Five Stocks To Watch This Week

(Photo Credit: Mike Mozart)

Tuesday, November 15

![]()

Thursday, November 17

Friday, November 18

![]()

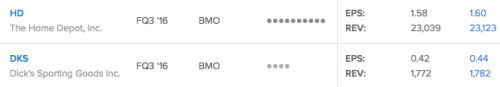

Home Depot (HD)

Consumer Discretionary - Specialty Retail | Reports November 15, before the open.

The Estimize consensus is looking for earnings per share of $1.60, 2 cents higher than the sell-side consensus and 17% higher than the year-ago quarter. That estimate has increased 2% since HD’s last quarterly report. Revenue is anticipated to increase 6% to $23.125 billion, slightly higher than Wall Street’s consensus.

What to Watch: Low interest rates and a bounce back in the housing market have led to robust earnings in recent quarters. Not only does Home Depot benefit from an increase in new home sales, but as home prices stay high, consumers tend to invest heavily into their properties. Strong job growth has also supported this ongoing trend, allowing consumers to spend on home improvement projects. In the second quarter the home improvement retailer posted a 4.7% increase in comparable sales and 5.4% in United States stores. The company should continue to deliver encouraging results but faces a number of near term headwinds including intense competition and significant international exposure. Besides Lowe’s, consumers are starting to look towards online retailers like Amazon for their home improvement needs. This shift to e-commerce could have a lasting impact on Home Depot if it is not taken seriously in the immediate future.

Dick’s Sporting Goods (DKS)

Consumer Discretionary - Specialty Retail | Reports November 15, before the open.

The Estimize consensus is looking for earnings per share of $0.44, two cents higher than Wall Street and down 1% from the same period last year. That estimate has increased 13% since DKS’s most recent report. Revenue is anticipated to increase 8% YoY to $1.779 billion, slightly higher than the sell-side consensus. The stock is up 72% YTD.

What to Watch: Dick’s has been gaining strength in recent quarters despite a pullback from apparel brands like Nike and Under Armour. Its efforts to expand online capabilities along with strategic marketing and merchandising have helped drive traffic trends and sales. Dick’s has also benefited from a consolidation in the industry following the bankruptcy of Sports Authority stores. Dick’s now owns the intellectual property and much of the branding of the former retailer. Tomorrow’s report is forecasted to maintain its current trajectory but will more importantly shed some light on the pivotal holiday season to be reported in early 2017.

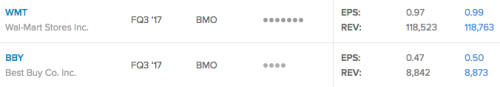

Wal-Mart (WMT)

Consumer Staples - Food & Staples Retailing | Reports November 17, before the open.

The Estimize consensus is looking for earnings per share of $0.99 on $118.78 billion in revenue, above Wall Street by 2 cents on the bottom-line and by $254M on the top. Compared to a year earlier, this reflects a 3% increase in earnings and flat sales. Earnings and revenue estimates have only increased by 1% since the last quarter. The stock is up 15% since the beginning of the year.

What to Watch: It has been no secret that Walmart is trailing Amazon as an ecommerce retailer. Its acquistion of Jet.com is a direct message to Amazon that they are coming for them. In FQ2 2017 online sales rose 11.8%, much better than the 7% increase recorded in the prior quarter. Along with boosting online sales the company is focused on creating a better customer experience and lowering prices even further. These initiatives might generate sales but they will also pressure margins in the short-term.

Same store sales have come in positive for eight consecutive quarters, driven by 7 quarters of increasing traffic. Walmart’s biggest advantage over Amazon and other online retailers is its expansive grocery and fresh food offerings. Walmart’s are often considered one stop shops for families to do their weekly grocery shopping and to pick up anything else they might need. The adoption of these services amongst online retailers have yet to gain traction. Amazon is of course testing this out as part of its Amazon Prime services. In the meantime, Walmart, Target and Costco will have the upperhand in this segment.

In preparation for its biggest quarter of the year, Wal-mart just announced it’s plans for Black Friday. The holiday shopping event will begin at midnight on Nov 24, and will offer “something for everyone – from $1.96 movies to a $30 Sharper Image Video Drone and a $798 65-inch Samsung HDTV.”

Best Buy (BBY)

Consumer Discretionary - Specialty Retail | Reports November 17, before the open.

The Estimize consensus is looking for earnings of $0.50 per share on $8.87 billion in revenue, 3 cents higher than Wall Street on the bottom line and $26 million above on the top. Compared to a year earlier, earnings are expected to increase 24% with revenue up 1%. EPS estimates have been pushed down by 3% since the last quarterly report, and revenue estimates have come down 1%. Even so, the stock is still up 31% YTD.

What to Watch: In the last couple of years, many have written off Best Buy as a showroom for Amazon. The rising popularity of online retail has really taken its toll on the electronics store in recent years, forcing the company to expand its omni channel capabilities and push more frequent discounts to compete in the rapidly changing environment. This has taken its toll on quarterly results in the form of higher operating expenses and lower margins. However, bottom-line growth still appears to be intact, a trend that analysts expect to continue into Q3. Revenue growth is where the concern lies, still expected to come in flat for the second quarter in a row.

While comparable store sales only increased 0.8% in Q2, comparable online sales up-ticked by an impressive 24%. Strength in wearables, home theater, appliances and computing have kept growth afloat while phones and gaming suffer. With the popularity of the iPhone 7, investors will be looking for signs that the latest iteration of the smartphone boosted overall sales as the retailers heads into its most important quarter of the year.

Abercrombie & Fitch (ANF)

Consumer Discretionary - Specialty Retail | Reports November 18, before the open.

The Estimize consensus calls for EPS of $0.21, 2 cents above the Wall Street consensus. Meanwhile, revenue expectations of $831.8 million are just slightly below the sell-side consensus. Earnings expectations have fallen 24% since last quarter, with revenues declining 3%, putting YoY growth expectations at -55% for EPS and -5% for sales. The stock is down 38% for the year.

What to watch: ANF is the first of the teen retailers to report this quarter. Last quarter saw wins from fellow teen retailers such as American Eagle and Urban, but Abercrombie and Fitch still missed missed expectations on the top and bottom-line.

In the second quarter, the company saw comparable store sales decrease 4%, in-line with first quarter results. While the namesake Abercrombie stores posted negative SSS of 7%, Hollister was only down 2%. Hollister has now been repositioned to compete in the burgeoning fast fashion segment. The move into fast fashion could provide Abercrombie an edge over its competitors and also drive top line expansion. Concerns still remain around currency headwinds and deep discounting measures that have been taken in order to push inventory.

Disclosure: None.