Huami Could Face Headwinds When IPO Lockup Expires

The 180-day lockup period for Huami Corporation (HMI) ends on August 7, 2018. When this six-month period ends, the company's pre-IPO shareholders will have the opportunity to sell large blocks of currently-restricted shares for the first time. The potential for a sudden increase in the volume of shares traded on the secondary market could negatively impact the stock price of HMI on August 7th.

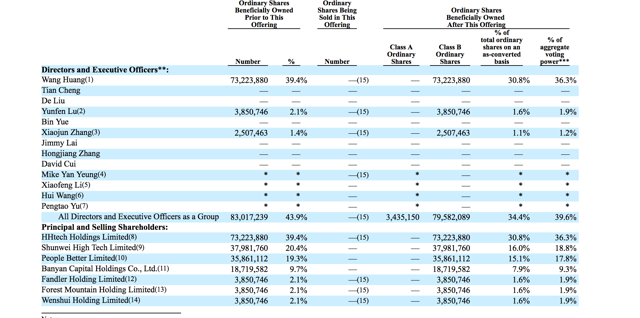

This group of pre-IPO shareholders and insiders includes three directors and seven corporate entities.

Currently, HMI trades in the $9.50 to $10 range, lower than its IPO price of $11. Shares of Huami Corp. had a first-day return of 2.3%. The shares climbed a bit to reach $11.83 on March 5 and dropped to $8.71 by April 25. HMI has a return from IPO of -13.4%.

Business Overview: Maker Of Wearable Smart Devices

Huami Corporation is a business in the People's Republic of China that designs, makes, and markets wearable smart technology devices. The company has two segments: Self-Branded Products and Xiaomi Wearable Products. Its product portfolio includes smart watches, bands, and scales, as well as an array of accessories such as sportswear, necklaces, watch straps, and bands. Huami also develops mobile apps, including Mi Fit that provides fitness and sports features for use with Xiaomi wearable technology. The company also has an app called Amazfit that provides functionality related to medical care and health issues for use with self-branded products.

Source: Huami Website)

Through September 30, 2017, the company's mobile apps had nearly 50 million registered users. Huami collects data from these users on 10 factors such as steps, GPS running track, heart rate, ECG, body fat, weight composition, sleep duration, and more. The company intends to use this large warehouse of data to develop new applications for wearable smart devices.

Huami was founded in 2013 and keeps its headquarters in Hefei, The People's Republic of China.

Company information was sourced from the firm's F-1/A and the company's website.

Financial Highlights

Huami Corp. reported the following first quarter financial highlights as of March 31, 2018:

- Revenue was RMB585.9 million, or $93.4 million, for an increase of 77 percent over the same period of 2017

- Gross margin was 25 percent for an increase of 22.4 percent in the first quarter of 2017

- Net income was RMB14.8 million, or $2.4 million, versus a net loss for RMB4.5 million for the same time period of 2017

- Adjusted net income was RMB92.5 million, equivalent to $14.8 million for an increase of 817.5 percent over the first quarter of 2017

- Total units shipped was 4.8 million in the first quarter versus 3.2 million for the same time period last year

Financial highlights were sourced from the firm's website.

Management Team

Chairman and CEO Wang Huang is founder of Huami. He also founded Anhui Juami, Fefei Huaheng Electronic Technology, and Hefei Huakai Yuanheng Information Technology. He previously served as a research and development engineer for Huawei Technologies. He earned a bachelor's degree in applied physics from the University of Science and Technology of China.

Chief Financial Officer David Cui has served the company since August 2017. He has held senior financial positions at China Digital Video Holdings, iKang Healthcare Group, Deloitte Touche Tohmutsu, China, Ernst & Young, Health Net, and Symantec. Mr. Cui earned a bachelor's degree in business administration from Simon Fraser University. He is a licensed CPA in the United States and Canada.

Management information was sourced from the firm's website.

Competition: Fitbit and Garmin

Huami operates in a highly competitive and evolving market for wearable smart devices. Designers and manufacturers of these popular gadgets include Fitbit (FIT), Garmin (GRMN), Apple (AAPL), Samsung (OTC: SSNLF), and Huawei. In its SEC filings, the company notes that it believes it has a competitive edge with extended battery life that can reach 20 days with some of its gadgets.

Early Market Performance

The underwriters for Huami Corporation priced its IPO at $11 per share, at the midpoint of its expected price range of $10 to $12. Its six-month performance on the NYSE has been lackluster. The stock closed on its first day of trading at $11.35 and then dropped to a low of $8.71 on April 25. HMI currently has a return from IPO of -13.4%.

Conclusion

When the HMI IPO lockup expires on August 7th, a significant group of pre-IPO shareholders and company insiders will be able to sell currently-restricted shares of HMI for the first time. Significant sales of currently-restricted stock could flood the secondary market and result in a sharp, short-term downturn in share price.

Aggressive, risk-tolerant investors should consider shorting shares of HMI ahead of the August 7th IPO lockup expiration. Because HMI volume is relatively light, we suggest shorting the stock in several smaller orders over a couple trading days. Interested investors should cover short positions either late in the trading session on August 7th or during the trading session on August 8th.

Disclosure: I am/we are short HMI.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more

I wouldn't expect much of anything based upon this share price.