using Altera for their chips in lieu of more expensive custom offerings from Intel in certain product categories.

Altera's specialties include field-programmable gate arrays (FPGAs). These chips are not quite as effective as a purpose-built specialty processor for a given task, but they can be configured by customers to meet needs in encryption, switching, servers, etc. that make them more cost-effective.

Clearly, Intel saw a long-term threat to its business from these alternate manufacturers and decided to take one of them out via its ample cash reserves. The chip-manufacturer will now be able to add Altera's FPGA technology to its popular line of Xeon semiconductors--used in servers--and meet the challenges moving forward in that critical business segment.

This deal has been in the works for a while, as Intel has repeatedly made offers for the company which were ultimately rejected. The current deal provides for a price of $54/share, which is roughly in line with an offer that was rejected back in April.

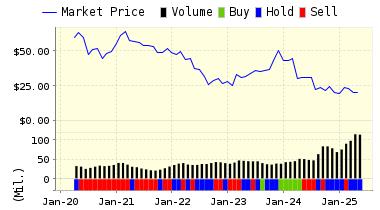

As always, it will take a while to see how the deal shakes out vis-a-vis the respective share prices of Intel and Altera. Altera has been up big since the news first surfaced back in March. Intel was flat this morning while Altera was up @5% on the news of the finalized acquisition

Prior to this latest news, ValuEngine had a HOLD recommendation on ALTERA CORP. Based on the information we had gathered and our resulting research, we felt that ALTERA CORP had the probability to ROUGHLY MATCH average market performance for the next year. The company exhibited ATTRACTIVE Company Size but UNATTRACTIVE Price Sales Ratio.

Prior to this latest news, ValuEngine had a BUY recommendation on INTEL CORP. Based on the information we had gathered and our resulting research, we felt that INTEL CORP had the probability to OUTPERFORM average market performance for the next year. The company exhibited ATTRACTIVE Company Size and Momentum.

Below is today's data on INTC:

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

34.66 | 0.59% |

|

3-Month |

35.33 | 2.53% |

|

6-Month |

36.59 | 6.19% |

|

1-Year |

36.89 | 7.07% |

|

2-Year |

42.27 | 22.65% |

|

3-Year |

28.16 | -18.27% |

|

Valuation & Rankings |

|||

|

Valuation |

24.36% overvalued |

Valuation Rank(?) |

|

|

1-M Forecast Return |

0.59% |

1-M Forecast Return Rank |

|

|

12-M Return |

27.82% |

Momentum Rank(?) |

|

|

Sharpe Ratio |

0.32 |

Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return |

7.09% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

22.07% |

Volatility Rank(?) |

|

|

Expected EPS Growth |

-1.84% |

EPS Growth Rank(?) |

|

|

Market Cap (billions) |

166.61 |

Size Rank |

|

|

Trailing P/E Ratio |

14.66 |

Trailing P/E Rank(?) |

|

|

Forward P/E Ratio |

14.94 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

n/a |

PEG Ratio Rank |

|

|

Price/Sales |

2.98 |

Price/Sales Rank(?) |

|

|

Market/Book |

4.08 |

Market/Book Rank(?) |

|

|

Beta |

0.97 |

Beta Rank |

|

|

Alpha |

0.10 |

Alpha Rank |

|

Disclosure: None

ValuEngine subscribers can easily check out all of our top-rated STRONG BUY stocks with our "5-Engine ...

more