Floor & Decor Sets Terms For Strong IPO

Floor & Decor (Pending:FND), a hard surface accessories and flooring retailer, has filed terms for its upcoming IPO.

The company expects to raise $150M through the offer of 8.8 million shares at an expected price range of $16 to $18. Assuming Floor & Decor prices at the midpoint of the proposed price range, it would have a market cap value of $1.7B and trade at a price/sales ratio of 1.44x. The IPO is expected for Thursday, April 27.

Underwriters for the IPO include: BofA Merrill Lynch, Barclays, Credit Suisse, UBS Investment Bank, Goldman Sachs, Jefferies, Piper Jaffray, Wells Fargo Securities, Houlihan Lokey.

Company Overview

Floor & Decor provides natural stone, laminate, wood and tile flooring as well as decorative accessories. Floor & Decor operates 72 warehouse-format stores across 17 states, and the size of an average store is approximately 72,000 square feet - much larger than home improvement retailers such as Lowe's (NYSE:LOW) and Home Depot (NYSE:HD). Management has indicated that it plans to expand to more than 400 stores. Customers include: professional installers, commercial businesses, and DIY customers. The Georgia-based company sells in stores and online.

(Company Website)

Smyrna, GA-based, Floor & Decor writes it has not faced the same competitive pressures as other retailers from Amazon (Nasdaq:AMZN ), as customers shopping for tools and flooring tend to prefer shopping in-store where a flooring expect is available to support them in making the best purchase.

The company was founded in 2000 by board member George Vincent West. West has served as the CEO from the company's inception to 2012.

Major investors in Floor & Decor include FS Equity Partners and Ares Corporate Opportunities Fund, with 24.6% ownership and 67.6% ownership, respectively.

Executive Management Overview

Thomas Taylor has served as CEO and board member since 2012. Taylor began his experience in the DIY retailing industry at the age of 16, working at Home Depot. He eventually worked his way up to EVP of Operations for more than 2,200 Home Depot Stores and EVP of Merchandising and Marketing for the retailer. He left Home Depot in 2006 and became Managing Director at Sun Capital Partners.

Trevor S. Lang, serves as Executive Vice President and Chief Financial Officer. Prior to joining the company in 2011, Land served as CFO of Zumiez Inc. (2007 - 2011) and Vice President of Finance for Carter's, Inc. since 2003. Lang is a 1993 graduate of Texas A&M University with a B.B.A. in Accounting. He is also a Certified Public Accountant.

Financial Overview

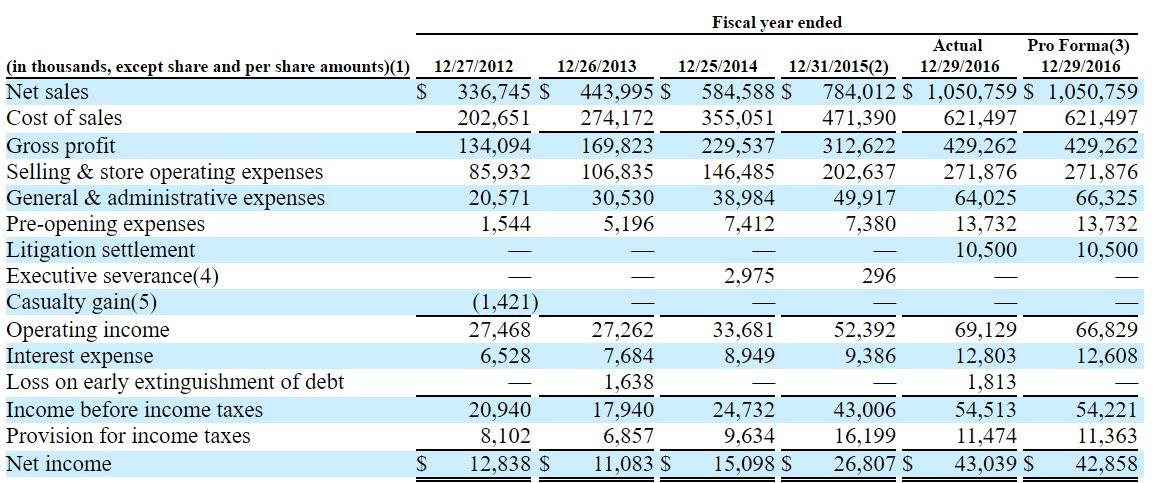

Revenue has continued to increase. The company generated revenue of $584.5, $784.0, and $1.5B in 2014, 2015, and 2016, respectively. Gross margins have remained steady at 40%. Net income increased from $26.8M to $43M between 2015 to 2016. As of December 31, 2016, Floor and Décor had cash and cash equivalents of $318M and total debt of $177.9M.

According to management, the company expects to rake in approximately $306 million of unaudited sales for 1Q 2017.

(Click on image to enlarge)

Market and Competition

Floor & Decor sells its services and products to three segments of customers: build-it-yourself, do-it-yourself and professionals. The company indicates that has a favorable competitive position as it markets itself as a large-format retailer with 72,000 square feet of dedicated store space - more than Lowe's and Home Depot. Floor & Decor also offers an "everyday low price" strategy instead of offering promotions or sales to draw in customers, thus reportedly creating trust with its customers.

Compared to peers, FND trades at a similar price/sales ratio, but touts higher profit margins and revenue growth.

|

Market Cap |

Price/Sales |

Revenue Growth |

Gross Margin |

|

|

FND |

$1.7B |

1.44x |

34% |

40% |

|

HD |

$184B |

1.93x |

6.86% |

34% |

|

LOW |

$72B |

1.11x |

10.06% |

34% |

|

Specialty Retail Average |

$8.8B |

1.56x |

5.88% |

36% |

(Fidelity)

Conclusion: Consider Buying In

Despite recent pressure on retailers, we believe Floor & Decor's emphasis on strong customer support and products will enable further growth.

The company has a history of revenue growth, strong cash flow operations, and consistent growth margins.

At its current valuation we recommend a buy.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in FND over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses ...

more