Foot Locker Long Thesis, In A Nutshell

- We look into Foot Locker's business through a simple, yet powerful model.

- We analyze the value chain of the athletic footwear industry, Foot Locker's positioning and the implications about the durability of the business model.

- We comment on implications for Nike and Adidas and share insights on their DTC initiatives.

- We put a value to the earnings power and comment on the investment opportunity.

Foot Locker (FL) is a specialty retailer of athletically inspired footwear and apparel.

The company is part of the market-beating IW Portfolio since July 2017, when we sifted through beaten down North American apparel retailers and ended up picking L Brands (LB) (long thesis here) and Foot Locker for the portfolio.

In August of last year, the announcement of weak Q2 results triggered a pronounced selloff that brought the stock price to $30, making a cheap quality business even cheaper. And so we added aggressively to our long position.

Today, less than 1 year after going long, we are sitting on 50%+ unrealized returns. It is the reward for laying down an independent thesis and remaining committed to it, profiting from Mr. Market's temper tantrums along the way.

On what follows, we dissect the fundamentals of the business model, value current earnings power, outline the long thesis and close by assessing the investment opportunity as of today, with the stock in the mid $50s.

The business model

Foot Locker's business is extremely simple, and that makes it all the more attractive for investors.

In a nutshell, Foot Locker "transforms" premium products from vendors into premium experiences for consumers, and gets compensated dearly for the transformation.

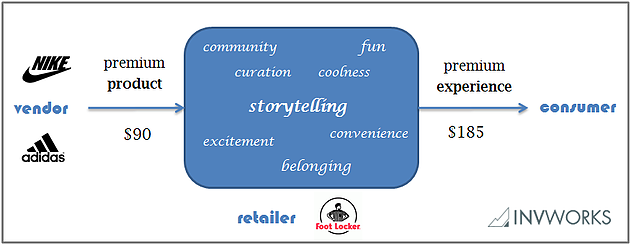

Foot Locker's business model in a nutshell (source: Investment Works)

The products are athletically inspired footwear, apparel and accessories. The vendors, first-class labels such as Nike (NKE), Adidas (ADDYY), (ADDDF), Vans (VFC), Puma (PMMAF) and Under Armour (UA) (UAA). The experience, emotional relatedness and convenience. The target demographic, urban, style-conscious girls and boys willing and able to spend $100+ in a pair of sneakers.

The process that transforms inanimate products made out of leather and synthetic fabrics into elevating, emotionally-charged, consumer experiences is based on storytelling, with strong elements of fun, community, excitement, coolness and belonging. Foot Locker also provides curation ("Foot Locker Approved") and convenience (premium real estate and DTC options), but it is the story-telling that sets this business apart, empowering it to sell high-end merchandise at hefty prices with unmatched efficiency.

The above diagram tells the story in a single snapshot. After a careful look, it is apparent that the health of the business is driven by two main factors:

-

The desirability and breath of the product assortment supplied by the vendors.

-

The efficacy and cost efficiency with which products are transformed into experiences.

Factor (1) is exogenous, outside the control of Foot Locker, but healthy competition among premium vendors ensures, on average, a robust flow of desirable products. Product weakness from the vendors was one of the main culprits of last year softness, but management expects product flow improvements in the second half of the year

Factor (2) is under direct control of Foot Locker, and is indeed its bread and butter business. The company is undertaking significant investments in digital (new website and app platform, new loyalty program) and physical stores (ongoing shift from malls to flagship street locations) to keep improving the experience.

The value chain of the athletic footwear industry

To assess the durability of the business model, one needs to familiarize himself with the value chain of the premium athletic footwear industry.

Retail mark-ups in athletic footwear are in the 100% ballpark. This figure include lower price players such as Dick's Sporting Goods (DKS), Sports Direct (SDIPF) or JD Sports (JDDSF).

For high-end products, they are likely to be even larger.

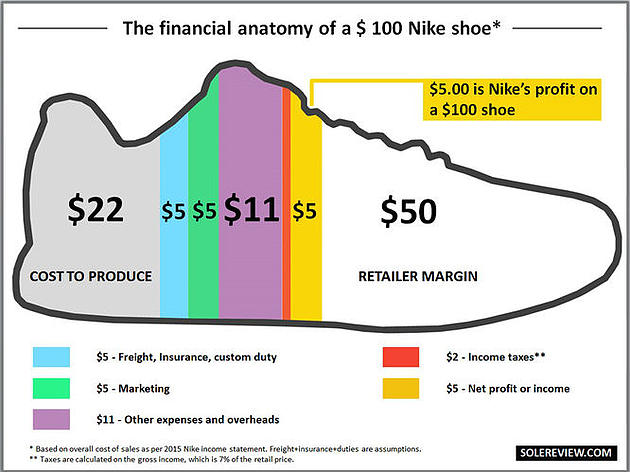

Financial anatomy of Nike sneakers -vendor financials (source: Sole Review)

The full retail price of a pair of Nike sneakers manufactured for $40 and sold wholesale to Foot Locker for $90, may be as high as $185.

That means that when Foot Locker does a good job in converting that wholesale product into a convenient and emotionally-charged experience, the emotional load of coolness, excitement, fun, belonging and community can be worth more than the product itself!

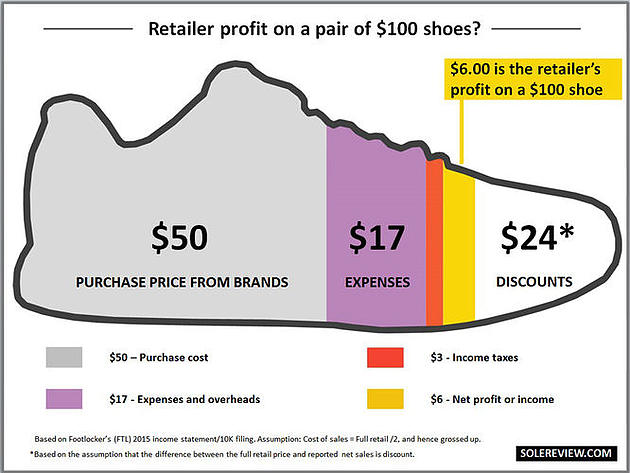

Financial anatomy of Nike sneakers -retailer financials (source: Sole Review)

Unfortunately for retailers, discounts are a common practice to reign over inventory. When average markdowns are considered, the value added by retailers is closer to 1/2 of the value delivered by vendors.

What are the main factors behind discount dynamics? Exactly the same two factors we outlined before as driving the health of the business: the desirability and breath of the product assortment (exogenous to Foot Locker) and the efficacy and cost efficiency with which Foot Locker "transforms" them into experiences.

The durability of the business model

Just think about that. The vendor (Nike, Adidas, ...) is responsible for design, production and the lion share of advertising budget, yet it is entitled to only half of the full retail price.

That should make you question why would the vendor allow such deal.

Discounts

One reason is that the present deal allows vendors to unload most of the effect of discounts on retailers. Part of the retailer margin can be seen as compensation for that volatility (last year, Foot Locker stock lost 35%+ while Nike stock gained 20%, even though Foot Locker misperformance was mostly due to weakness in Nike's product assortment!).

Salesmanship

Another part of the answer is that "transforming" a $40 inanimate bunch of leather and synthetic fabric into a $180 experience is no easy undertaking.

A vendor can manufacture a pair of traditional sneakers for $24 and have them sold in Amazon (AMZN) or a department store for $65. For basic merchandise, commodity distribution channels are enough.

But selling $180 sneakers takes a great deal of salesmanship. And when it comes to premium athletic footwear, nobody executes the last steps of that transformation better than Foot Locker. In fact, Foot Locker has been doing it for decades, with industry leading ROIC and profitability. And until last year, with an uninterrupted track record of profitable growth.

That doesn't mean that vendors have not tried and will continue to try to reduce their reliance on middlemen to distribute their premium assortment. Vendor DTC digital initiatives such as nike.com or adidas.com are a growing phenomenon, as there is no much advantage for a customer searching for Nike sneakers to do it at footlocker.com rather than at nike.com. In fact, one of the weakest datapoints in Foot Locker's Q1 report was flat YoY DTC performance. Investments in digital may eventually bring back momentum, but we are cautious on the potential of online sales for Foot Locker.

Most vendors also operate their own branded physical store base. Here Foot Locker's value proposition is much more compelling. Brick and mortar is Foot Locker's core business, and although vendors don't disclose details on the performance of their own physical store base (other than comparable sales and aggregate DTC numbers), we believe that Foot Locker's brick and mortar sales efficiency is unmatched in the industry even if vendor branded stores are considered.

We have expressed our skepticism on Foot Locker's purely online initiatives. But we are much more positive on omni-channel initiatives for which Foot Locker operates at an advantage thanks to its physical store footprints. Same day inexpensive delivery of in-store inventory, pay online pick-up in store and in-store returns are some examples.

Single brand vs multi brand

Another important point is that there will always be demand for differentiated multi-brand retailers. Fans of a particular brand may favor a direct visit to one of their favorite brand's establishments, but most customers are likely to prefer a store offering a premium curated selection of all the main brands. A multi-brand offering also allows to shift the product assortment towards the best executing vendor at each point in time.

Vendors reliance on premium merchandise

Making this whole thing all the more relevant is the fact that the current business model of premium footwear vendors is dependent on being able to sell high end sneakers for $100+.

Without premium pricing, Nike and Adidas could not afford the multi-hundred million dollar endorsements, sponsorship and marketing campaigns necessary to elevate their brands above competition and sustain their abnormal pricing power. And vice versa.

Nike and Adidas are completely hooked to their model, and could not escape it without intolerable financial pain.

Valuation

We see Foot Locker generating $520+ million of distributable cash flow p.a. for the foreseeable future, or $4.37/share, based on 119 million diluted shares outstanding as of Q1 2018.

This is based on conservative assumptions. In particular, the figure is lower than both the operating income after tax (NOPAT) and the FCF for each of the last 4 years, and lower than 2018 guidance.

For full year 2018, company outlook calls for "solid double-digit EPS growth" over last year's $3.99/share. With a conservative 10% YoY EPS growth, that puts 2018 net income at $522 million or $4.39/share, marginally above our assumption.

Also for comparison: last year, NOPAT came in at $529 million, and FCF, at $539. And both metrics were significantly higher in the preceding 3 years.

Using a discount rate of 8%, the value of a perpetual stream of $520 million p.a. is $6,500 million, or $54.6/share. Adding $826 million of net distributable cash on the balance sheet as of end of Q1 brings the value of equity to $7,326 million, or $61.6/share.

That conservative estimation of intrinsic value is some 10% above the current stock price.

Takeaways and future coverage

Retail is undergoing a period of unprecedented transformation. Consumer expectations have never been higher, but neither have the technological means available to retailers to understand and fulfill those expectations.

Some retailers, will not survive the transformation. But there is no reason why those who understand their target customer and execute on that understanding with a differentiated, value-accretive service proposition won't survive and even thrive.

We believe that Foot Locker belongs to the group of the survivors.

It is an excellently managed, shareholder-friendly business in a market segment with positive secular trends (active lifestyle, sportswear, casual & comfortable dressing, urbanization, etc.). The current business model of premium footwear and apparel vendors relies on first-class marketers such as Foot Locker. They are trying to weaken that dependency through DTC initiates, but for the time being they are dependent, and we believe there will always be solid demand for multi-brand premium curated assortments.

At $55/share, Foot Locker no longer trades as a non-going concern (as last November, when it was selling at $30/share). It is no longer a screaming buy.

But it still offers value. The ex-cash market cap is some 10% below the value of current earnings power, and a back to 2017 financial performance would easily take the stock price close to $70/share.

We recommend investors to maintain their long positions and to consider adding at prices in the mid-to-high $40s.

We will update the investment thesis as events unfold. In the meantime, we will keep publishing research on potential stock picks and current positions, including L Brands (LB), the other world-class retailer in our equity portfolio.

Disclosure: I am/we are long LB, FL (see all other positions in our portfolio).

If you have enjoyed the read, more

Thank you for reading.

To be notified about updates on FL and future stock picks, join our Investment Newsletter @ invworks.com/subscribe