Good And Bearish?

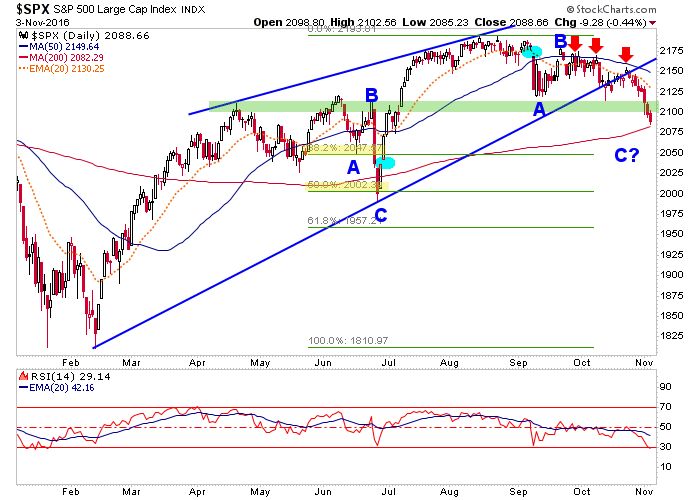

If players are finally buying into the bearishness, now we are getting somewhere. Very simply, SPX has had a date with the 2100 (+/-) target we have had open since it broke down from the 50 day average at the beginning of September.

As noted weekly in NFTRH, I shorted and held through each subsequent bounce (adding shorts) as long as SPX stayed below the MA 50, which it dutifully did. Given the need for a decline to a major support test (of the long-term uptrend), I chose to short against longs in order to maintain 2016’s profits, not to make a killing from the short side. That would only come if the longer trend fails. But for now risk is reduced in the short-term, both technically and sentiment-wise.

SPX is now firmly in the target zone, which is a fat 2100 down to 2000. The upper part of the zone includes lateral support and the SMA 200. The lower part of the zone has the 38% and 50% Fib retrace levels and the ‘higher low’ (to June) parameter.

A bounce to a short-term moving average, like the EMA 20 (orange dotted) seems very possible at any time now. That does not mean the bottom is in, but it does mean that this market could screw over anyone waiting for this breakdown signal (ref. SPX below lateral support) in order to short, take puts or sell out of emotion.

SPX is getting over sold by RSI and as long as the low is higher than June’s, well, it’s still in an uptrend. It might be just like this market to find something to get relieved about, bounce, fail and then catch investors, black boxes, quant machines, casino patrons, substance abusers and most of all, the emotional herd that is eating up election hysterics, in a whipsaw. But that’s just me being hopeful I guess.

The play has been for a short-term decline to test major support ( ) and pending that test, a decision on longer-term direction. I mean, only charlatans make predictions. Mere humans who want to do things the unspectacular way go with probabilities; and it’s a funny thing, the vast majority of the time you end up being right at important junctures because you’re doing hard, boring, unsensational work every step of the way to make sure you arrive at each decision point in line with the probabilities. That involves being open minded, not being a Swami.

) and pending that test, a decision on longer-term direction. I mean, only charlatans make predictions. Mere humans who want to do things the unspectacular way go with probabilities; and it’s a funny thing, the vast majority of the time you end up being right at important junctures because you’re doing hard, boring, unsensational work every step of the way to make sure you arrive at each decision point in line with the probabilities. That involves being open minded, not being a Swami.

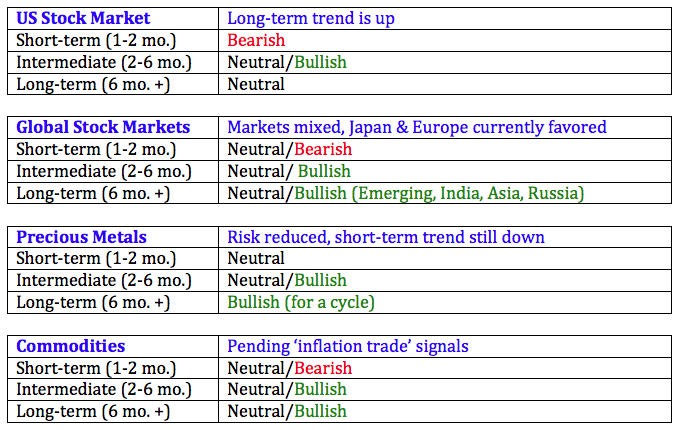

Here’s a table I’ve added to the NFTRH ‘Wrap Up’ summary. Easy now, it’s just meant as a general view and will be revised each week as needed because I’m just a lowly human and this is my educated (by the analysis) guess each week on how things stand. We’ve had the short-term US situation nailed and await the completion of the test in order to confirm or change the intermediate-term view.

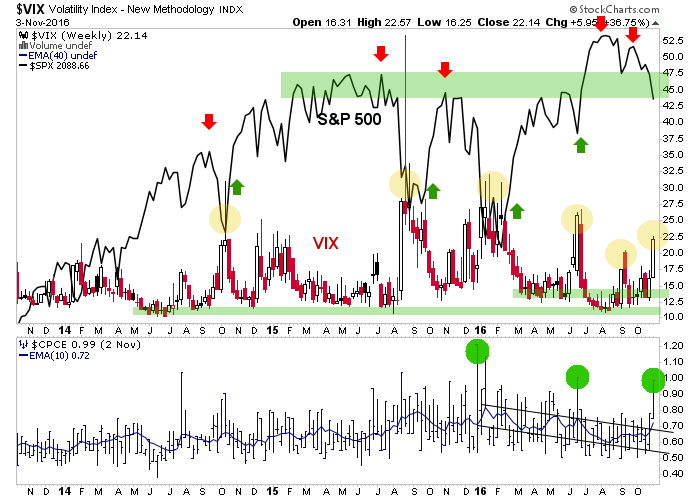

VIX instructs when it is time to buy fear (when everybody’s dumb and happy) and sell it (when they are freaking out… like they are now, at least to a degree). The Equity Put/Call ratio in the bottom panel is spiking as casino patrons far and wide buy puts to protect themselves or just try to momo the short side (no longer advisable, unless the market gets a robust bounce). But these spikes in the VIX and the CPCE have proven to be buying or short covering opportunities, previously.

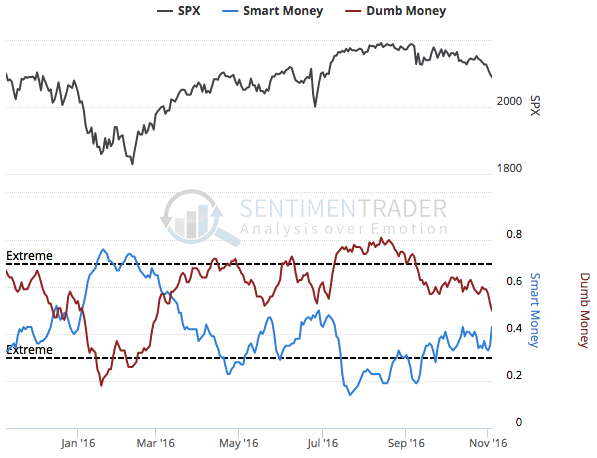

Meanwhile, compliments of Sentimentrader, here is how the blunt aggregate of sentiment indicators views the current situation. Smart and Dumb money are finally assuming their correct positions in order to clear the way (sentiment is a condition, not a director) for a bounce as it is nearly to the reading it was at during the Brexit hysterics. Notably, it has further to go before reaching extremes that could signal a major low.

We’ll see how the whole FOMC-to-Election clown show unfolds over the next week or so.

Disclosure: Subscribe to more