Hedge Funds Are Abandoning This Investment In Droves

The last time this happened was in mid-2015 when they began liquidating their long positions in oil. From that point, oil dropped another 60%. Right now, that same trend is developing but with a different investment, and it could fall just as hard. Here’s how to prepare your portfolio.

Now, we’ve been notable U.S. dollar bulls for over 18 months, and it’s worked out well. Our top pick from 2014, Ross Stores (NASDAQ: ROST) is up 40% since then, thanks to its U.S.-only focus. Then, from 2015, our pick Tyson Foods (NYSE: TSN) is up 65%.

In any case, we go to where the best opportunities are. And it appears the tides are shifting for the U.S. dollar.

This comes as there are a few things working against the dollar right now, including the Federal Reserve’s dovish stance on interest rates and an unsteady global economy.

With that, while hedge funds, until recently, had their largest bets on the U.S. dollar in years, they’ve started to make their exodus.

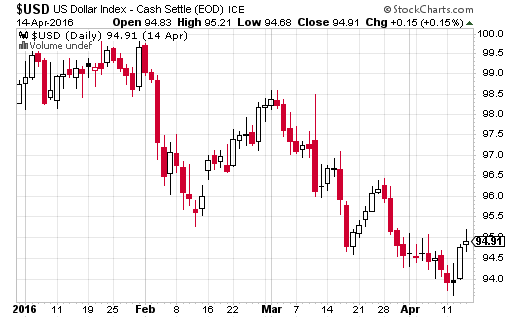

Back in March, hedge funds started abandoning their currency bets at an increasing rate. This marked the biggest one-month fall for the U.S. dollar since 2010. The U.S. dollar index is now down 5% this year.

The dollar weakness also comes as the Federal Reserve is taking a dovish approach to raising interest rates. The key item to watch for is a Fed rate hike. The next meeting is in June, and it’s unlikely they’ll do anything. Then their next meeting after that will be in September, where they’ll likely also not raise interest rates given the proximity to U.S. elections. The last time the Fed raised rates in September of an election year was 2004.

It looks like the first possible date for a rate hike won’t be until December. Even then, it’s questionable as U.S. company earnings as a whole have deteriorated the most since 2011. The weakening in earnings will put more pressure on the U.S. economy – we really are entering a vicious cycle.

Digging deeper, the companies with no international exposure in the non-financial sector are seeing their worst period of earnings in nearly a decade. Specifically, the domestic pre-tax profits of non-financial U.S. firms are falling at the fastest rate since the second quarter of 1998.

What all this means is that great dollar bull run might be over, with the hedge fund exodus being the tipping point.

Recall that back in mid-2015, hedge funds were dumping their crude positions, taking their net long positions to two-year lows. At the time, there were still a lot of headwinds for crude oil, including oil suppliers above five-year averages. And since then, West Texas Intermediate crude oil prices are down 60%.

If hedge funds are right once again, this time about the U.S. dollar, there are a number of stocks that could be ready to take a plunge. Here are 3 companies to sell as the dollar weakens:

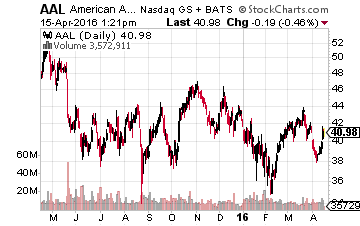

Weak Dollar Stock To Sell No. 1: Airlines

Now, we’ve talked about the next big bear market, and higher oil prices will only exacerbate this. It’s no secret there’s a correlation between oil prices and the U.S. dollar. As the dollar goes down, oil prices tend to rise, which also means other fuels such as gasoline and jet fuel rise in price. This comes as oil is priced in U.S. dollars, so as the dollar weakens demand tends to increase.

In any case, the industry that relies heavily on oil is airlines. Jet fuel is one of their largest cost inputs, and a rise in prices will put pressure on margins. The stock to watch here is American Airlines (NYSE: AAL), which has prided itself on being completely unhedged to oil prices.

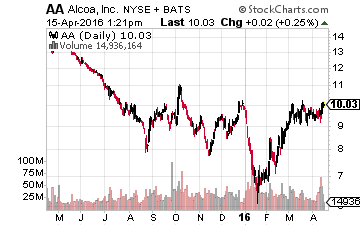

Weak Dollar Stock To Sell No. 2: Industrials

The go-to playbook for investing in a strong dollar has been companies that generate most of their revenues from within the U.S. Now, there are certain industrial companies that generate a lot of revenues from within the U.S., such as Alcoa (NYSE: AA). However, they could still be hurt by a weak dollar.

This comes as Alcoa and others that mine and source materials from international markets, such as Brazil and Australia. A weak dollar will make sourcing commodities and materials from these countries more expensive and ultimately squeeze margins.

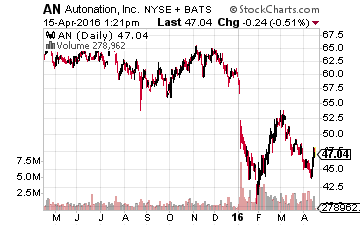

Weak Dollar Stock To Sell No. 3: Automobiles

Now, piggybacking on the previous idea that imported goods will be more expensive, the car retailers that are heavily weighted toward imports will soon be paying more for the cars they sell as the dollar weakens.

Then, car dealers will likely boost prices to help recoup these costs. But, with the potential for a weaker economy (or even recession) consumers will also be cutting back on luxury products like imported cars — another vicious cycle.

This, coupled with the potential for higher gasoline prices, is a major headwind for car dealers.

AutoNation (NYSE: AN) is the name to watch, where it generates close to 70% of its new car sales from imports.

In the end, the hedge funds have been one of the major buyers of the U.S. dollar, but their behavior last month makes it seem like they think that the bull run might be over. The stocks to avoid are those that sell imported goods and rely on low oil. In particular, airlines, automobile retailers, and industrials are great places to look when it comes to stocks you should be selling before the dollar crash.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more