Income Planning Using Altria

Most of us know by now that the financial and retirement situation for many people in this country is really awful. But did you know that the median working age couple has only $5,000 saved for retirement?

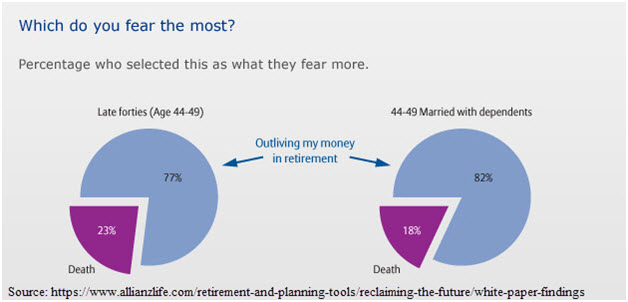

The Ultimate Fear For People: Outliving Their Assets

What is the number one fear for most people in their 40s? It's not death; it's outliving their money.

What is going on in this country? What has brought us to this? Let's start with low-interest rates. Only nine years ago we could place a lot of our retirement money into treasury bonds and high-quality corporate bonds. That world is gone. With the 10 year treasury only yielding 1.6% today, we can't even beat inflation.

Today's Investing World Vs. The Past

It's hard to remember, but we really could move a lot of our money into treasury bonds in retirement just nine years ago and do just fine. To show this, I ran an interesting scenario in our WealthTrace Financial Planner, which is available to the public as well.

Let's step back in time and see how a couple that is 50 years old could have done in the year 2007 when bonds yielded so much more. You can see my assumptions here:

|

Inflation (CPI) |

2.3% |

|

Current Age of Both People |

50 |

|

Age Of Retirement |

65 |

|

Age When Both People Have Passed Away |

85 |

|

Social Security at age 67 (combined) |

$40,000 per year |

|

Average Savings Rate |

20% on Income of $125,000 |

|

Total Investment Balance Today |

$650,000 |

|

Recurring Annual Expenses in Retirement |

$55,000 |

|

Investment Mix |

70% U.S. Value Stocks, 30% Treasuries. Switches to 100% Treasuries at Retirement |

|

Investment Location |

50% in taxable accounts, 50% in IRAs |

|

Return Assumption Value Stocks |

6.0% per year |

|

Standard Deviation Value Stocks |

16.20% |

|

Return Assumption Treasuries |

5.0% per year |

|

Standard Deviation Treasuries |

7.20% |

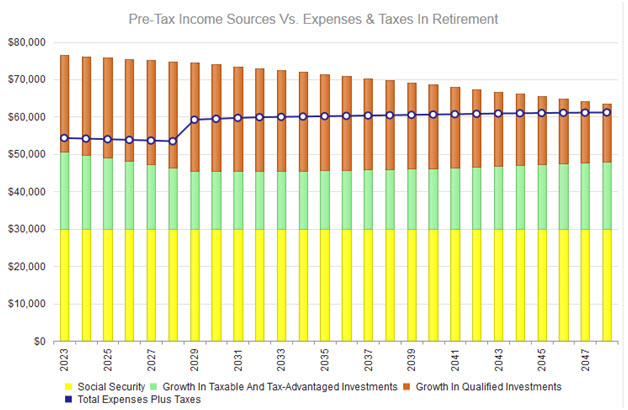

Take a look at the chart below. In retirement this couple's income from bonds can completely pay for all of their expenses. That would be absolutely impossible today given how low interest rates are.

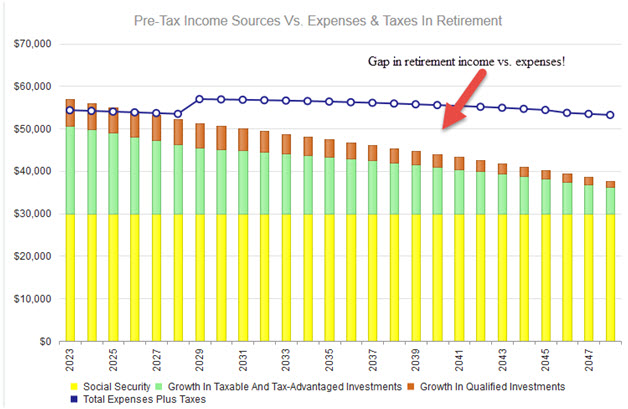

Let's go ahead and take a look at how this couple would fare in today's low-interest rate world.

Replacing Treasuries With Dividend-Growth Stocks

My strategy is to use the best dividend-growth stocks along with bonds for retirement income. I look for dividend payers who have a long history of increasing their dividends. I like to start by using our Dividend Calculator to project the long-term dividend payouts. Using this I came up with a few great stocks for my retirement portfolio, with my favorite being Altria (MO). Some others that I recommend are Exxon (XOM), Intel (INTC ), Procter & Gamble (PG), and Johnson & Johnson (JNJ).

Don't forget to diversify. I'm not saying you should only invest in these stocks. But these are a great start. Let's look at the characteristics of Altria that make it such a great dividend payer for retirement portfolios:

|

Div. Yield |

Div. Growth |

Div. Growth |

|

3.8% |

8.5% |

8.2% |

I love that Altria has nearly a 4% dividend yield and continues to have dividend growth rates above 8%.

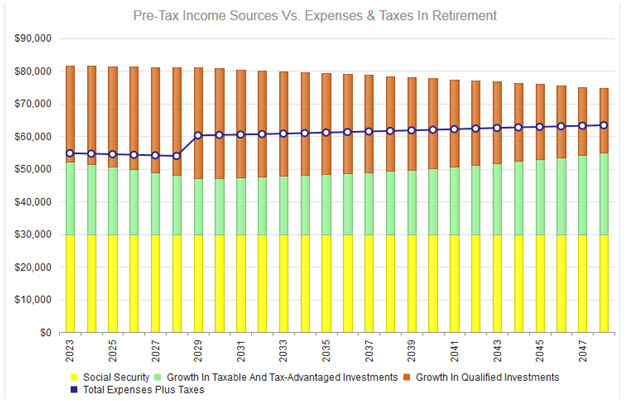

I want to now run my retirement plan again. What if the couple we looked at takes half of their investments in bonds and places it into dividend payers that have characteristics like Altria? Take a look below:

They are now back to having enough income to cover their expenses. In this scenario and with this investment mix, they will never outlive their money. This, of course, assumes that the dividend payers continue their dividend payouts and increases.

Income Planning Is Not Easy Today

This is probably the toughest investing environment since the Great Depression. Interest rates are so low that we are forced to come up with other ideas for generating enough income for retirement. But if we dig deep we can find great dividend payers who will pay out a consistent and growing dividend over years and years. This is how we can close that income gap that is so detrimental to many people in retirement.

What would increasing your savings rate or investing in different asset classes do to your retirement plan? Could you handle a stretch of stock-market volatility? WealthTrace can help you find ...

more