Insider Buy Spotlight: Matrix Service Co. (MTRX)

Matrix Service Company (MTRX) saw a notable insider purchase last week as Director Jim Mogg bought 10,000 shares at $15.15, a $151,500 purchase, the largest insider purchase at MTRX since January 2008. Mogg is also a Director at ONEOK Partners, Bill Barrett, and ONEOK Inc. The purchase came with MTRX shares down 25% YTD.

Matrix’s services include construction and restoration at Utility facilities, storage solutions for Crude, LNG, and NGL, Refinery plant maintenance/turnarounds, Upstream services, chemical and tank cleaning, bulk material handling, and fertilizer production facilities. MTRX reports results in 4 segments, Electrical Infrastructure, Oil Gas & Chemical, Storage Solutions and Industrial.

In the Electrical Infrastructure segment, drivers for the power generation industry include new-build natural gas combined cycle construction, Report and coal to gas switching, and accelerating the transition to cleaner sources of power generation. In Power Deliver, an aging infrastructure sets up for new-build infrastructure to support renewables and new natural gas. In the Storage Solutions segment, positive drivers include a contango market and the lifting of the crude export ban, and in Gas & Gas Liquids the North American conversion from an importer to exporter calls for more infrastructure, and demand trends from low prices causing a need for additional chemical and NGL processing plants. The Industrial segment remains challenging with lower commodity prices causing capex cuts in Mining & Minerals, Iron & Steel, and Fertilizer.

The $416.9M provider of engineering, infrastructure, construction and maintenance services to the Oil, Gas, Power, Industrial and Mining markets trades 10.6X Earnings, 0.32X Sales, 1.34X Book and 5.68X cash value with a debt-free balance sheet. EPS is 2015 at $0.63 was a 52.6% drop Y/Y, but expected to jump 78.7% in 2016 and 20% in 2017 to $1.35, surpassing its record EPS year in 2014. Backlog in FY15 grew to $1.42B, up from $916M in FY14, a record year in revenue, new project awards, working capital performance and backlog. New projects account for around 55% of revenues while recurring at around 45%. In Q1 MTRX saw a sharp jump in revenues from Electrical Infrastructure and Storage Solutions, while Oil Gas & Chemical and Industrial saw declines. MTRX did sharply cut its FY16 guidance for EPS and Revenues due to lower commodity costs.

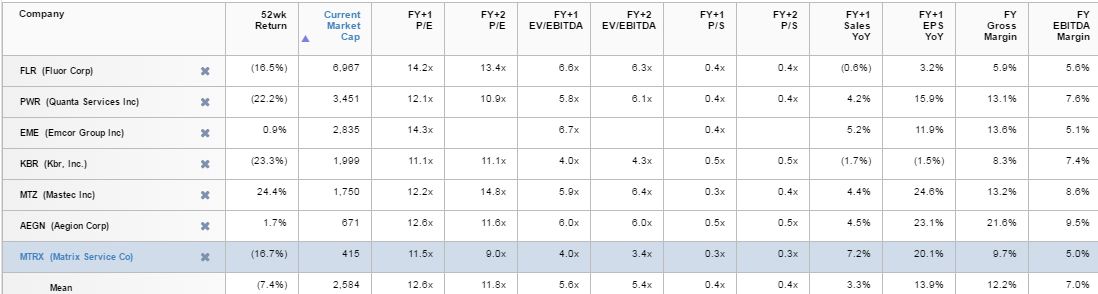

At 9X FY18 earnings, MTRX trades cheaply to a peer average of 11.8X, and at 3.4X EV/EBITDA it is cheap to a peer average of 5.4X. MTRX is performing better than peers in terms of Sales and EPS growth, so the discounted valuation does not appear appropriate, though it does trail peer margin levels. A comparison table is shown below:

MTRX also is trading at the low end of its historical multiples, which considering the commodity price environment is fair, but seeing stabilization in commodities that should position MTRX for better times ahead.

![]()

MTRX has a strong seasonal bias, averaging a +5.88% return in Q4 and +13.35% return in Q1 over the past 5 years, and the same tendencies seen in the 10 and 15 year averages as well.

On the chart, MTRX shares recently traded down to the lowest level since 2013, and down more than 50% from hitting above $37 in Summer of 2014. A chart with quarterly candles is shown below, and shows MTRX coming into long term trend support at the recent low while also retesting a former base breakout, an optimal level of entry for a trader with a long term time horizon, and shares are also deeply oversold.

In conclusion, Matrix Service (MTRX) shares are trading at an extremely cheap valuation considering its cash position and debt-free balance sheet, coming into a long term optimal entry level at trend support, and seeing a positive signal from an insider stock purchase. MTRX deserves to trade back towards $20/share if the commodity price environment stabilizes at these levels, and if commodities actually start to rise again, I can see MTRX earnings at least $1.50/share and deserved of a 15X multiple, giving an end of year target of $22.50, 45% upside from current levels.

Not Investment Advice or Recommendation Any descriptions "to buy", "to sell", "long", "short" or any other trade related terminology should not be seen as a ...

more