How Will KB Homes Stock Move After Earnings?

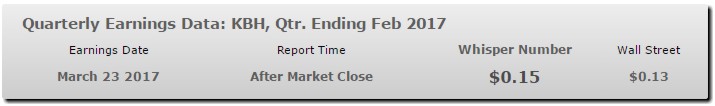

KB Homes (KBH) is expected to report earnings today after market close. The whisper number is $0.15, two cents ahead of the analysts' estimate and showing confidence from the WhisperNumber community. Whispers range from a low of $0.12 to a high of $0.17.

A year ago the company reported earnings of $0.14. KB Homes has a 62% positive surprise history (having topped the whisper in 32 of the 52 earnings reports for which we have data).

Earnings history:

- Beat whisper: 32 qtrs

- Met whisper: 0 qtrs

- Missed whisper: 20 qtrs

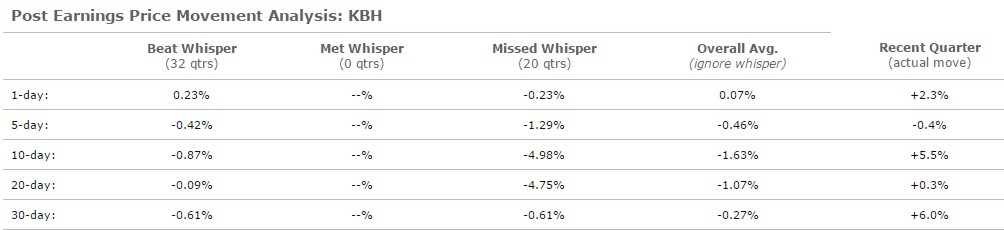

Our primary focus is on post earnings price movement. Knowing how likely a stock's price will move following an earnings report can help you determine the best action to take (long or short). In other words, we analyze what happens when the company beats or misses the whisper number expectation.

The table below indicates the average post earnings price movement within a one and thirty trading day timeframe:

(Click on image to enlarge)

The strongest price movement of -0.9% comes within ten trading days when the company reports earnings that beat the whisper number, and -5.0% within ten trading days when the company reports earnings that miss the whisper number. The overall average post earnings price move is 'negative' (beat the whisper number and see weakness, miss and see weakness) when the company reports earnings.

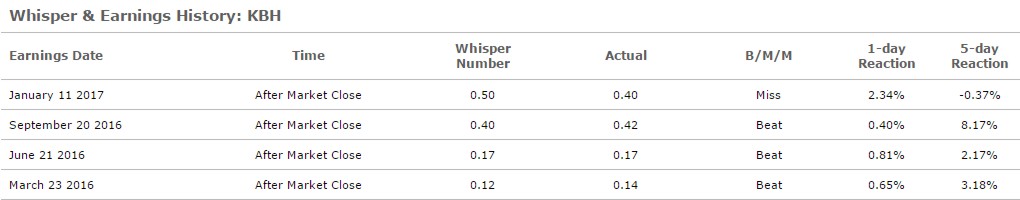

The table below indicates the most recent earnings reports and short-term price reaction:

(Click on image to enlarge)

The company has reported earnings ahead of the whisper number in three of the past four quarters with a whisper number. In the comparable quarter last year the company reported earnings two cents ahead of the whisper number. Following that report, the stock realized a 3.2% gain in five trading days. Last quarter the company reported earnings ten cents short of the whisper number. Following that report, the stock realized a 0.4% loss in five trading days, before turning and seeing a 6.0% gain in thirty trading days. Overall historical data indicates the company to be (on average within thirty trading days) a 'negative' price reactor when the company reports earnings.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am ...

more