General Electric Continues Digital Transformation With Acquisition Of 3-D Printers

General Electric (NYSE:GE) announced on Sept. 6, 2016, its acquisition of Swedish company Arcam and German company SLM Solutions at a cost of $1.4 billion. The companies are 3-D printing machine manufacturers that produce machines capable of 3-D printing. The acquisitions are the latest move by GE into additive manufacturing technology, and it comes as GE is working to transform itself as a digital industrial company.

Several months earlier, we posted a review of GE, recommending that investors keep watch on how GE's push into digital technology unfolded in the latter half of 2016. At that point, GE had recently spun-off its private label credit company, Synchrony, and CEO Jeffrey Immelt had announced plans to invest more than $1 billion on software and digital technology.

GE's decision to sell off its financial business and restructure its business operations has been a good move for the company. The company now has more flexibility with its balance sheet and is able to focus on the industrial space, which tends to be a more profitable business. While some investors may be leery of the $1.4 billion investment, this is a small percent compared to the overall size of the company.

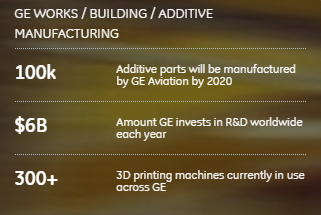

Additive technology is not new to GE. The company had already been using it to manufacture fuel nozzles used in jet airplanes. Before this technology, the nozzles had to be constructed of 20 parts from different manufacturers. With 3-D printing, GE was able to produce the nozzle as one part, making it cheaper, as well as more durable and lighter. The company stated that its acquisition of the two companies will allow it to use 3-D printing to manufacture many other parts. GE expects to purchase around 1,000 new 3-D printing machines over the next decade and indicated that 3-D printing could save the company between $3 to $5 billion due to savings on material and design costs.

(Source: GE Website)

Transformation into a Premier Digital Industrial Company

In September 2015, GE formed GE Digital with the objective of becoming one of the top 10 software companies. One year later, the company is nearing the end of its restructuring. It fully completed the sale of its financial arm, GE capital, and has streamlined its business to focus on digital industrial technology. After the acquisition of these 3D-printing companies, GE's CEO said on a conference call to analysts that this latest move will add to the company's strategy of becoming a premier digital industrial company.

Recent Earnings Results

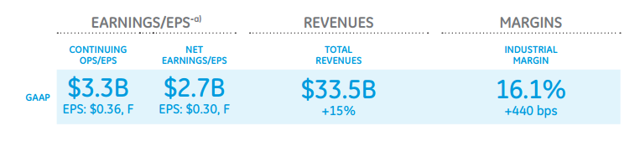

GE reported impressive Q2 2016 earnings results, beating analyst estimates on EPS and revenue. GE's Power, Aviation and Healthcare business segments performed particularly well, offsetting declines in its Oil & Gas unit. Despite strong performance, GE shares dipped after earnings announcement, partially due to the fact that Standpoint Research initiated a sell rating that same day. GE shares are currently trading down by 6.2 percent from their 52-week high and have also trailed the S&P 500 YTD total return. GE's year-to-date total return percentage is down 2% percent while the S&P 500's total return percentage for the same time period is 6%.

(Source: General Electric Q2 2016 Press Release)

Comparison with competitors

GE's largest competitors include 3M Co. (NYSE:MMM), Honeywell International (NYSE:HON), and Danaher (NYSE:DHR). Compared to its peers, GE trades at a slightly higher price to earnings. GE has a P/E ratio of 37.0 compared to 22.9, 18.1, and 20.2 for 3M, Honeywell, and Danaher, respectively. This higher P/E ratio can partially be explained by GE's high dividend yield. GE investors receive an average dividend of 3 percent. In addition, compared to its peers, GE's focus on aviation and digital manufacturing are two areas which are more lucrative than traditional forms of industrial manufacturing and may also contribute to the higher ratio. GE has a market cap of $278 billion, more than double the size of the other competitors.

Conclusion: For Growth and Income-Oriented Investors, GE is a Good Investment

GE has made a substantial number of positive steps in its effort to transform itself from an industrial behemoth into a nimble, efficient and digitally aware 21st-century company. Its financials are strong despite its underperformance, investors enjoy healthy dividends, making it an attractive investment for income investors. We have long been bullish on GE for income-oriented investors and, after these recent developments, also view GE as a good investment for growth-oriented investors.

The current acquisition of these 3-D printing companies could save the company billions of dollars while also helping it to increase its profits and sales. While the investment may show fruit more in the long term, it should produce good returns for investors in the future.

We believe the company's current share price of $30 may be a good entry point, and we recommend that investors buy shares now.

Disclosure:

more

thanks for sharing