Forcerank Weekly Review (XOM, TSLA, NVDA)

The Federal Reserve took the spotlight this week after announcing it would raise interest rates for only the second time since the financial crisis. It was also the first FOMC meeting following the election, leaving Chairwoman Yellen responsible for answering questions not only about the economy but also President-elect Trump’s victory. Above all else, Yellen mentioned that the Fed foresees three rate hikes over the course of 2017, an early sign that the economic outlook may warrant policy normalization or even tightening The comments came as surprise to the markets and investors who had become accustomed to the Chairwoman’s unbending dovish remarks in recent years.

Beyond Fed talk, the Trump trade continued to drive stocks higher this week with the Dow on the verge of crossing 20,000 any day now. Trump’s cabinet also received one new member after the President Elect extended an offer to Rex Tillerson, now former CEO of ExxonMobil (XOM), for the position of Secretary of State.

Between the Fed, Trump and everything else that occurred, it was another great week for Forcerank. Forcerank users continue to show an unrelenting degree of accuracy picking both winners and losers from week to week. We’ve found that the top three ranked stocks in a given contest tend to outperform while the bottom three do just the opposite. A few of the biggest gainers were Tesla (TSLA) and Nvidia (NVDA) both of which ranked highest in their respective games.

Tesla shares jumped 5% on a number of positive reports about driverless cars and Elon Musk’s relationship with Trump. Tesla announced it will release its first iteration of a driverless car in the very immediate future, while Alphabet tabled its car initiative for the time being. These two separate wins helped propel shares higher this week that also coincided with Trump’s Tech Summit. The summit included leaders in the tech industry from Jeff Bezos of Amazon (AMZN) to Tesla’s own, Elon Musk. Trump also recently appointed Musk to his advisory council, a move that is expected to benefit Tesla. Financially speaking, Tesla shares took a beating for the better part of 2016 despite improving underlying fundamentals. The recent surge very well may be reversing the year long downturn

NVidia, on the other hand, maintained its year long winning streak surging about 10% this week, driving year to date gains over 200%. The chipmaker boasted the best third quarter report among companies in the S&P 500 on the back of strong GPU sales and rapid growth in data centers, automotives and Internet of Things. Investors expect Nvidia to jump even higher as new technologies like driverless cars become more mainstream. To no surprise Nvidia sits atop the Semiconductors contest with an average rank of 3.18, about 1 point lower from the prior week.

Other winners included ExxonMobil, Southwest Airlines, Netflix, McDonald’s and Apple, all of which gained 2% or more but also ranked in the top 3 at the start of the week.

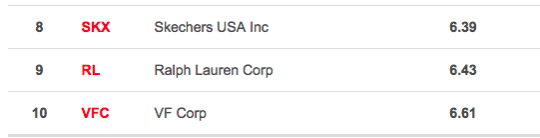

Don’t worry, the list of losers were equally as robust. The biggest drop came out of the apparel game where the bottom three ranked stocks all dropped over 5%; Ralph Lauren (RL), VF Corporation (VFC) and Skechers (SKX). Following the Wednesday rate hike, the U.S. dollar soared to a 14 year high creating an interesting situation for apparel brands that rely heavily on international markets. It won’t be surprising to see many retailers give back their 2016 gains on speculation of weakened sales growth moving forward. Big drops also came from the usual suspects, Box, Groupon, Yelp, and Fitbit (FIT). Week after week these companies take a beating on the markets and Forcerank rankings. Fitbit, in particular, remains one of the worst performing stocks since its abysmal third quarter report that missed analyst’s estimates and signaled weak forward sales. The wearables company ranked second to last in the Hardware contest this week, sporting an average rank of 7.6.

Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their respective games deliver the greatest positive price movement while the worst ranked companies post the biggest losses. To access this information earlier in the week, play next week’s contests and test your knowledge against hundreds of seasoned investment professionals.

Click Here to play next week’s contests and access the highly predictive consensus rankings Monday morning.

Photo Credit: Automobile Italia

Disclosure: None.