Franco Nevada: Investigating Our Top Gold Holding

Franco Nevada (FNV) is one of our favorite plays in the precious metal sectors. If you are going to play gold, and do not want to own physical assets or an ETF, we highly recommend a company like Franco Nevada. It is not a miner. Rather, it is a royalty and streaming company, and that gives it a lot of leverage and advantages over traditional companies in the sector.

While there are a number of streaming and royalty companies out there, Franco Nevada is one of the top gold-focused royalty and streaming companies in operation. Relative to its competition, it has the largest and most diversified portfolio of cash-flow producing assets that come from gold operations.

We love the fact that the business model protects downside while leveraging upside. It all comes down to the quality of deals in place. In recent years, they have been hit or miss, but the business model provides investors with gold price and exploration optionality while limiting exposure to many of the risks of operating companies. Keep in mind that Franco-Nevada is debt free and uses its free cash flow to expand its portfolio and pay dividends while generating healthy returns. The stock swings a bit with precious metal prices, but has had a strong few years:

(Click on image to enlarge)

Source: Yahoo finance

Key Portfolio Dynamics

In this column, we actually are going to dig a bit into the portfolio of projects the company has and discuss what progress is being made. This is of particular interest to us because we have a long position in the name. We believe the outlook is quite strong for its portfolio of streams and royalties. It is a global company:

(Click on image to enlarge)

Source: Franco Nevada Asset Map

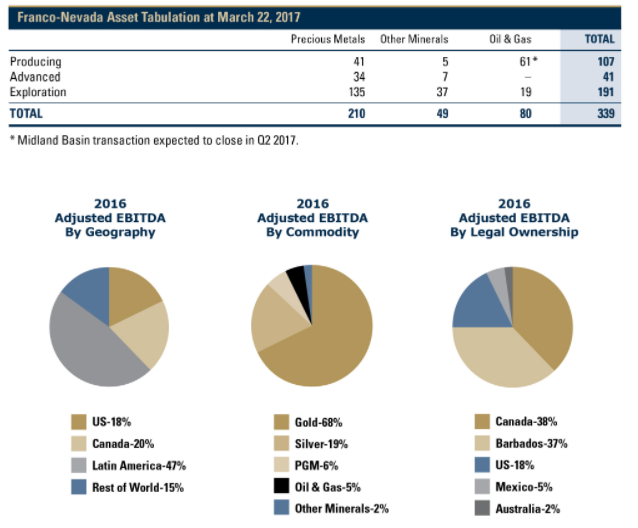

As you can see it has a number of different projects all across the globe. Take a look at the property listings for precious metals, and then for other minerals as well as oil and gas:

Source: Franco Nevada project listing

As you can see, there are a significant number of different projects happening. Detailing them all is beyond the scope of this article but you can read about them here. That said, it may be helpful to know the breakdown of the projects by area and percentage:

Source: Investor presentation

As you can see here, gold is the primary commodity followed by silver and then platinum group metals. There are 107 producing assets, 41 that are advancing, and a whopping 191 that are exploration stage, setting up nicely for the future. So what do we see happening?

General Outlook

Over the next five years, we assume that the Cobre Panama project will be fully ramped-up. From 2019-2021, we expect to see a decline in revenues from the scheduled fixed ounce payments from Midas/Fire Creek, Karma and Sabodala. These are expected to step down to longer-term royalty payments or stream deliveries.

Franco-Nevada expects its existing portfolio to generate between 565,000 to 595,000 gold equivalent ounces [GEOs] by 2022. Oil & gas revenues at the same $55 per barrel WTI oil price assumption are expected to range between $80 million and $90 million.

Let us now discuss updates that we are seeing at the precious metal, mineral, and oil gas segments.

Latin American Precious Metals

For Latin American precious metals, we did not see a change in assets that was meaningful. from Latin American precious metals assets were consistent year-over-year. Precious metal GEOs earned from Latin America were 60,568 GEOs compared with 60,808 GEOs in Q4 2016. Let us talk more specifically about key projects and the attributable production we saw.

Cobre Panama (gold and silver stream) – During Q4 2017, Franco-Nevada contributed $89.4 million of its share of construction capital for the Cobre Panama project. Franco-Nevada at year-end has contributed $726.6 million of its total $1 billion commitment for the construction of Cobre Panama.

Franco-Nevada expects to fund between $230 and $250 million in 2018 towards the $1 billion deposit. Recently, First Quantum announced expansion plans for the Cobre Panama throughput capacity to 85 million tonnes per annum and potential to accommodate a further increase to 100 million tonnes per annum after 2022. First Quantum reported that the project was 70% complete as of year-end with phased commissioning expected during 2018 and continued ramp-up during 2019.

Candelaria (gold and silver stream) – GEOs earned from Candelaria were 14,185, compared to 19,698 GEOs in the prior year quarter, in line with expectations. Lundin Mining provided a Mineral Reserve update for the project which included a net increase to both Proven & Probable and Measured & Indicated estimates despite mining depletion.

The substantial increase to the underground reserve will allow Lundin to optimize the mine plan as well as extend the mine life at Candelaria.

Antapaccay (gold and silver stream) – Antapaccay delivered 19,430 GEOs in Q4/ 017, for a total of 71,183 GEOs in 2017. Over at Antamina (22.5% silver stream), we saw GEOs earned from Antamina were 12,870 during the quarter compared to 10,619 GEOs in Q4/ 016. For the full year 2017, Antamina sales were 49,656 GEOs.

Guadalupe-Palmarejo (50% gold stream) – During Q4 2017, Franco-Nevada sold 13,741 GEOs under the Guadalupe agreement and 52,124 GEOs for the full year. Coeur Mining, Inc. provided a new Mineral Resource estimate for the project in February 2018 following a strong exploration campaign in 2017.

Gold Mineral Reserves increased by 19% while gold Measured & Indicated Mineral Resources increased by 56%. Franco-Nevada estimates that the majority of the Mineral Reserves & Resources are covered by the gold stream.

Cerro Moro (2% royalty) – Yamana reported that Cerro Moroconstruction is progressing and is expected to be completed by the end of Q1 2018 with ramp-up of operations expected in Q2 2018.

United States Precious Metals

Turning to the United States, GEOs from precious metals assets decreased by 16.1% year-over-year mainly due to the completion of Phase 2 mining at South Arturo. GEOs received from the United States precious metal assets were 19,284 GEOs. Let us talk about each key project.

Goldstrike (2-4% royalty & 2.4-6% NPI) – Successful exploration at Goldstrike increased the Mineral Reserve. Barrick is expected to continue to target areas below the Betze-Post open pit and below the current workings at the Meikle underground which are subject to Franco-Nevada royalties.

Stillwater (5% royalty) –The Blitz project achieved first production in September 2017 and is expected to reach full production by late 2021 or early 2022. Blitz is anticipated to increase total PGM production from Stillwater by more than 50% to approximately 850,000 ounces per year.

Bald Mountain (0.875-5% royalty) – Kinross successfully doubled production from the operation in 2017. Kinross has started construction of new process facilities in the South Zone and expects commissioning in Q1/2019.

Fire Creek (fixed gold deliveries and stream) – Klondex provided an initial open pit Mineral Resource at what has historically been an underground operation in December 2017.

Hollister (3-5% royalty) – Klondex began processing Hollister ore at the Midas mill which included the commissioning of a new CIL circuit in order to optimize recovery.

South Arturo (4-9% royalty) – Joint Venture operators Barrick and Premier Gold announced a significant increase to Mineral Reserves and Mineral Resources for the South Arturo operation. Phase 2 mining was completed in 2017 and the Joint Venture now expects to start development of Phase 1 open pit in mid-2018.

Canadian Precious Metals

Over in Canada, we saw a large drop-off. GEOs from Canadian precious metals assets decreased by approximately 31.6% to 14,262 GEOs compared with Q4/2016 mainly due to reduced NPI payments from Hemlo and Musselwhite. Let us discuss key projects here.

Brucejack (1.2% royalty) – Brucejack poured first gold on June 20, 2017, declared commercial production on July 3, 2017, and produced a total of 152,484 ounces of gold in 2017. Franco-Nevada's royalty begins after approximately 500,000 ounces have been produced. Pretium submitted an application to increase production from 2,700 tonnes per day to 3,800 tonnes per day with a decision expected before the end of 2018.

Hemlo (3% royalty & 50% NPI) – Barrick had another successful exploration campaign at Hemlo in 2017 and added 397,000 ounces of Mineral Reserves (before mining depletion). Barrick has indicated that exploration will focus on the expansion potential of the underground operation.

Musselwhite (5% NPI) – Goldcorp estimates that the Materials Handling project is 53% complete and is tracking 10% below the capital cost estimate. The project is expected to reach commercial production in Q1 2019.

Kirkland Lake (1.5-5.5% royalty & 20% NPI) – Kirkland Lake Gold announced plans for a new shaft at the Macassa mine which would support higher levels of production and offer more effective underground exploration. The two phase project is expected to be completed by the end of 2023.

Canadian Malartic (1.5% royalty) – Canadian Malartic reported an updated Mineral Resource estimate for the Odyssey deposit and a new Mineral Resource at East Malartic. Both of these deposits are located east of the currently planned open pit and may partially be covered by the Franco-Nevada royalty.

Precious Metals Produced In Remaining Locations

Turning to the rest of the world, we saw the largest year-over-year increase in history form the company. GEOs from Rest of World precious metals assets were 22,660 GEOs during the quarter. This represented a year-over-year increase of 47.1% as increased sales from MWS, Sabodala and Karma positively impacted the quarter.

Tasiast (2% royalty) – Kinross announced plans to proceed with the Phase Two expansion at Tasiast. Phase Two is expected to increase mill capacity to 30,000 tonnes per day and produce an average of approximately 812,000 gold ounces per year for the first five years. The Phase One expansion remains on schedule for full production in Q2 2018 with Phase Two commercial production expected in Q3 2020.

Subika (2% royalty) – Newmont has begun underground mining at Subika with commercial production expected in H2 2018. The Ahafo mill expansion is expected to be in commercial production in H2 2019.

Together, the Ahafo expansion projects (Subika underground and mill expansion) are expected to increase Ahafo's production to 550,000 - 650,000 ounces per year for the first five full years of production (2020–2024). Franco-Nevada estimates that the majority of underground reserves are covered by its royalty.

Karma (fixed gold deliveries and stream) – 4,453 GEOs were delivered and sold in Q4 2017. In Q4/2016, 3,750 GEOs were delivered of which 2,500 GEOs were sold.

Sabodala (fixed gold deliveries and stream) – 5,625 GEOs were delivered and sold in Q4 2017 compared with 3,750 GEOs sold in Q4/2016.

Sissingué (0.5% royalty) – Perseus Mining poured first gold from Sissingué on January 26, 2018 and expects to ramp-up to full-scale commercial production by the end of Q1 2018.

Oil and Gas

Revenue from oil & gas assets increased to $14.0 million in Q4 2017 compared to $10.4 million in Q4 2016, reflecting both higher prices and production levels year-over-year.

Weyburn (NRI, ORR, WI) – Whitecap Resources Inc. are the new operators of the asset having acquired operatorship from Cenovus Energy Inc. Weyburn generated $8.8 million in the quarter versus $7.9 million in the previous year capping off a strong year overall.

Orion (GORR) – Osum Oil Sands Corp. announced plans to double production by accelerating the expansion of Phase 2C, which will now be constructed concurrently with the Phase 2B expansion. Together, the two phases are expected to increase production capacity to over 18,000 barrels per day.

Anadarko (various royalty rates) – Higher production and new mineral royalty purchases increased revenue year-over-year. Rig activity is, on average, at or ahead of our original expectations and royalty revenue is expected to increase.

Permian (Midland/Delaware) (various royalty rates) – A second transaction on the Delaware side of the Permian Basin was closed in February 2018. Rig activity is ahead of original expectations and royalty revenue is expected to increase.

Take Home

We realize this is a lot of information and analysis to digest, but as shareholders, this is the level of detail you should pay attention too. As a whole, Franco Nevada achieved record results that were at the high end of its guidance for 2017.

As we look ahead for the company we are expecting another phase of growth through 2022 with the ramp-up of Cobre Panama over 2019-2022, the first phase expansion of Tasiast later this year and the second phase in 2020, the expansion or start-up of a number of smaller mines over 2018 and 2019 and the 50% expansion of Stillwater by 2021.

All of the expectations for GEO production from assets assumes there will be no more deals made. Let us be clear, there will most certainly be more deals made in the future, so these estimates are almost guaranteed to be surpassed, provided there are no extraordinary circumstances such as civil unrest, strikes, political issues, etc. So long as gold prices remain at or above present levels the stock will flourish. If gold retraces, so will the stock, but long-term, we are bullish.

Disclosure: Long FNV.

Quad 7 Capital is a leading contributor with various financial outlets. If you like the material and want to see more, scroll to the top of the article and hit ...

more