IBM’s Anecdote Of The Hole

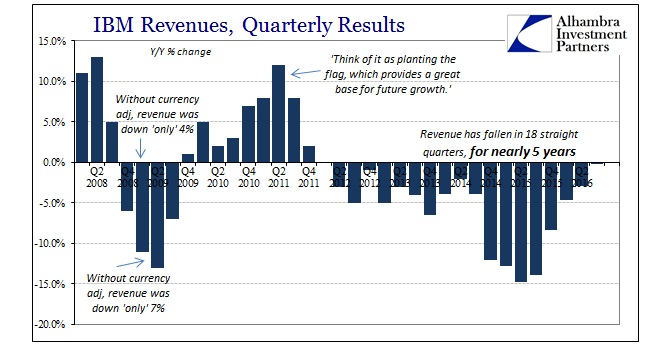

Revenue at IBM (IBM) fell just barely in Q3 2016, perhaps something of an achievement for beleaguered Big Blue. The company has seen its revenue shrink for an astonishing 18 quarters in a row. During that time, IBM has been written off as no longer important, where once a bellwether for the industry and even the whole global economy now supposedly a laggard in a world onrushing toward the cloud. As we have seen with online shopping, however, I believe that IBM isn’t directly a victim of structural changes but rather the global depression that is accelerating them.

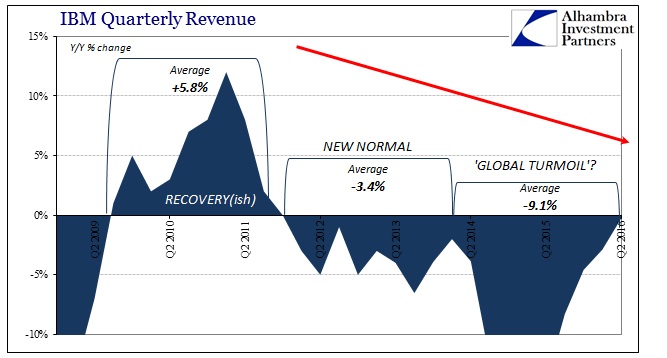

But whereas Nonstore Retail Sales have surged only this year, IBM’s core business has been undercut by new technology adoption for these past almost five years. In the middle of 2011, amidst 12% revenue growth, management believed that it was the same economy as before the Great “Recession”, with Big Blue positioned right at the front of recovery with all its traditional hardware offerings. Not coincidentally, in my view, that all changed right at that time where the eurodollar system became widely viewed (from the inside) as no longer able to perform that task (rebuilding as in pre-2007 condition).

Businesses globally are being squeezed by slow depression, a factor reflected in IBM’s steady shrinking. The proportions are nothing short of astounding. Q3 2016 revenue though down just 0.3% versus Q3 2015, is 26.6% less than Q3 2011. YTD for the three quarters through Q3, IBM revenue is 24.7% less than the same three quarters of 2011, amounting to almost $20 billion difference.

As constructive as those comparisons are in terms of how they reflect IBM’s position as an economic indicator, I think comparing the latest results to the same quarters in 2007 perhaps even more relevant in these broad economic terms. Revenue is down 20% from Q3 2007, a massive decline in terms of cash as well as time. For the three quarters YTD period, in 2007 topline sales were $69.9 billion, but just $58.1 billion so far in 2016.

Despite the huge decline at the top of the income statement, IBM’s net income is actually significantly higher now. In 2007, the bottom line showed $6.5 billion in profit as compared to $7.4 billion for the nine months so far of 2016. Margins have clearly expanded enormously to “accommodate” a drastically smaller company.

The only way that happens is if IBM manages its cost structure in unending attention to the most minute details of efficiency. In 2007, the company employed about 386,000 workers; in 2015, however, headcount only shrunk to 378,000 workers. Those numbers alone show that not only has the company held up hiring, it clearly had to have obtained far cheaper personnel.

In 2010, IBM stopped reporting the direct breakdowns of its staffing worldwide, switching instead to a generic global headcount as with so many other tech firms. At the time, the company was accused of “covering up” just how much of itself it was actively offshoring – and that was when revenue was growing and recovery seemingly still viable. We can only assume by these comparisons that was a roughly justified accusation, likely pushed even further as revenue began to shrink steadily after 2011.

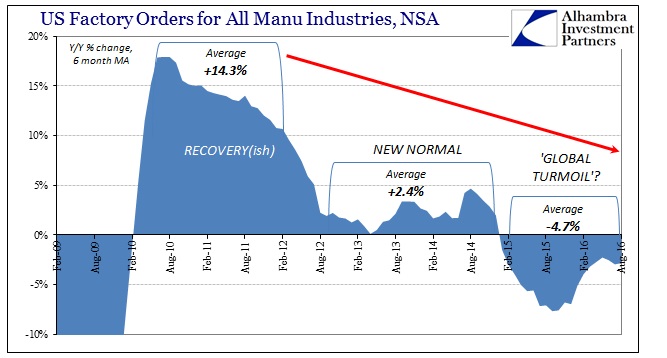

This may be one anecdote from a tech dinosaur, but even though perhaps more extreme than at other big businesses the same pressures have certainly been applied almost universally. We know without question that revenues never really recovered from the Great “Recession” and that they have been under greater strain if not contracting like IBM during this “rising dollar.” We also know that profit margins are at historically high levels. To grow or even maintain profits has meant inordinate attention to costs, greatly undercutting yet again how the past few years could possibly have been the “best jobs market in decades.”

And though IBM revenue may have finally been flat for once, that still isn’t nearly the same as actual growth nor does it come close to filling in what is now stretched to an economic hole the size of a decade. Not recession.

Disclosure: This material has been distributed for ...

more