Hewlett-Packard Company: All Eyes On Company Split

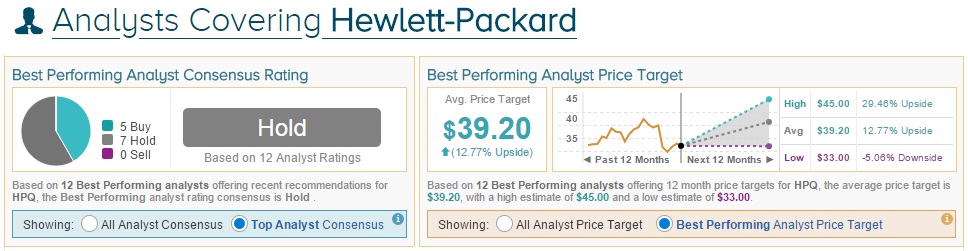

Hewlett-Packard Company (NYSE: HPQ) released second quarter earnings for fiscal year 2015 on May 21, beating the estimate for earnings per share but narrowly missing revenue expectations. The top analyst consensus for the stock was a Moderate Buy before earnings, but now the consensus has turned to Hold.

Aside from figures in the earnings report, analysts were listening for an update from HPQ regarding the company split. By November, Hewlett-Packard will split into HP Inc., which will encompass the computing and printing business, and Hewlett-Packard Enterprise, which will include the computing segments such as software, storage, and cloud technology. Each will be an independent and publicly traded company.

Many analysts were concerned about the high cost of splitting the company, but HPQ announced that the cost of “dis-synergies” is approximately $400 million to $450 million. CEO Meg Whitman commented in the conference call with investors that most of the costs should be offset in fiscal year 2016, and more than fully offset by fiscal year 2017.

Hewlett-Packard posted earnings per share of $0.87 on a non-GAAP diluted basis, beating the analyst consensus by one cent, though marking a 1% year-over-year decrease. The company posted $24.45 billion in net revenue, missing the analyst consensus of $25.68 billion by a narrow margin and marking a 7% year-over-year decrease. Revenue derived from the Personal Systems segment decreased 5% from the same quarter last year while revenue from the Printing segment decreased 7% year-over-year. The two segments combined made up more than half of HPQ’s total revenue.

Looking forward, Hewlett-Packard expects to post 3Q15 non-GAAP diluted earnings per share between $0.83 and $0.87. For the full year 2015, HPQ expects to post non-GAAP diluted EPS between $3.53 and $3.73.

On May 22, Jim Suva of Citigroup reiterated a Buy rating on Hewlett-Packard with a $41 price target. Suva noted that HPQ’s second quarter earnings were “solid,” especially after accounting for foreign exchange headwinds. Suva noted that the Hewlett-Packard’s estimated cost of splitting the company was lower than his initial estimate of $500 million to $1 billion. He concluded, “Overall, we believe the risk of a large dis-synergy cost was the last major overhang that needed to be resolved before investors became comfortable owning HPQ shares into the break-up in November.”

Jim Suva has a 52% overall success rate recommending stocks with a +4.5% average return per rating.

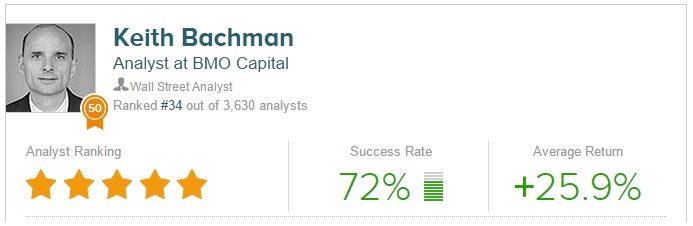

Separately on May 22, Keith Bachman of BMO Capital reiterated a Market Perform rating on HPQ but lowered his price target from $42 to $38. Bachman highlighted that HPQ has “consistently underperformed its own expectations/targets and market growth opportunities” for the last 10 quarters. In order for HPQ to continue to “grow its top line” as it restructures, Bachman believes the company needs to “lower its cost, including increasing its offshore mix, and invest to add to skill sets and capabilities in growth areas such as cloud and analytics.” The analyst concluded, “Our point is that we don’t think HP can simply cut cost to create a compelling services organization.”

Keith Bachman has a 72% overall success rate recommending stocks with a +25.9% average return per rating.

Disclosure: To see more visit more