Genesee & Wyoming: Falling Traffic, Paltry Margins Could Weigh

Genesee & Wyoming (GWR) reports Q2 earnings on Monday. Analysts expect revenue of $490.5 million and EPS of $0.78. The revenue estimate implies a 2% increase sequentially. Investors should focus on the following key items:

Declining Carloads

While other railroads have experienced declining revenue Genesee's revenue has been growing. Q1 operating revenue of $483 million grew an eye-popping 22% Y/Y. On a same store basis revenue actually declined. Revenue from North America and Australia was down Y/Y by 6% and 14%, respectively. Revenue from the U.K. region grew over 500% from $20 million in Q1 2015 to $131 million last quarter.

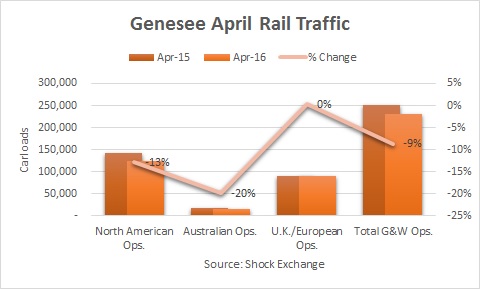

Q1 results were likely obfuscated by the company's recent acquisition of Freightliner, an international freight rail operator with a presence in the U.K., Poland, Germany and Australia. That said, April carloads fell 9% Y/Y. This is important as the results for both periods included the impact of Freightliner. On an apples-to-apples basis, carloads and revenue are likely in decline.

North America was negatively impacted by coal and coke (off 40%) and agricultural products (down 16%). For the first 28 weeks of 2016, cumulative U.S. rail traffic was down 12% Y/Y. North America represents 56% of Genesee's total carloads, so the region will likely drive sentiment.

Europe represents 39% of total carloads, up from 36% last year. April 2016 results were negatively affected by coke and coal (down 64%) and minerals & stone (off 12%). Intermodal was 83% of total rail traffic in April 2016, up from 75% in the same month last year.

EBITDA Margins

The company's Q1 adjusted EBITDA margin was 26%; that pales in comparison to Canadian Pacific (CP) with margins north of 50% and Norfolk Southern (NSC) with margins in the mid-30% range. Management has vowed to rightsize the business and increase EBITDA margins to 30% in 2016. However, that assumption was predicated on full-year revenue of $2 billion. Q1 revenue was $483 million and with carloads and revenue in decline for April, the company will be hard-pressed to reach its revenue or EBITDA targets for 2016.

Another headwind could be the increasing percentage of Intermodal traffic in Europe. Intermodal tends to garner the lowest freight revenue per unit. Intermodal's increasing percentage of total European traffic at the expense of higher priced commodities like coke and coal could hurt Europe's price per carload; Europe's increasing percentage of Genesee's total worldwide traffic imply revenue per unit could fall company-wide.

In Q1 Europe's average revenue per carload for coke and coke, and Intermodal was $539 and $304, respectively. Secondly, Q1 average revenue per carload for North America, Australia and Europe were $579, $536 and $317, respectively. As more of Genesee's rail traffic becomes weighted towards Europe, the less revenue per carload the company will likely generate. Investors should continue to avoid GWR.

I am short GWR