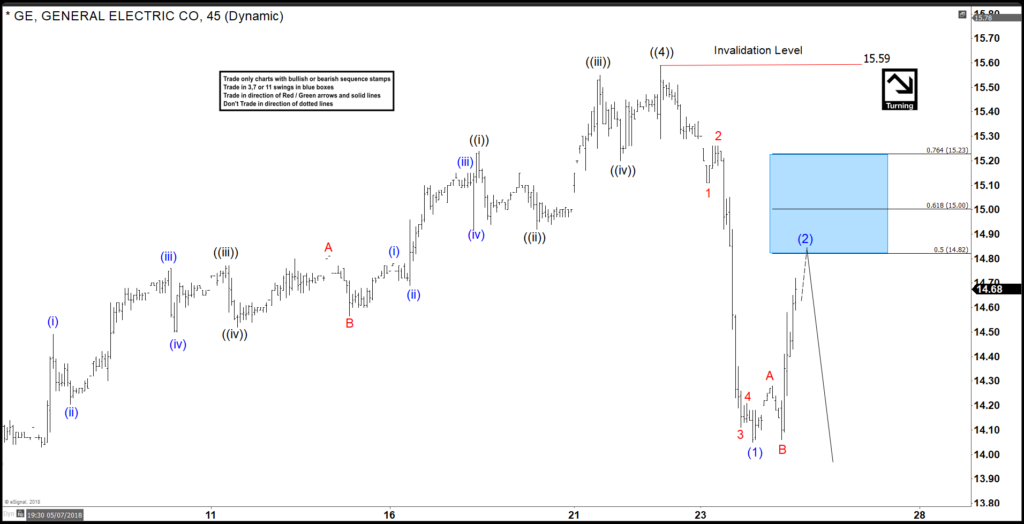

General Electric (GE) Ending Elliott Wave Impulse Soon

The General Electric (GE) short-term Elliott Wave view suggests that the rally to May 22 high of 15.59 ended primary wave ((4)). When intermediate degree wave (Y) of ((4)) ended as a Zigzag correction with Minor wave A ended at 14.79 and Minor wave B ended at 14.58 low.

Down from 15.59 high, the decline unfolded as impulse Elliott Wave structure with extension in 3rd wave lower within intermediate wave (1) thus favored it to be an impulse structure. The internals of intermediate wave (1) ended Minor wave 1 at 15.11, Minor wave 2 ended at 15.26 and Minor wave 3 ended at 14.05 low. Then bounce to 14.28 high ended Minor wave 4 and the decline to 14.05 low ended Minor wave 5 of (1).

Above from there the stock is already bounce higher in intermediate wave (2) bounce against 15.59 high as a Flat correction. When it should be looking to extend another push higher in shorter cycles towards 14.82-15 50-61.8% Fibonacci retracement area (blue box) to end the proposed Flat correction. Afterwards, the instrument is expected to turn lower again as per Elliott Wave theory suggests that we should get another 5 waves into the direction of the previous leg of 5 waves as far as a pivot from 15.59 high stays intact.

GE 1 Hour Elliott Wave Chart

But if the pivot from 15.59 high gives up and the stock manages to break higher from current levels then that will create a possibility of a Flat correction from 4/20 peak (15.06). Which means that the 5 waves decline from 15.59 high was part of a wave C of a Flat correction from 4/20 peak within intermediate degree wave (X) pullback. And we could still see another leg higher towards 16.39-16.93 area approximately to end the bounce from 3/26 low within primary wave ((4)) bounce before instrument resumes lower.

GE 4 Hour Elliott Wave Chart with a Flat possibility

Keep in mind that the market is dynamic and the view could change in the meantime.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for you. ...

more