High-Quality, High Yield Dividend Growth Stocks Trading Below Fair Value

This article presents several high-quality, discounted dividend growth [DG] stocks yielding at least 4%. For each stock, I present key metrics, quality indicators, a fair value estimate, and the so-called Chowder number. In my view, the stocks are good candidates for further research and possible investment.

Quality

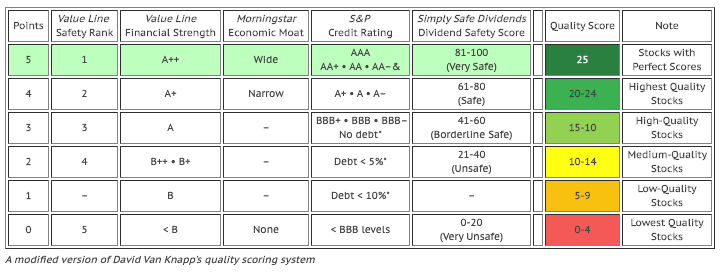

There are many ways to assess the quality of companies, but I favor an approach devised by David Van Knapp to employ five widely used, independent quality indicators. I've been using a slightly modified version of this quality scoring system to rank DG stocks, including the Dividend Kings, an elite group of stocks with 50 consecutive years of dividend increases.

My modifications include assigning points to companies that don't have an S&P Credit Rating but carry no or little debt. My color coding scheme is similar to the one used in the original article, though I differentiate perfect scores.

Valuation

To estimate fair value, I reference fair value estimates and price targets from several sources:

- Morningstar: fair value estimate based on discounted cash flow analysis.

- Finbox.io: fair value estimate based on several financial models.

- Finbox.io: the average of analyst targets.

Additionally, I estimate fair value using the 5-year average dividend yield of each stock using data from Simply Safe Dividends:

fair value estimate = recent price × dividend yield ÷ 5-year average dividend yield

With several estimates and targets available, I ignore the outliers (the lowest and highest values) and use the average of the median and mean of the remaining values as my fair value estimate.

Key Metrics

In addition to quality indicators and quality scores, I provide columns with key metrics of interest to DG investors, including years of consecutive dividend increases [Yrs], the dividend Yield for a recent stock Price, and the 5-year compound annual dividend growth rate [5-Yr DGR].

Furthermore, I also provide the so-called Chowder number [CDN], obtained by summing the Yield and the 5-Yr DGR. The Chowder Rule favors DG stocks likely to produce annualized returns of 8% by requiring:

- CDN ≥ 15 for stocks yielding less than 3%,

- CDN ≥ 12 for stocks yielding at least 3%, and

- CDN ≥ 8 for stocks in the Utilities sector, provided they yield at least 4%.

Finally, I provide a fair value estimate [Fair Val.] to help identify stocks that trade at favorable valuations. The last column shows the discount [Disc.] or premium [Prem.] of a recent price to my fair value estimate.

The Stocks

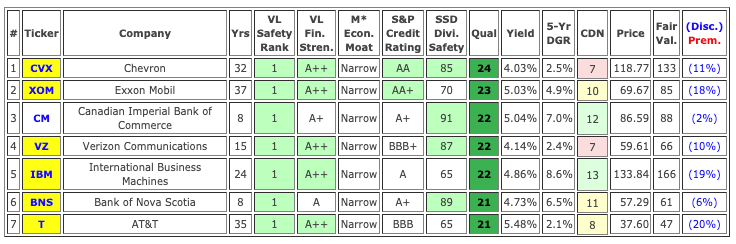

The following table presents DG stocks that have quality scores of at least 20 points, dividend yields of at least 4%, and fair value estimates below their current market prices:

Stocks I own are highlighted in the Ticker column.

The CDN column is color-coded to indicate the likelihood of delivering annualized returns of 8%.

The stocks colored green are likely to deliver annualized returns of 8%. Yellow indicates stocks less likely to deliver annualized returns of 8%, while red indicates stocks unlikely to deliver annualized returns of 8%.

Stocks with CDN's ≥ 12

Canadian Imperial Bank of Commerce (CM) is a diversified financial institution that provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally. CM was founded in 1867 and is based in Toronto, Canada with additional offices Denver, Menlo Park, Montreal, Reston, and Vancouver.

Founded in 1910 and headquartered in Armonk, New York, International Business Machines (IBM) is a global information technology [IT] company that offers consulting and application management services, IT infrastructure services, and infrastructure technologies. IBM’s Watson is a cognitive computing platform that interacts in natural language, processes big data, and learns from interactions with people and other computing systems.

Stocks with CDN's ≥ 8 (but less than 12)

Exxon Mobil (XOM) is the world's largest publicly traded international oil and gas company. Founded in 1882 and based in Irving, Texas, the company is engaged in oil and natural gas exploration and production, petroleum products refining and marketing, chemicals manufacture, and other energy-related businesses. The majority of XOM's earnings come from operations outside the United States.

Bank of Nova Scotia (BNS) provides various banking products and services in North America, Latin America, the Caribbean and Central America, and the Asia-Pacific. The company offers financial advice and solutions, day-to-day banking products, and commercial banking solutions. BNS was founded in 1832 and is headquartered in Toronto, Canada.

Incorporated in 1983 and based in Dallas, Texas, AT&T (T) is a holding company providing telecommunications services across the world. These services include wireless communications, data/broadband and Internet, video, local exchange, long-distance, managed networking, and wholesale services. Through DirectTV, a subsidiary, T provides pay television in the United States and internationally.

Stocks with CDN's < 8

Founded in 1984 and based in San Ramon, California, Chevron (CVX) is a multinational energy corporation involved in all aspects of the oil and gas industries, including exploration and production; refining, marketing and transport; chemicals manufacturing and sales; and power generation. CVX has major operations in about 30 countries.

Verizon Communications (VZ) provides communications, information, and entertainment products and services to consumers, businesses, and governmental agencies worldwide. Formerly known as Bell Atlantic Corporation, the company changed its name to Verizon Communications, Inc. in June 2000. VZ was founded in 1983 and is based in New York, New York.

Commentary

Based on the Chowder Rule, some stocks are less likely or unlikely to deliver annualized returns of 8%. But DG investors should always delve a little deeper to understand the true picture. Many companies have stock buyback programs, which increase their net payout yield well above the dividend yield. In such cases, I'd consider investing even for lower CDN's.

CM is the only stock in the table I don't own. CM offers an attractive dividend yield of about 5% and is trading just below fair value. However, I like to buy stocks when they're discounted by at least 10%. Besides, I already own three Canadian bank stocks, so I'm not really looking to add another.

IBM has impressive patent activity but the company continues to deliver lackluster results while trying to reinvent itself. The stock yields almost 5% and is trading well below my fair value estimate. I'd be interested in adding shares to my current position if IBM trades below $130 per share.

While XOM is a blue-chip stock, its performance over the past 10 years has been lackluster. The company is focusing on replenishing its reserves and growing its dividend, but CEO Darren Woods says a plan to sell $15 billion in assets may pave the way to reinitiate a share buyback program. If that happens, I'd be interested in adding to my XOM position.

In May 2019, BNS announced that it received approval to repurchase up to 24 million of its common shares. This should push the stock's net payout yield well above the current dividend yield of 4.73%. I'd be interested in adding more shares below $55 per share.

AT&T's acquisition of Time Warner in 2018 has left the company with heavily leveraged debt and little margin for error. The underlying business remains strong, though, and AT&T continues to make progress paying down debt. I already own a fairly large position, so I'm not looking to add shares.

CVX plans to return more than 6% to shareholders in the form of dividends and share buybacks in the coming year. This makes the stock more attractive to me. I'd consider adding to my position below $115 per share, the current average cost basis of my CVX position.

Finally, VZ is facing some tough challenges, including slowing subscriber growth and a high debt load. While the dividend remains safe, the low dividend growth rate is likely to continue. I'm not interested in adding any shares to my position at this time.

Concluding Remarks

This article presented seven DG stocks from the Highest Quality category of David Van Knapp's quality scoring system. The stocks yield at least 4% and trade below my fair value estimates.

I like the simplicity of the quality scoring system and I believe it does a great job identifying high-quality stocks. The quality scoring system is quite stringent, so stocks scoring 20-25 points would be considered high-quality stocks by many investors.

As always, I encourage readers to do their own due diligence before investing in any of these stocks.

Thanks for reading and happy investing!

Disclosure: Long: BNS, CVX, IBM, T, VZ, XOM

Disclaimer: I'm not an investment professional or a licensed financial advisor. This article represents my personal views and decisions, ...

more